Sentix GmbH recorded the highest increase in consumer confidence in the entire Eurozone since August 2018. Although slow vaccine launches and the third wave were the main reasons for the Eurozone’s gloom, there is a basic factor playing a role in a different growth trajectory, namely fiscal policy. The Eurozone is struggling to ratify and implement the Next Generation EU recovery fund, which was agreed upon in July 2020, because the disbursement of funds is still being used for unemployment insurance and it is likely that the first payment related to the fund will not happen until the second half of this year.

Meanwhile, the February Eurozone unemployment rate was unchanged at 8.3%, worse than expectations of 8.1%, after the January figure was revised up from 8.1% to 8.3%. The EU unemployment rate was also unchanged at 7.5% in February.

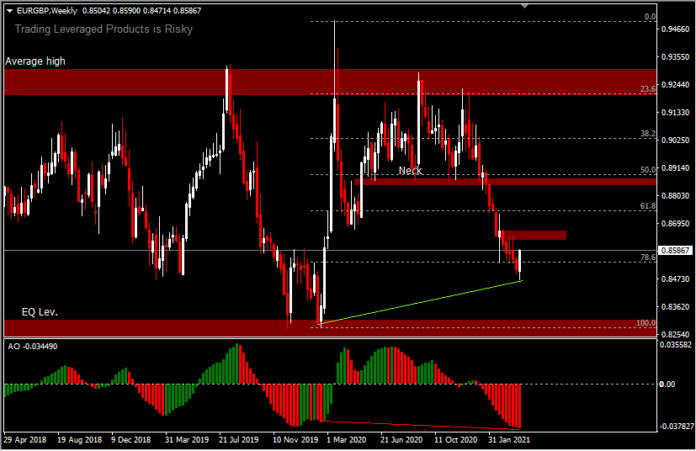

EURGBP – In general, EURGBP is in a downturn in 2021, which has coincided with Britain’s withdrawal from the European Union, or Brexit, as well as the second wave of Covid-19 outbreaks, the latter likely being the main reason for pressing the pair. England was the first country to have good news about the Covid-19 vaccine; according to Bloomberg, 47.3% of the UK population have been vaccinated so far, while only 12.7% of the EU population has been vaccinated.

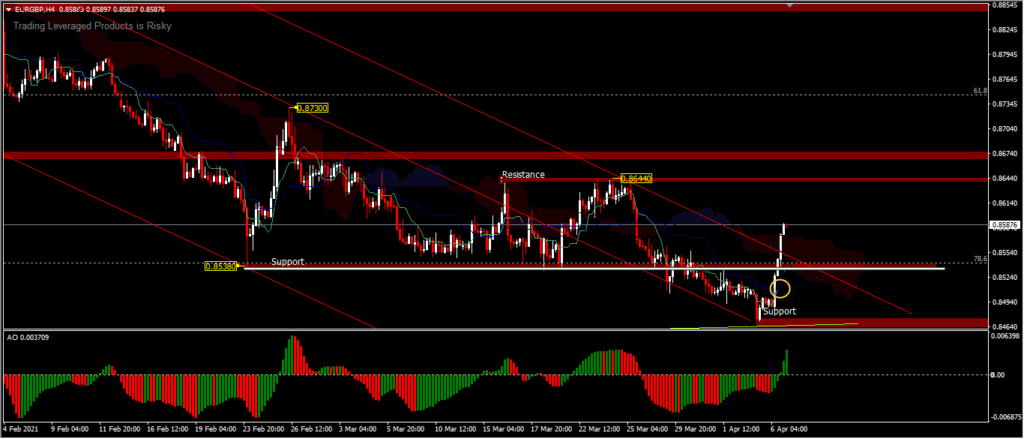

The pair strengthened significantly yesterday by recording an increase of +1.16%. Even the Support level 0.8538 which was originally broken down and to print a new low of 0.8471 is now being broken up again. A Golden cross of Tenken sen and Kinjun sen has been formed; this provides a strong rebound signal with the price moving above Kumo which will further target the next resistance level at 0.8644.

However, this rebound yesterday and so far today has not confirmed a reversal, because is falls in line with 4-months down channel range and BB range, so it is still possible that it will ran out of steam and might fall back down to re-test back to the 0.8538 level. Early indications of a rebound are already there, as the AO crossing is above the neutral zone, while the descending trendline in the short term (4-hour chart) has also been broken upwards. To ensure that this advance is not just a liquidation of short positions, there needs to be certainty that the price rally will continue past 0.8644 to confirm short term gains.

Yesterday’s significant move was in line with the technical view that sees the occurrence of Bullish Divergence since MACD lines are presenting a decrease of negative bias as price action continues its downtrend. Even though MACD lines are still below the 0 line, a significant Resistance is at the 50-day SMA line at 0.8650, as stated above. Only a break above this level could strengthen the odds of a reversal. On the flipside, a failure to break this level could suggest the continuation of 4-month decline.

Click here to access our Economic Calendar

Ady Phangestu and Chayut Vachirathanakit

Market Analysts – HF Educational office – Indonesia and Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.