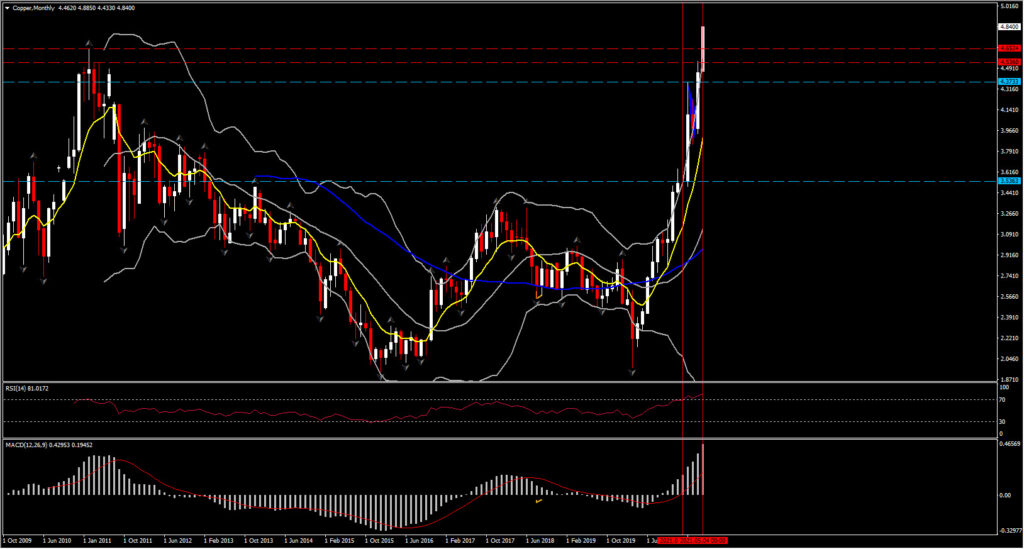

Precious and industrial metals are in extending mode of their recent or even all-time highs so far in 2021, on the back of commodity super-cycle optimism. Base metal prices have continued to surge to fresh trend highs. Oil prices are off recent highs, with the market being affected by the Covid situation in India (which is among the world’s biggest importers of oil), but the bigger-picture market prognosis remains bullish given the success of vaccinations and ramping up of supply capacity for vaccine production. As explained in March, the overall outlook of industrial metals e.g. Copper is set to enjoy an even bigger rise in demand because of the transition away from fossil fuels, similarly to Palladium which is also a necessary component of electric vehicles engines. In the meantime, the reflation trade story also supported and keeps supporting Copper amid the hopes of reopening of the global economy, and hence the rising demand is not solely from China but further regions.

Hence that said, the overall outlook remains supported by the above, however this week’s skyrocket seen in Copper, Platinum, Palladium, Gold and Silver is supported not solely by the weaker US Dollar but also by reopening optimism and hope of large-scale infrastructure spending in both US and China.

All this means is that prospects for a strong rebound in the US economy remain on track, but it will take longer to achieve as a consequence of the ironic drag of pandemic support measures, while the demand/supply imbalance will have an inflationary effect, which is largely why longer-dated treasury yields have more than unwound the steep declines that were seen in the immediate wake of the payrolls release on Friday and why the metal market found a further bid.

Meanwhile as reported by ING news, China has been key to the broad-based rally seen across the metals complex, with its post-Covid stimulus boosting infrastructure projects, and in turn boosting demand for metals. However, it’s not just China where we are seeing a recovery, global demand is making a return as more economies reopen, and downstream sectors restock following the pandemic-induced lockdowns. US plans for a large infrastructure spend have only provided further support to markets, with investment planned to go towards electric vehicle infrastructure, power grids, as well as roads and bridges.

In addition, a group of 15 key copper smelters in China has agreed to cut purchases of raw material copper concentrate in 2021 by 8.8% on the year, state-backed research house Antaike said, in a bid to boost flagging treatment and refining charges.

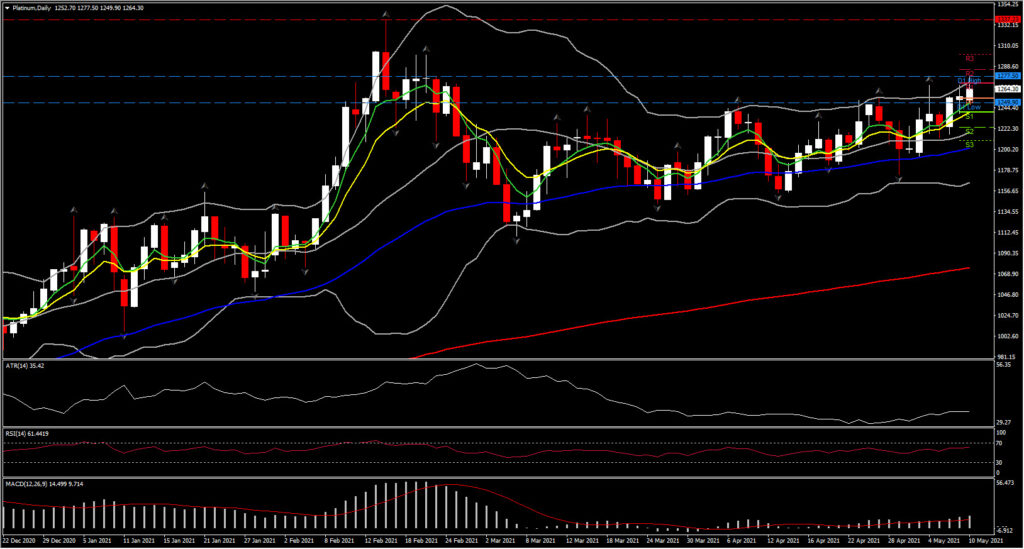

Copper broke previous record highs at 4.65, while Platinum opened the week above 3-month highs echoing its bullish momentum after consolidating in April, with 1250 being a key resistance area.

The asset presents an increasing positive bias with 50-day SMA providing key support as it points higher, with the Bollingers extending northwards. The oscillators are indicating that positive momentum is gathering gains, endorsing the price’s fresh upward drive, as MACD is strengthening above its signal line in the positive area, while the RSI is navigating towards the 70 level. If the commodity sustains bullish bias, the next Resistance area to be seen is at the 2021 highs at 1337.

If sellers gain control, only a sharp sell off below 1200 could turn the overall positive outlook into doubt.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.