Recent employment figures have seen a relatively good performance in the UK economy for a few weeks, as according to the Office for National Statistics, the unemployment rate fell to 5.0% in January, while the data that has currently been published on the country’s inflation shows that it is still mild, with average consumer prices falling from 0.7% to 0.4% in February and some analysts have expressed that there are not many possibilities for the Bank of England to implement negative short-term interest rates. (1)

In this context, Lloyds Bank have managed to boost themselves as they seek to become an important owner in the United Kingdom, with the aim of diversifying their income in a period of low interest rates. They are considering buying and renting new and existing houses nationwide by the end of the year in order to generate large returns as the country has a high housing deficit, which could mean that the bank’s profitability for shareholders becomes relatively minimal.

During the trading hours on Thursday, Lloyds Banking Group shares were trading down GBX 0.47 at GBX 41.77. About 226,447,873 shares of the company were exchanged, compared to its average volume of 208,524,891. The company has a 50-day moving average of GBX 39.14 with a 200-day moving average of GBX 33.84, with a 1-year low of GBX 23.59 and a 1-year high of GBX 42.33, so Lloyds currently has a market capitalization of $40.64 billion (29.59 billion pounds) and a price/earnings ratio of 35.20. Similarly, Lloyds also revealed that its dividend will be paid on May 25, so shareholders registered a couple of weeks ago that they will receive a GBX 0.57 dividend, which represents a yield of 1.45%. (2)

It should be noted that during the current year, Lloyds has seen five higher estimates in the last sixty days compared to three lower ones, while the full year 2021 estimate has achieved three upward revisions compared to one downward revision in the same time period. The company’s recent earnings estimates show great enthusiasm, as the current year’s consensus estimate has increased by 19.7% over the past two months, while the estimate for the full year improved by 1.4%, which is why Lloyds stock has a Zacks #3 rank , indicating expectations for the company’s short-term online performance. (3)

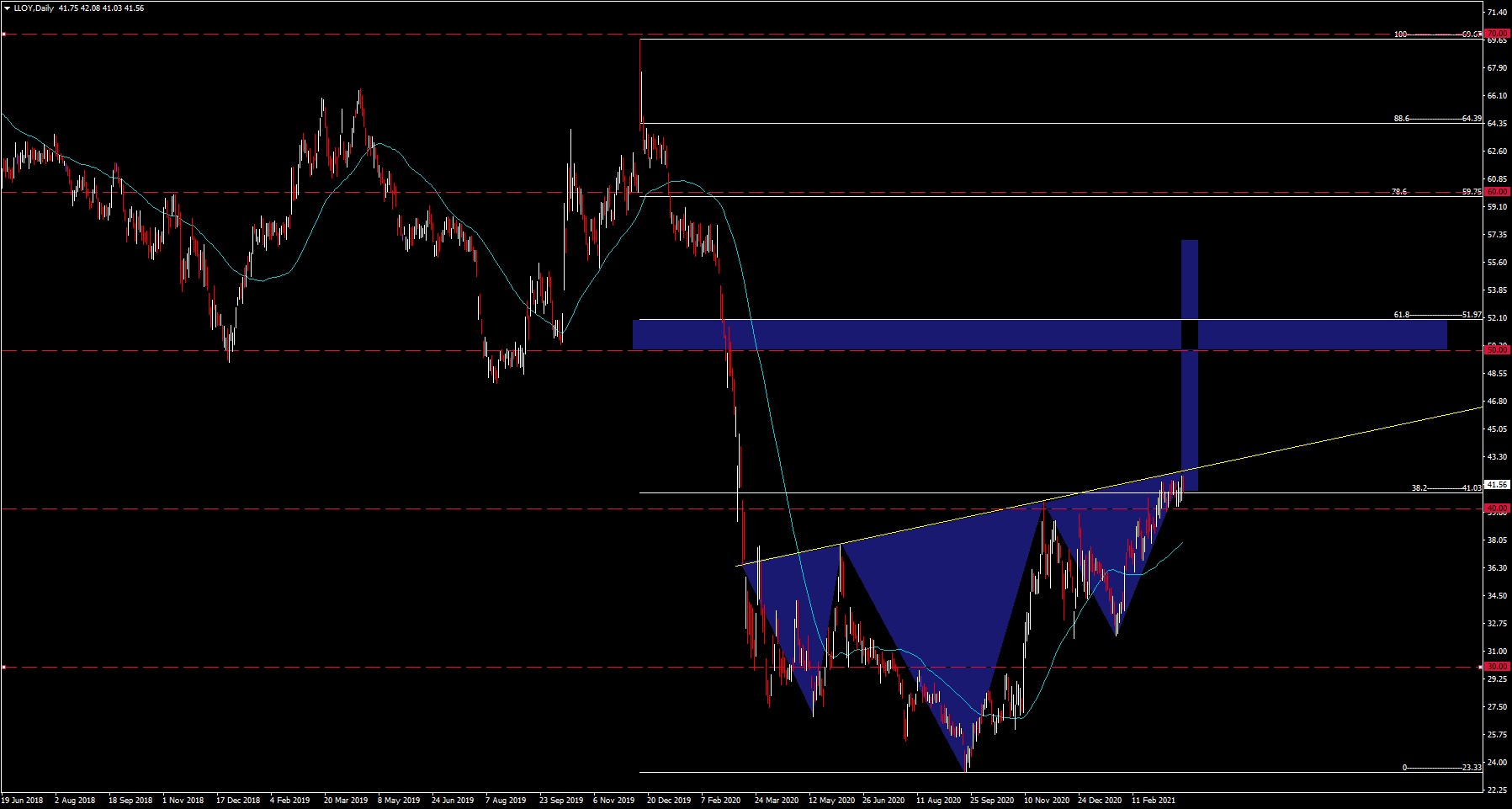

Lloyds stock presents a head and shoulder pattern that can be visualized on the daily time frame. The next Resistance of the pattern is situated past the psychological level of $50 and the Fib. level of 61.8% at $51.97. Currently, the price is testing the neckline of the pattern and has broken the psychological level of $40 and the Fib. level of 38.2% at $41.03. Support is at the 50-day SMA near $38.

ADX is at 23.07 after 3 consecutive drops with lower highs, while the + DI has a value of 18.99 and is above the -DI with a value of 9.85, suggesting increasing weakness.

ADX is at 23.07 after 3 consecutive drops with lower highs, while the + DI has a value of 18.99 and is above the -DI with a value of 9.85, suggesting increasing weakness.

- https://www.investingcube.com/lloyds-share-price-forecast-does-the-rally-have-more-room-shares/

- https://www.marketbeat.com/instant-alerts/lon-lloy-insider-buying-and-selling-2021-03-2-3/

- https://finance.yahoo.com/news/value-investors-consider-lloyds-banking-062606979.html

Click here to access our Economic Calendar

Aldo Weidner Z.

Market Analyst – HF Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.