What Fed Chair Powell did not say that shook up the markets.

Wall Street turned sharply lower following Fed Chair Powell’s remarks, even though it was not what he said but what he did not mention that undermined equity sentiment. Specifically, he did not push back against the recent surge in Treasury rates. Indeed, he took attention of the spike and would be concerned by a “disorderly” move, providing tacit approval for the run-up in longer dated yields. Consequently, the stock market was dragged lower once again thanks to rising rates and expectations for more of the same as the economy and inflation pick-up further.

Headlines:

- The Chair’s comments that he took attention of the spike and would be concerned by a “disorderly” move were not in the market’s narrative.

- Fed Chair Powell’s perceived benign neglect of the surge in bond yields weighed on Treasuries and extended the recent selloff back toward the highs from February 25.

- The US 10-year rate corrected slightly overnight but remains at 1.56%. The 10-year rate is currently down -5.3 bp at 0.079%, while yields jumped 6.0 bp and 7.5 bp in Australia and New Zealand respectively.

- The tech-heavy USA100 over -3% lower intraday, with spill over to the broader indexes. However, the losses were pared in late trading with closing declines of -2.11% on the USA100, -1.34% on the USA500, and-1.11% on the USA30. JPN225 and ASX were still down -0.2% and -0.7% respectively at the close.

- BoJ’s Kuroda sees no need to widen yield band. He said there is no need to widen the implicit band set for its long term yield target, while stressing the need to keep borrowing costs low to support the economy.

- Oil prices jumped higher after the OPEC+ meeting decided to maintain current output levels. The USOIL is currently trading at USD 64.60 per barrel.

- In Europe, key central bankers have also played down the rise in rates and signalled that the central bank won’t add additional measures next week that would reverse the rise in rates. Verbal intervention and a flexible use of PEPP purchases will likely be used to smooth an uptrend that most central bankers seem to feel is essentially justified, given the improved outlook for growth later in the year.

- German manufacturing orders rose 1.4% m/m in January, more than anticipated

Forex Market

JPY – USD rallies again – USDJPY over 108.00

EUR –dropped against a largely stronger Dollar- Currently at 1.1947

GBP – at 1.3859

AUD – dipped below 50-DMA again, at 0.7686

CAD –steadied to 1.2660 after 1.2574 bottom

GOLD – breaks the $1,700 – trades on 1695 now

USOil – Oil rocketed following OPEC+ agreeing to no production increase and to keeping current levels for at least April. USOil at 64.60 up from 59.20 lows on Wednesday

Bitcoin – returns to 47K

Today: Attention will turn to the US February employment report, hourly earnings, unemployment rate, January trade report and consumer credit is due late in the session, seen rising $10.0 bln from $9.7 bln previously. Canadian Ivey Purchasing Index in the tap as well.

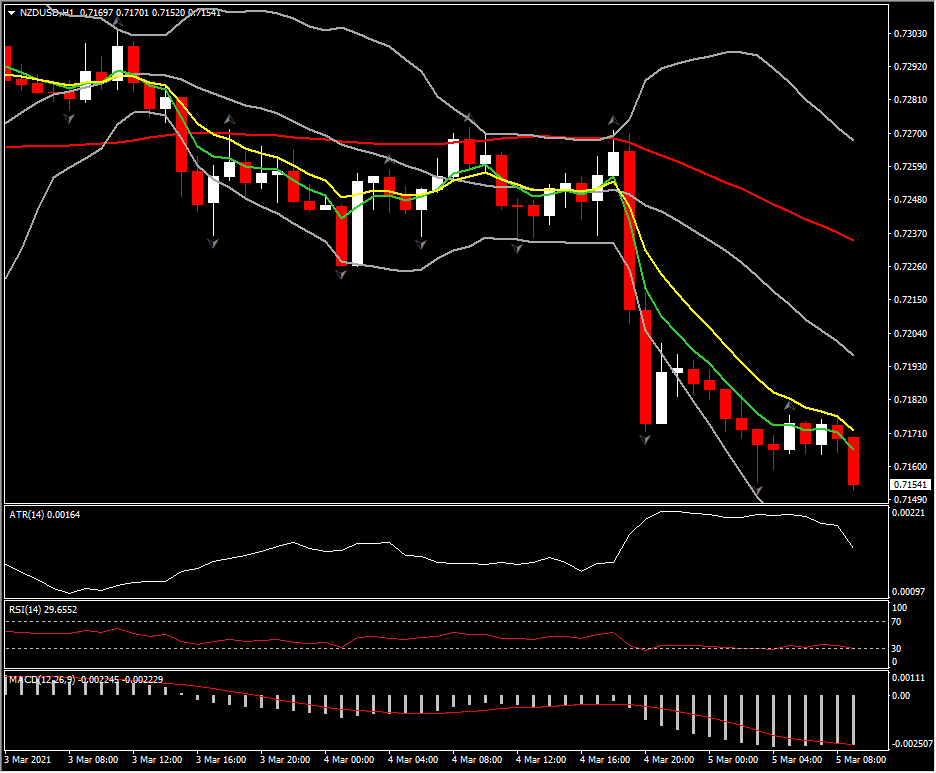

Biggest mover – NZDUSD (+0.45% as of 07:30 GMT)

Click here to access the our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.