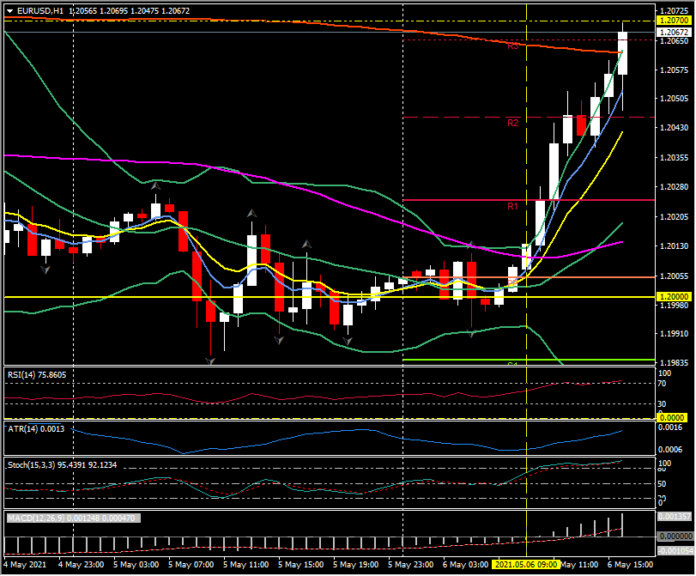

EURUSD, H1

US initial jobless claims dropped -92,000 to 498,000 in the week ended May 1, more than expected and posting another new post-covid low, after sliding -13,000 to 590,000 (was 553,000) previously. Just before the US economy closed last year, claims were at 256,000 in the March 13 week. The 4-week moving average fell to 560,000 from 621,000. Initial claims not seasonally adjusted tumbled -107,400 to 504,700, following the prior 27,000 jump to 612,100. Continuing claims bucked the trend and climbed 37,000 to 3.690 million in the April 24 week after bouncing 1,000 to 3.653 million in the April 17 week.

Initial claims are entering May below prior averages of 580,000 in April, 724,000 in March, and 800,000 in February. The 566,000 April BLS survey week reading sharply undershot recent survey week readings of 765,000 in March and 847,000 in February. The diminished downtrend in continuing claims caps the significance of the big initial claims declines into May. The median consensus for tomorrow’s April nonfarm payroll forecast remains in the 978,000-990,000 range, with an upside bias, the highest estimate being around 2.1 million.

Earlier, the US Challenger reported that announced layoffs declined -7,700 to 22,900 in April following the -3,900 drop in March to 30,600. It is a third straight monthly decline. On a 12-month basis, announced layoffs are down -96.6% y/y, versus -86.2% y/y previously. Last April, employers had announced a record 671,000 in cuts. Challenger said the good news is that layoffs are declining, but the bad news is that employers are seeing labour shortages, even with millions still unemployed. Aerospace/defense led the job cut announcements last month. Announced hirings declined -21,400 to 76,300k after March’s -48.600 decline to 97,800.

The Dollar moved higher after the lowest initial jobless claims print since the beginning of the pandemic, though continuing claims firmed up some. Q1 productivity rose more than expected. USDJPY rallied modestly toward R1 at 109.40 before slipping back to 109.20, EURUSD edged a few points low to near R2 at 1.2047, before again challenging above R3 at 1.2070.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.