XAUUSD, H1

You will notice that the gold price decline is clearly correlated with higher bond yields by the all-time high of the gold price at the beginning of August last year. It was the same period that the US 10-year bond yield was also stuck in the all-time low zone, while another closely related asset to gold was the US dollar. During the volatility of the market in the past year, there were both periods when gold and dollar prices moved in opposite directions and the range moved in the same direction as a safe haven.

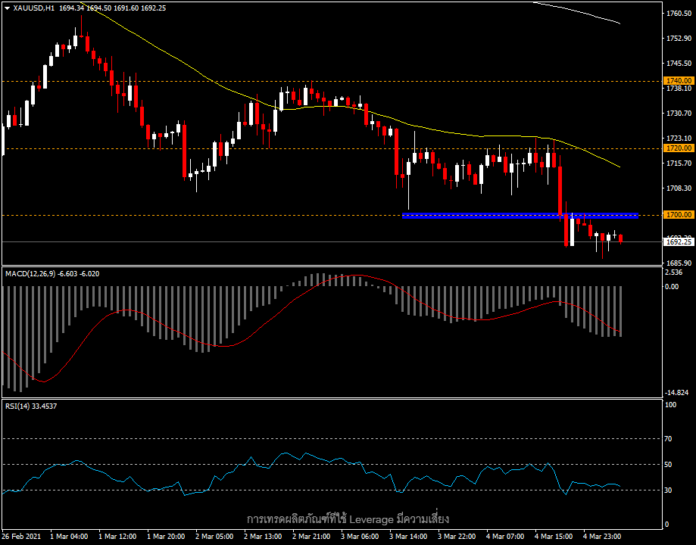

Just like last night, following comments from Fed Chair Powell that the 10-year US Treasury yield rose to a new high of 1.582, the US dollar index this morning moved up to a three-month high of 91.73, causing gold to drop to the original low, coming down to trade below the level 1,700.

From a technical point of view, last night the price of gold surpassed 1,700, falling in the same level as the March high zone. That was the beginning of the Covid-19 crisis and the gold price that has continued to fall so far. Still, there are no significant or interesting reversal signs or patterns. And from vaccination, including the new round of US economic stimulus measures one of the hopes of driving gold prices is now an inflationary concern. That began to cause concern in the market at this time but it has to be looked at whether investors will maintain their gold inflation hedge strategy or not. The first support seen at this time is at 1,685 and the next at 1,630, while the resistance is at 1,720 and 1,740, respectively.

On top of today’s economic calendar, there are Non-Farm Payroll figures that forex traders are looking forward to after the non-farm employment figure continues to fall below the market expectations since December onwards.

Click here to view the economic calendar or the free webinar.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.