USDJPY, H1

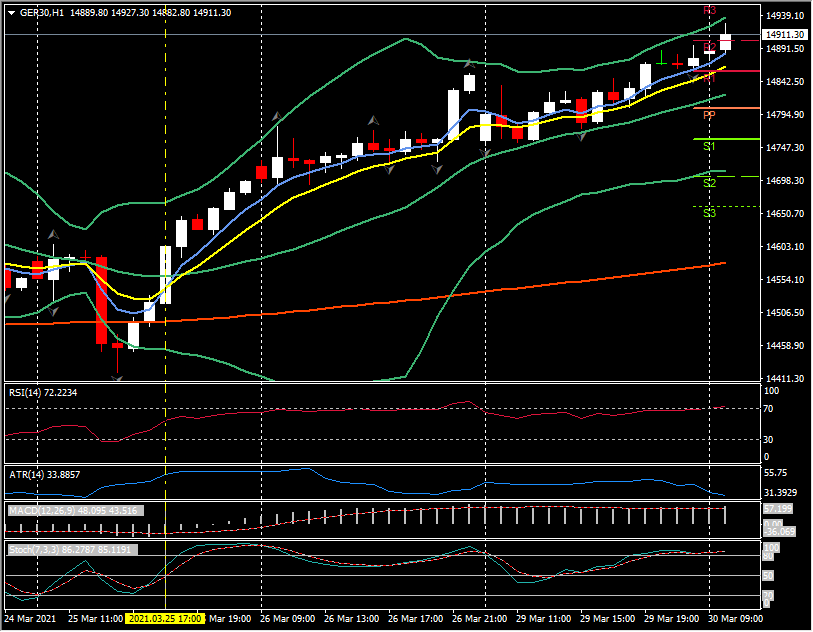

European stock markets are broadly higher in early trade and GER30 and UK100 are posting gains of 0.47% and 0.53% respectively. US futures continue to trade narrowly mixed, however, as the tech heavy USA100 struggles to find a footing. Asian markets had also painted a slightly mixed picture overnight, although generally it seems recovery hopes are back and that is also driving reflation trades and putting pressure on bonds this morning. 10-year yields are currently up 2.9 and 4.2 bp respectively in Germany and the UK, with the latter now at 0.83%. The marked rise in UK refinancing costs won’t help the government tackle the rapidly increasing debt mountain, but with the currency strengthening, the large current account deficit will be easier to handle.

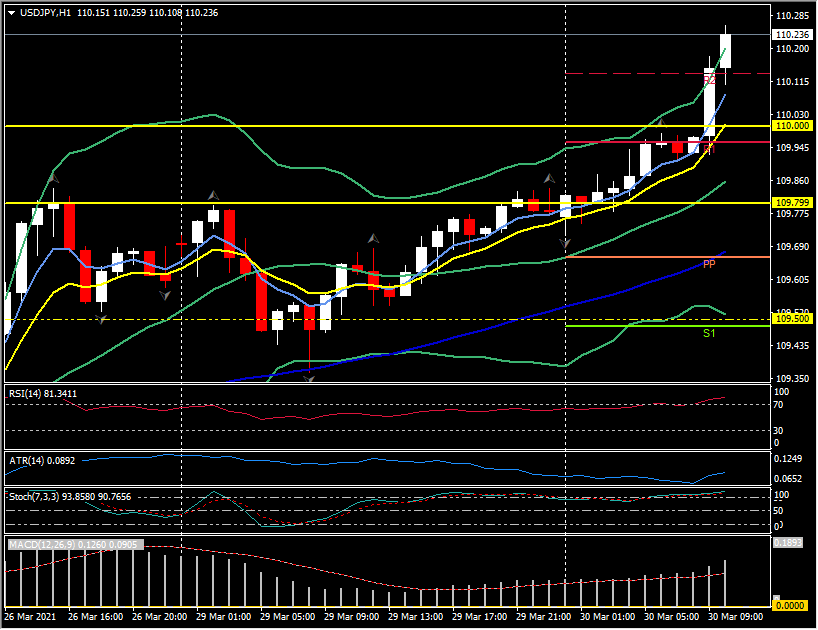

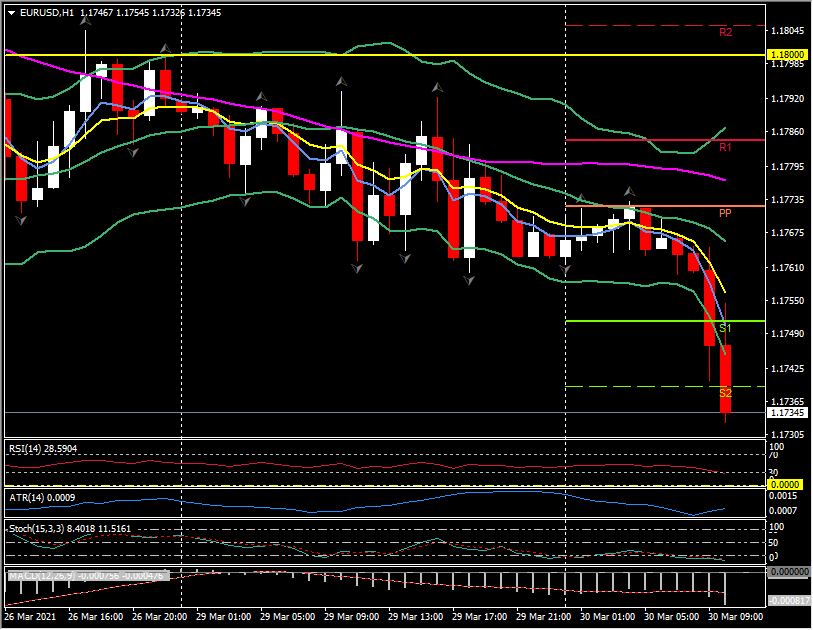

The Dollar rallied to a near five-month high on the measure of the narrow trade-weighted USDIndex. The high is 93.02, with the USDIndex rising above 93.0 for the first time since the first week of last November. The Dollar’s gains were in tandem with a vault higher in mid- to longer-dated Treasury yields, with the 10-year note yield rising nearly 4 bp from yesterday in testing the 1.760% level for the first time since January 2020. The yield had been foraying under 1.60% just last Thursday. At the same time, yield differentials have widened more in the dollar’s favour, with the 10-year T-note over Bund spread, for instance, stretching out to new 14-month highs over 203 bp. A marked yield differential widening has also been seen in the case of the T-note versus JGB yield, while the cases for US versus UK and Australian 10-year yields have seen much less, if any, widening. This yield dynamic has been playing out against a backdrop of overall positive risk appetite.

The MSCI Asia-Pacific stock index rallied over 0.6% and US index futures were showing modest gains, as of the early London morning. Weakness in Nomura shares was a drag on Japan’s Nikkei 225, which underperformed most regional peer indices today. Nomura and Credit Suisse have been hit hard by the Archegos Capital default, and both banks are facing regulatory scrutiny. Investors are wary about who else might be exposed, although the overall tone across Asian equity markets has been positive.

The global rollout of Covid vaccines remains a central focus for investors, especially with cases spiking again in Brazil and some other Latin American countries, in addition to continental Europe. The Philippines in Asia is also seeing a sharp spike in new cases. Vaccination supply capacity is ramping higher, however, and given the evident success of the vaccination programmes in the US, UK and Israel, where the rollout has been expensive compared to most other countries, it is anticipated that the reflation trade will fully recommence after the passing of month- and quarter-end, and the end of the financial year in the case of Japan. Expectation is that this will be bullish for the Dollar and dollar bloc and other cyclical currencies, and bearish for the Euro and Yen.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.