Reflation trades are back with a vengeance, pushing pressure on stock markets as yields rise. Treasuries managed to stabilise somewhat overnight, after a sell off yesterday saw rates pushing higher again, but across Asia bonds as well as stocks sold off.

Markets are looking ahead to scheduled comments from Fed Chairman Powell for soothing words, but in Asia mounting concern over the health of China’s property market added to pressure on equity markets. Essentially it seems the turning point on policy is getting closer and that will keep bonds under pressure. GER30 and UK100 futures are currently down -0.9% and -0.7% respectively, with US futures also under pressure, led by a -0.7% drop in the USA100 future. While much of the erosion is a function of the improved outlook on the recovery, as noted by Fed officials, there is a breath of inflation filtering in, reflected in the pop in the 5-year breakeven to 250 bps, the widest since mid-2008.

JPN225 and ASX closed with losses of -2.1% and -0.8% respectively, while Hang Seng and CSI 300 are currently down 2.2% and 2.99%. Markets remains very susceptible to the action in Treasuries with the jump in rate supporting the USA30’s reflation trade, but weighing significantly on the tech-heavy USA100 which plunged -2.7% given its high valuations.

Headlines:

- Reuters report that China’s $1 trillion sovereign wealth fund (China Investment Corp (CIC)) is scouting for long-term investments in the United States.

- Australia Retail Sales for January, final, +0.5% m/m.

- Australia trade balance for January AUD 10,142m surplus (vs. expected AUD 6850m surplus).

- Goldman Sachs is looking for further rising commodity prices and a comeback in growth.

Forex Market

EUR – stacked in the mid 1.20 area.

GBP – steadied at 1.3900-1.3960.

JPY – at 7-month high at 107.16

AUD – benefited from a record trade surplus, NZD was also supported, t, recovered from early losses and rose to 0.7810

CAD –tested 1.2600 but settled at 1.2635 by the end of the North American Session.

GOLD – hit a 9-month low of $1,701.8

USOil – edged up to $61.60 ahead of the OPEC + meeting today.

Bitcoin – Reuters: Bitcoin has surged 78% so far this year as it gains more acceptance in the financial services industry, but the U.S. financial regulator is likely to start working on guidelines for digital assets, which could increase scrutiny of cryptocurrencies. (below 50K currently)

Today: The calendar has Eurozone retail sales and unemployment data for January, as well as the UK CIPS construction PMI. Investors will also continue to assess the UK budget, which offered an extension of furlough payments through to September, but also introduced first steps to try and recoup the costs of virus measures. Initial and continuous Jobless claims will be on tap however Fed’s Chairman Powell and OPEC meeting will be in the spotlight.

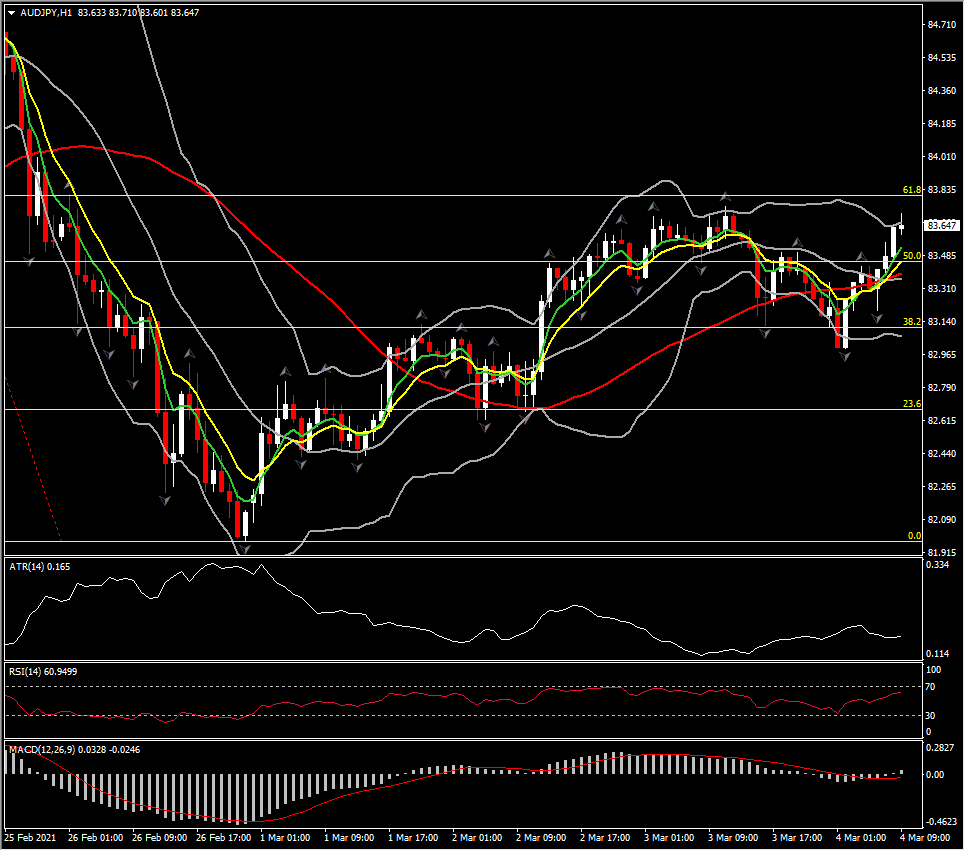

Biggest mover – AUDJPY (+0.60% as of 07:30 GMT) & EURAUD (-48% as of 07:30 GMT)

Click here to access the our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.