Market News Today – US equity futures are selling off, led by a more than 1% decline in the USA100 future, amid reports of USD 20 bln Block trades, selling of Chinese tech giants and the US media firm ViacomCBS. Asian stock markets have traded mixed and Japanese indices managed to move higher. JPN225 closed with a gain of 0.57%. The ASX was down -0.36% at the close. European futures are outperforming, but GER30 and UK100 are still down -0.07% and 0.21% respectively. Surging virus numbers in countries such as France weigh on confidence in Eurozone economies, which so far have had relatively relaxed virus restrictions. The UK meanwhile is finally easing its very strict measures, against the background of a successful vaccination campaign.

In FX markets the Yen strengthened and USDJPY fell back to 109.46, although the Dollar strengthened against most other currencies. AUD and NZD began to hand back small Friday gains. AUD slipped along with Australian shares, weighed by losses in technology shares, as Brisbane announcing a fresh three-day lockdown raised fears of a slow economic recovery. The EUR remains down against the Dollar and is currently trading at 1.1777, driven more by concerns over the weakening outlook for growth in the Eurozone in light of rising COVID cases. Cable dropped to 1.3755 (200-hour SMA).

Today – Data releases today focus on UK money supply and consumer credit data.

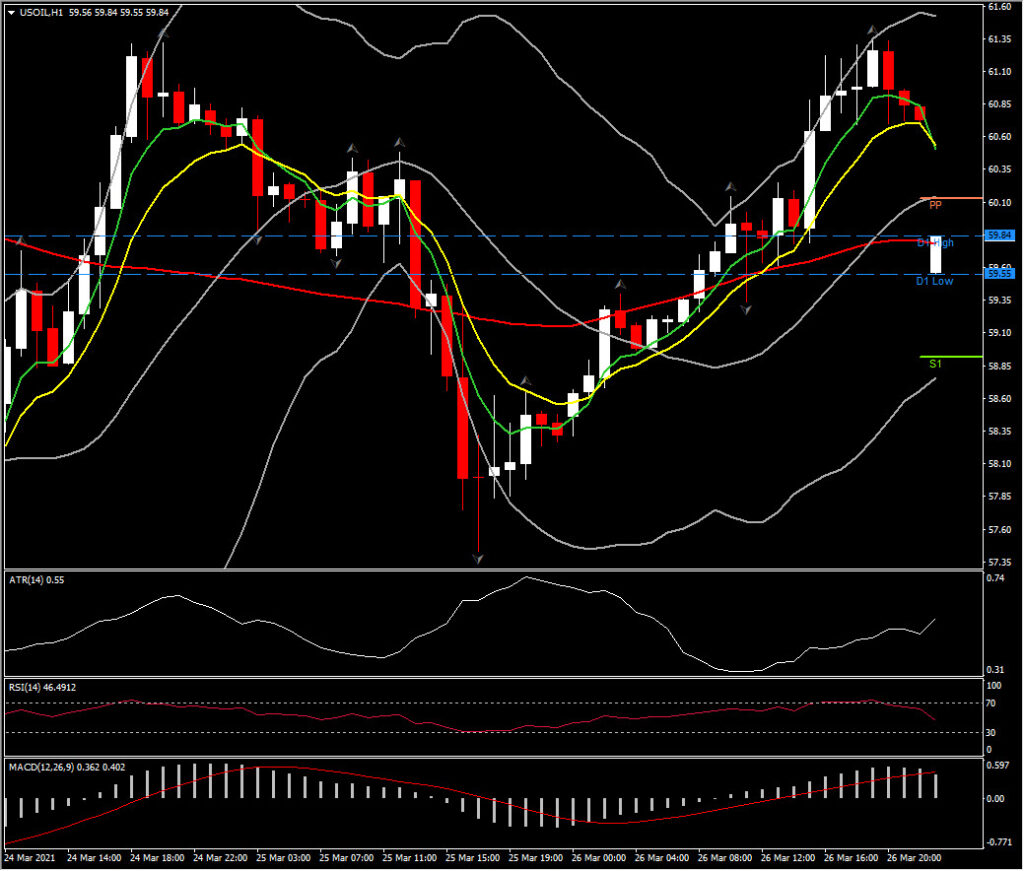

Biggest (FX) Mover @ (07:30 GMT) USOIL (-2.25%) Oil prices dropped at $59.55 after the Ever Given was finally refloated, although it doesn’t seem to be clear yet when the Suez Canal will be open again. Faster MAs remain aligned lower, RSI 45 and MACD histogram & signal line clashed without clear indication yet whether this implies consolidation or support. H1 ATR 0.55, Daily ATR 2.62.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.