Another important company from which significant growth is expected is the pharmaceutical company Pzifer, which is scheduled to report the results of the first quarter today. It should be noted that the shares added little more than 3% to their value during the last year, including an increase to position the stock 20% up after the use of the vaccine jointly developed by the company to combat Covid-19 was approved. Earlier this year the stock added another 6%, supported by the March 31 lifting of the ban that prevented the company from exporting any of the vaccines; the positive outlook remains based on the fact that Pfizer has started to send doses to Mexico. (1)

However, despite having developed the first vaccine licensed to be used in the United States, some investors consider that Pfizer shares are far from the levels that would indicate a celebration, since the stock gained just 8% during the last year, demonstrating that vaccine sales in the United States and around the world do not generate a large enough impact on the profitability of the company in the near future. On Friday, Pfizer shares closed at $38.65, but it is a fact that the company is already charging a higher price for its vaccine than some of its competitors; under the terms of its supply agreement with the United States, Pfizer is charging $19.50 for each injection of the two-dose regimen, while AstraZeneca, which still lacks government approval for its two-dose vaccine, has said it plans to charge less than $4 per injection, thus being regarded as the clear leader in the field of Covid treatment. Nevertheless, Pfizer despite competitors advantages, is well positioned to unlock more value for its investors after its latest corporate restructuring. (2)

Analyst groups like Trefis forecast that Pfizer’s valuation is $40 per share, largely in line with the current market price, with first-quarter revenue estimated to be around $14 trillion, slightly above the current market price, with the $2.2 billion be from the COVID-19 vaccine sales for the quarter. The revenue estimate is at $13.62 billion for Q1 FY 2021 with earnings per share be at $0.80 although some other resreach houses such as SeekingAlpha estimate it at $0.77, while margins are expected to improve further in the future as the current health crisis subsides. Pfizer’s adjusted net income of $2.4 billion in the fourth quarter of 2020 reflected a 15% increase over its figure.(3)

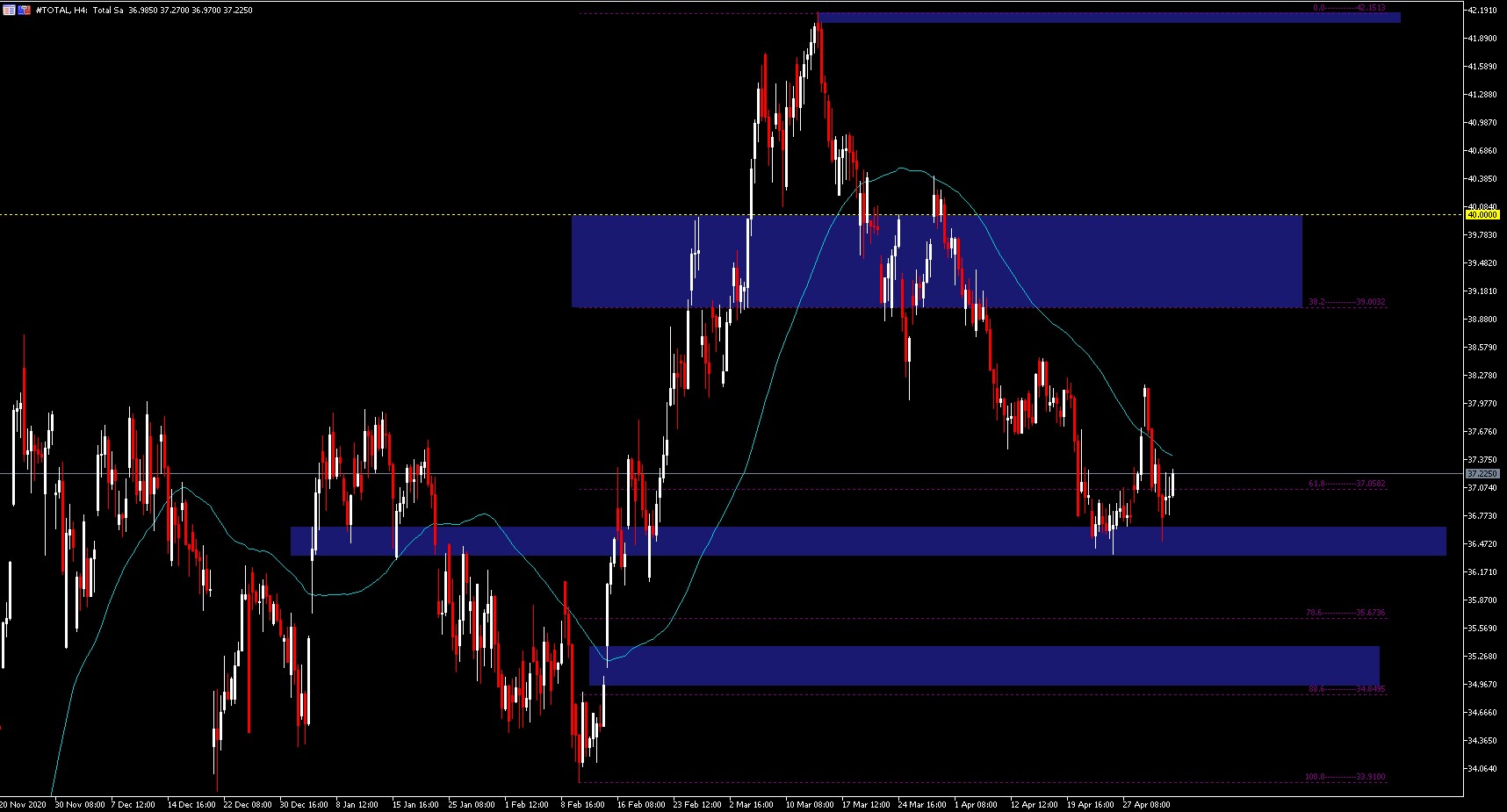

Pfizer has been on a bullish rally since February and after a setback from its March maximum at $42.15 to the 61.8% level at $37.05 which was tested 2 times before recovering to the current price of $37.22 and very close to testing the 50-period SMA in H4. If it resumes its bullish momentum, we will see resistance from the 38.2 Fibo at $39.00 to the psychological level of $40.00, which if crossed will then put resistance at the previous high at $42.15. If the Fibo 61.8 level is broken again, the level will probably no longer recover and will continue to the 78.6% -88.6% support at $35.67- $34.84 and the continuation GAP of the first bullish impulse.

Recent analyst ratings lean towards a “Buy” or “Strong Buy” outlook, so the share’s consensus target price is $40.69, giving it an upside potential of 5.4% at a recent price of $38.59, while the high target is $53, with upside potential around 37%. Currently Pfizer shares are trading at 11.6 times expected earnings per share for 2021, 12.5 times estimated earnings for 2022 and 12.1 times estimated earnings for 2023, with a 52-week range of the stock being $29.99 to $43.08 and the Dow Jones Industrial Average component paying an annual dividend of $1.56 with a yield of 4.04%. (1)

- https://247wallst.com/investing/2021/04/30/earnings-previews-cvs-pfizer-under-armour-and-more/2/

- https://in.investing.com/analysis/pfizer-q1-earnings-preview-vaccine-sales-in-focus-as-stock-fails-to-impress-200471330

- https://www.forbes.com/sites/greatspeculations/2021/05/03/all-eyes-on-covid-19-vaccine-contribution-as-pfizer-reports-its-q1/?sh=fb6fe624c464

Click here to access our Economic Calendar

Aldo Weidner Z.

Market Analyst– HF Educational Office – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.