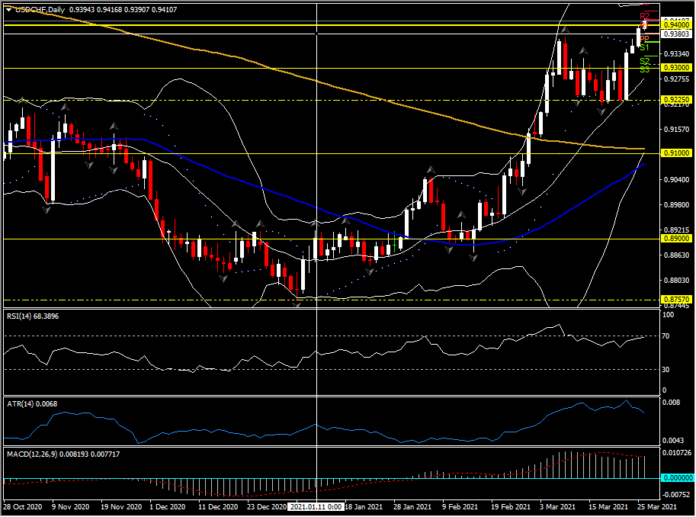

USDCHF, Daily

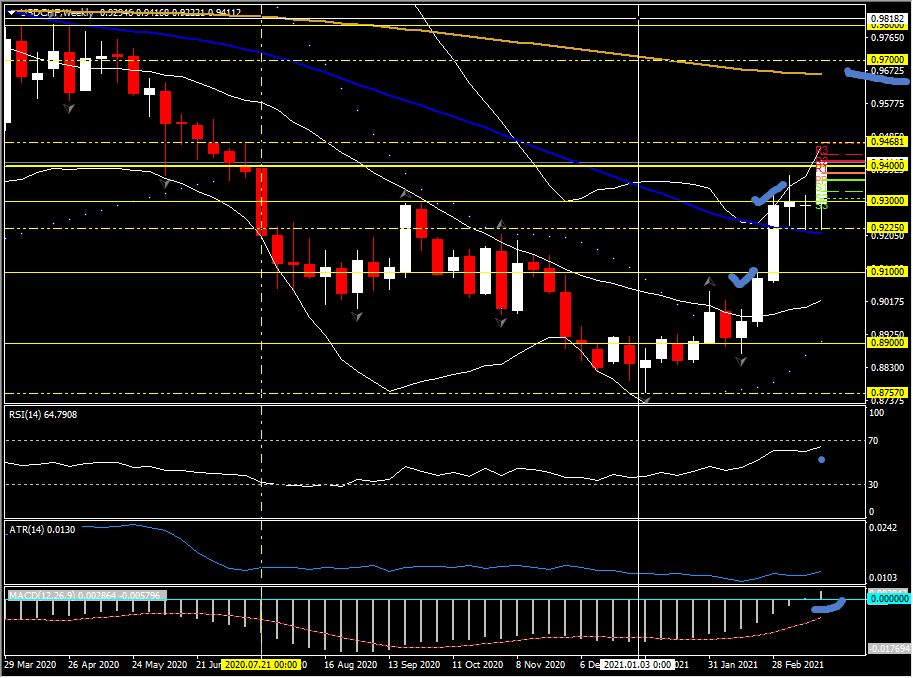

A somewhat perfect storm of a stronger Greenback and weaker Swiss Franc has created some strong trends from today’s intraday move to the higher timeframes. The USDCHF has breached 0.9400 today for the first time since July last year and is currently posting 35-week highs. It’s all about the central banks.

European central banks are basically in wait and see mode and the Swiss National Bank joined the club yesterday. Overall policy settings remain unchanged and the SNB remains committed to ensuring generous liquidity supply and low rates, while keeping a lid on the CHF by intervening in currency markets. Like elsewhere in Europe, uncertainty over the near term outlook remains high, but the central scenario remains for a rebound in growth later in the year and the growth forecasts remain unchanged.

The SNB left the policy rate and interest on sight deposits at the central bank at -0.75%. Forex intervention remains a key part of the strategy, and the central bank said today that “despite the recent weakening, the Swiss franc remains highly valued”. Against that background the SNB stressed that it “remains willing to intervene in the foreign exchange market as necessary”, which actually is slightly less aggressive than the December statement, which still said that “SNB remains willing to intervene more strongly”. Indeed, while for now the SNB’s expansionary monetary policy remains in place, there is the sense that the next move is more likely to be a slight tightening than a further expansion of already very generous settings. The fact that the CHF recently fell to a 20-month low clearly helped to create more room for the central bank.

The move today, north of 0.9400, following Tuesday’s rally from the 20-day moving average and short term support at 0.9225 ahead of the SNB, suggest there may be more upside to come. Initial resistance at R3 coincides with the monthly high from July 2020 at 0.9468, and beyond here is the 200-week moving average at 0.9650 and psychological 0.9700. To the downside, support is the 20-day moving average which is now up to 0.9275, the late March support at 0.9225, and then the key confluence of the lower Bollinger band, 50-day and 200-day moving averages which are all coalescing at 0.9100. A bullish Golden Cross could be completed should the 50-day cross the 200-day moving average.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.