Market News Today – USD holds its bid, big bounce back from Nasdaq (+3.69%, AAPL +4.06%, TSLA +19.64%, NIO +17.45%), Yields consolidate around 1.55%. Stimulus bill will pass into law later today. Nikkei closed flat. Overnight – Chinese CPI & PPI better than expected, RBA Lowe – would not say AUD is overvalued, but “comfortable” lower than last week. Gold bounced from key level ($1685), USOil drifted lower towards $63.00, BTC hit 55K.

USDIndex – Fell from 92.50 yesterday – today PP at 92.15

EUR – Tested back to 1.1900 yesterday – but back down again now at PP 1.1880 JPY – Retreats from 9-mth high at 109.20. Now 108.80 (PP 108.70, R1 109.00 GBP – Test of 1.3800 held again yesterday and rallied to 1.3915. Now at PP 1.3870

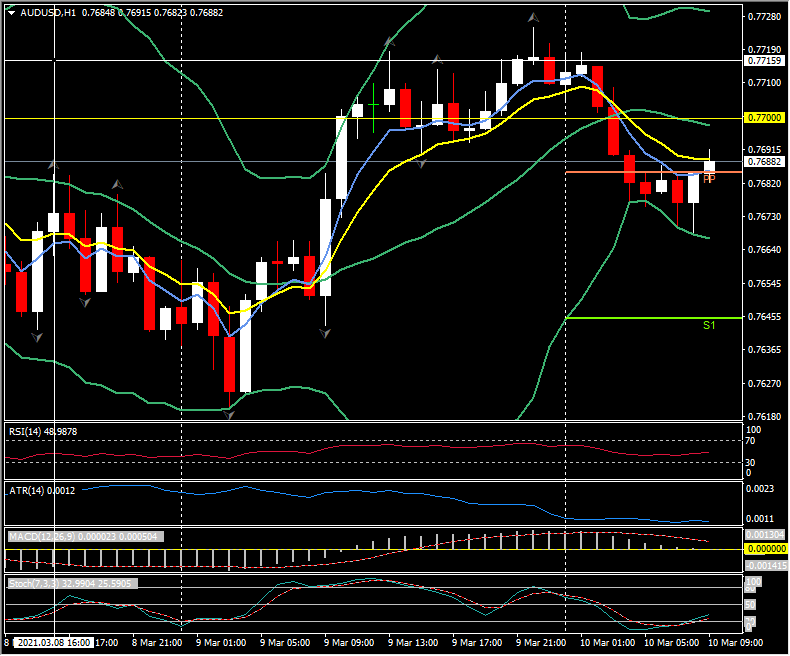

AUD – under 0.7700 to 0.7685 (PP) – s1 0.7645, R1 0.7750 NZD – rose from test of 0.7100 yesterday to -0.7180. – Trades at 0.7145 CAD – rose from test of 1.2600 (S1) to 1.2660 now. PP 1.2630, r1 1.2690. CHF – Holds back at 0.9300 after rally to 0.9375 yesterday – PP 0.9325.

BTC – held $50k yesterday, has rallied to R3 at $54,400. PP today at $50,600

GOLD – rallied from below important May & June lows at $1685 yesterday to 1720 earlier. Trades at $1715 now. USOil – down again to test $63.50 and the 200Hr MA – S1 $63.00. PP $64.45

USA500 – +54.09 (+1.42%) 3875. – USA500 FUTS now at 3860. – 20SMA (3878). 50SMA 3850

Today – US CPI (13:30 GMT), BoC Rate decision (15:00), Weekly Oil Inventories and – key today – Auction of $38 billion US 10-year Treasuries (18:00).

Biggest (FX) Mover @ (07:30 GMT) AUDUSD (-0.45%) Moved lower following LOWE comments. Under 0.7700 from 0.7820 highs yesterday, under PP (0.7865) earlier. Faster MAs aligned and lower but turning neutral, RSI 48 and neutral, MACD histogram & signal line aligned lower and attempting to break 0 line. Stochs rising from OS zone. H1 ATR 0.0012, Daily ATR 0.0098.

Click here to access the our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.