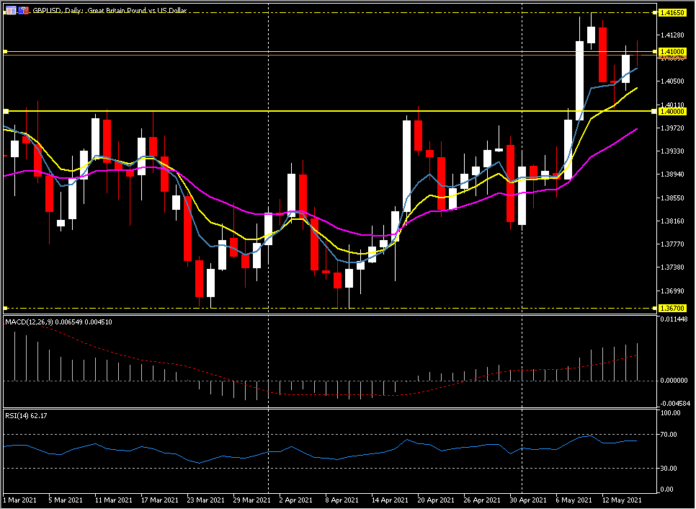

GBPUSD, Daily

The UK economy is building up a head of steam and is on the road to fully reopening by mid June, in line with the government’s timetable (though there are nascent concerns about the Indian Covid variant cropping up in some areas).

There is very little prospect of another legally binding referendum on Scottish independence anytime soon after the Scottish National Party failed just short of achieving a majority in Scotland’s parliament at last week’s elections. Opinion polls show there is little appetite amongst the Scottish people for another vote on independence. The country also remains evenly divided on the issue, just as it was heading into the referendum in 2014, despite the majority having since voted to remain in the EU at the 2016 Brexit vote. All this gives PM Johnson plenty of political ammunition to resist the SNP’s calls for another vote.

The calendar this week is busy, featuring the labour market report covering March and April (Tuesday), April inflation data (Wednesday), May consumer confidence and April retail sales (Thursday), along with the preliminary May PMI survey results (also Thursday). The labour market report is expect to show an unchanged unemployment figure of 4.9%, which is artificially being held down by the government’s pandemic furlough scheme. Average household income is expected to rise by 4.6% y/y in the three months to March in both the with- and without-bonus readings. As for inflation, the well documented pandemic-era y/y base effect will start to kick in, with headline CPI expected to jump to a rate of 1.4% y/y from 0.7% y/y in March. There is upside risk to this release. Consumer confidence should show improvement in the May survey from Gfk on the back of the successful Covid vaccination program and reopening economy. April retail sales, meanwhile, are expected to rise by a solid 4.0% m/m.

Today the major forex pairs await stimulus from data later in the week while the Dollar corrected after initially gaining in the wake of the hot CPI print out of the US last week. The Dollar has been tracking longer-dated Treasury yields, which spiked sharply on the CPI release before the inflation debate cooled, and yields unwound the gains seen. The Fed are sticking with the “inflation-will-be-transitory argument”, and hope the markets believe it. The prevailing dominant view is that price pressures will abate in Q3, as year-on-year base effects narrow and supply bottlenecks are ironed out, which — for now at least — is keeping shorter-dated Treasury yields anchored at low levels, with the Fed expected to hold out on Zero Interest Rate Policy (ZIRP). The CME’s Fedwatch Tool shows that market positioning is implying a probability for a 25 bp Fed hike by year-end of about 9%, which is only marginally up on the 7% probability being implied ahead of the CPI release. Also note that the Treasury’s 10-year auction was very well bid last week by both domestic and foreign accounts, with the spike in yields to 1.70% proving an attractive proposition.

At the moment, Cable holds over 1.4000, having spiked to 1.4165 in the wake of the UK local elections last week. The UK’s emergence and reopening from peak pessimism with regard to the pandemic is providing support for the long undervalued Pound, though Cable would face downside risk should Fed tapering start to look more inevitable, which we anticipate given the outsized stimulus in the US. Technically, the daily chart remains biased to the upside with the 20-day moving average at 1.3968 and the pair having been north of this key indicator for the last 11 trading days. A breach below the 20-DMA could test the May low at 1.3815 and then the Spring low at 1.3670. A break and breach of last week’s high would then bring in the February 24 high at 1.4240.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.