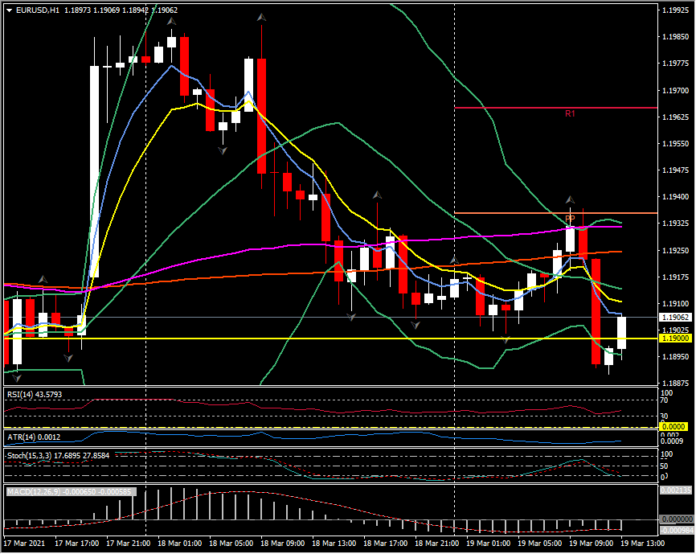

EURUSD, H1

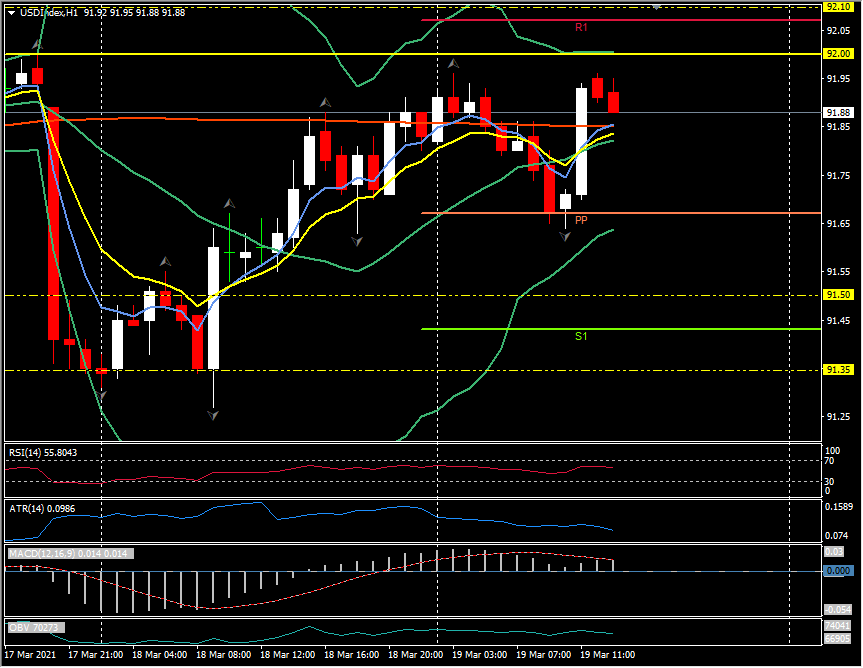

The Dollar lifted out of correction lows, tracking the action in US Treasury yields, as the 10-year T-note yield rose to near 1.700% from a pull back low at 1.676% after yesterday breaching 1.7500%.

The USDIndex rallied to a two-day high at 91.96 from a low at 91.66, while EURUSD dropped to two-day lows under 1.1900. Both Cable and AUDUSD saw similar price actions in turning lower, to the lower 1.3900s and lower 0.7700s respectively. USDCAD turned lower after an approach towards 1.2500. USDJPY lifted out of a one-week low at 108.60. The Yen has seen some outperformance amid a narrowing in the US over Japan yield differential, a backdrop of sputtering global stock markets and the decision by the BoJ to widen the target band under its yield curve control policy and remove its explicit target on ETF purchases, giving the central bank room to draw in stimulus. EURJPY fell to an eight-day low at 129.43, and AUDJPY to a two-day low.

The drop in Treasury yields will more than likely prove to be temporary given the combo of the $1.9 tln stimulus juxtaposed to the Fed’s ultra accommodative policy settings and signalling that it has flicked off the pre-emptive tightening switch (discarding the traditional Philips Curve approach in the low inflation environment). This should be supportive of the Dollar over the coming months, but only time will tell.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.