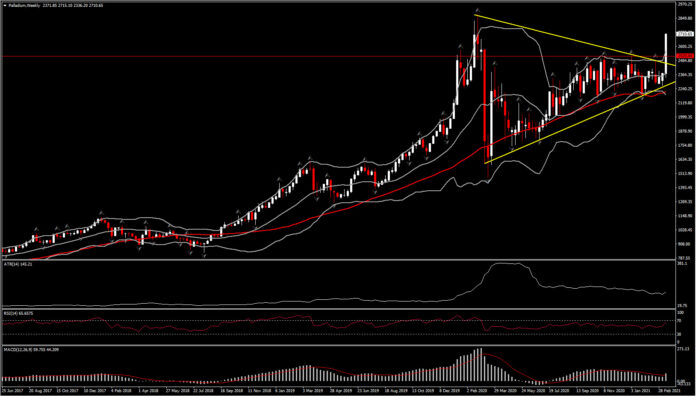

Palladium is back in the spotlight as the key Resistance at $2,500 failed to prove itself as the substantial 7-month barrier for palladium prices, but instead the asset continues to attract more buyers above $2,500. In the meantime, today we have also seen the breakout northwards of the 15-month triangle seen on the plummet of the price from $2,879 amid global lockdowns.

Along with the majority of precious and industrial metals, palladium also found support on surging Treasury yields as markets are losing trust and confidence in the Federal Reserve being able and willing to fight inflation. The US Federal Reserve on Wednesday said the US economy was on track for its fastest expansion in nearly 40 years, but the central bank pledged to keep its ultra-easy monetary policy stance despite expected inflationary pressure.

Hence similarly to gold, palladium found support as it is seen as a hedge against inflation, but rising Treasury yields have challenged that status as they translate into a higher opportunity cost of holding bullion. However the significant difference with gold is the physical demand of palladium as an industrial metal and a component of electric and hybrid car engines. The rally seen this week is also due to some reports from the Russian mining giant and the world’s largest palladium producer Nornickel said that its nickel, copper, platinum, and palladium output could be 15-20% short of its original guidance.

As Eugen Weinberg, head of commodity research at Commerzbank, said: “the price could make further gains in view of the tight physical supply situation. Indeed, the situation could soon tighten even further as sales of new cars are likely to be given a boost when the corona-related mobility restrictions are lifted in Europe, which is expected to happen soon.”

Palladium is currently outside the Bollinger Bands pattern at the $2,740 area looking overbought in the near and medium term. However the weekly spike seen this week has turned the so far neutral Palladium outlook into a positive one as it boosted positive momentum higher. The daily RSI entered into the overbought territory, while MACD lines have spiked higher. But despite the near term spike of positive bias, neither of these two indicators has reached a peak yet, suggesting that the odds of a potential retest of record highs at $2,879 (key psychological level at $2,900), are rising. In the meantime the weekly outlook is turning positive as well. Hence the weekly closing tomorrow could be key as it could trigger the attention to fresh record highs for palladium.

On the flipside, selling pressure could resume in the near term due to the already overbought condition of the asset, with support area at $2,480-2,520. Next immediate Support is at 20-DMA, i.e. $2,390. If sellers manage to take over palladium and drift the asset below the latter then we could see a resumption of the 7-month ranging market within the $2,120-$2,520 area.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.