Later today and tomorrow evening we will have the API and EIA reports, while the day after that, on March 4, eyes will be on OPEC and its non-OPEC partners, known as the OPEC+ meeting.

After touching the 13-month high at $63.67 on February 25, USOil started moving backwards for a few reasons. Let’s review where we are, what happened, and what’s going on.

Last year on April 12, OPEC+ made a historical decision: a 9.7Mbpd production cut, a cut of almost 10% of global supply in order to support oil prices amid the COVID-19 crisis. At that meeting, Russia led the non-OPEC members to agree with the OPEC decision. This plan started on May 1st – even though some members were not 100% committed to it – and continued until the end of July. From August 2020, the production cut was eased to 7.7Mbpd as recovery started in some developed countries. In the first meeting of 2021, many were expecting another rise in production; a rise of just 500 additional barrels a day was agreed, but that was just the beginning of another story.

In 2020, Saudi Arabia and Russia grew much closer on Oil market management, but 2021 seems different. After the 500 barrel per day rise in OPEC+ production, Saudi Arabia voluntarily started a production cut of 1Mbpd for the two months of February and March, which in fact was a sign of contrast to Russia, as they support a production rise. Currently the sharply rising US supply and potential for a weakening in discipline amid the OPEC+ group to maintain supply quotas may offset rising demand.

The OPEC+ group meets this week (tomorrow and Thursday) to decide on April quotas, with Moscow reportedly calling for a relaxation while the Saudis want to maintain output at prevailing levels. Another clash between Saudi Arabia and Russia on oil production quotas, or the ‘known unknown’ risk, to use epistemological phraseology, of more transmissible SARS-Cov2 coronavirus variants that might prove resistant to current vaccinations, which would threaten a further prolonging of restrictive measures, could also affect the supply and demand of oil.

Additionally on the Covid front, earlier today WHO Director-General Tedros Adhanom Ghebreyesus said the rise in cases was “disappointing but not surprising,” warning that it was “too early for countries to rely solely on vaccination programs and abandon other measures.” (Investing.com). In the next weeks, we will probably hear more similar messages.

On the other hand, concerns about rises in bond yields in the US and EZ, with over-betting on the latest US stimulus package and its effect will change market sentiment and behavior in the next weeks.

For tomorrow’s EIA report, since the freezing weather in the US has passed, it is normal to expect higher than forecast numbers for inventories. Simultaneously, the Thursday OPEC+ meeting is also widely expected to raise production, but the main question is the level and quotas. Both could be the motivation for more decline, at least in a short period.

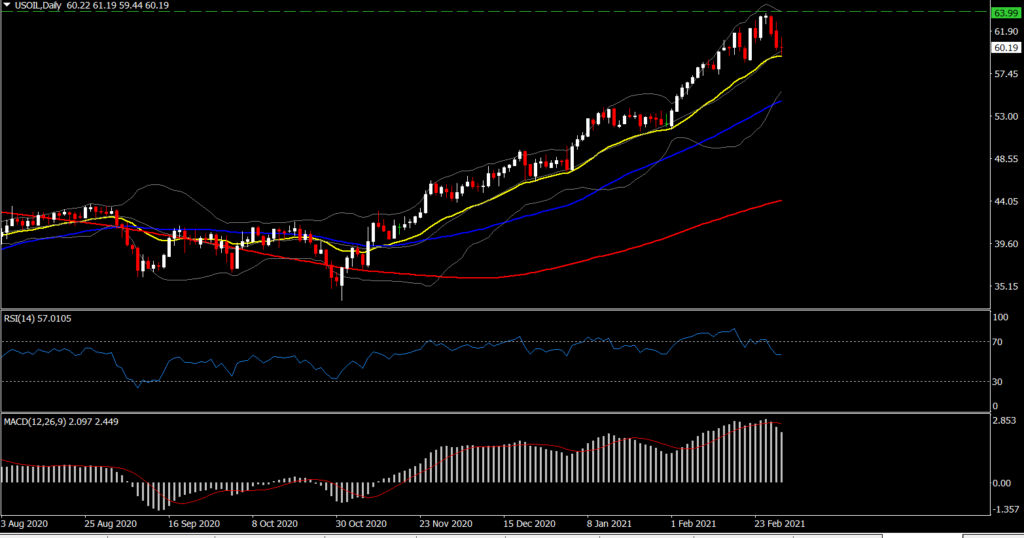

USOil – Daily Chart

Technical analysis on the daily chart started to have a correction signal. RSI is moving lower under 50, from OB zone, while market volume is still high, which can be a supportive signal for a downtrend, especially if the price breaks under 20 DMA and then S1 at 59 on today’s close price. For now, S2 is sitting at 58. On the flip side, PP at 61 could open the doors again for R1 at 62 and R2 at 63.90.

Click here to access the our Economic Calendar

Ahura Chalki

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.