Market News Today – USD gets a reprieve from surprise FOMC minutes. Minutes showed “taper talk” was discussed much more than any participant held implied since the meeting. USDIndex back over 90.00. Equities closed down -0.29%, USA500 4115, despite robust earnings from Lowes & Target, CISCO disappointed, after hours. Asian markets follow lower. Overnight – AUD unemployment mixed, JPY machine Orders better, trade flat.

This week – Economic data slim, FOMC Minutes, Earnings from Walmart (Beat), Vodafone (in-line), Home Depot (beat), Target (beat), Lowes (beat) Cisco (miss). Still to come today – Applied Materials & Ralph Lauren.

EUR – down from 3-mth highs at 1.2240 under 1.2200 to 1.2185, JPY still struggles at 109.00, Cable back under 1.4200 and 14100 now. AUD back to 0.7750, CAD up from 6-year lows to 1.2100.

USOIL edges back up after yesterdays sell-off from under $62.50 to $63.50, Gold – rallied to 3.5 mth high to test key resistance at $1875, again trades at $1874. Commodities cooled but remain robust. BTC sank under $30,000, (& lost -54% from peak last month) – back to $40k now. All from Musk & “China banned its financial institutions from offering cryptocurrency registration, trading, clearing, and settlement in a blow to investors who were betting that digital assets will gain mainstream status.” Reuters.

European Open – The June 10-year Bund future is down -15 ticks, underperforming versus U.S. futures, which have moved slightly higher, while in cash markets the 10-year Treasury rate is down -0.2 bp at 1.67%. The reading is up from overnight lows though, as stock market sentiment started to stabilise during the Asian part of the session and DAX and FTSE 100 futures are posting gains of 0.6% and 0.9% respectively. U.S. futures have moved sideways after a weaker close on Wall Street and against the background of the Fed minutes, which suggested that some policy markets have at least started to think about tapering “some point”. For now though the official line at central banks is that the uptick in inflation is transitory and ECB’s Schnabel, who predicted a German CPI rate of over 3% later in the year, said that inflation is likely to recede again in 2022.

Today – US Initial Job Claims, Philadelphia Fed Business Index, SARB rate decision, ECB’s Lane, Lagarde, BoE’s Cunliffe, Fed’s Kaplan, Earnings from Applied Materials & Ralph Lauren

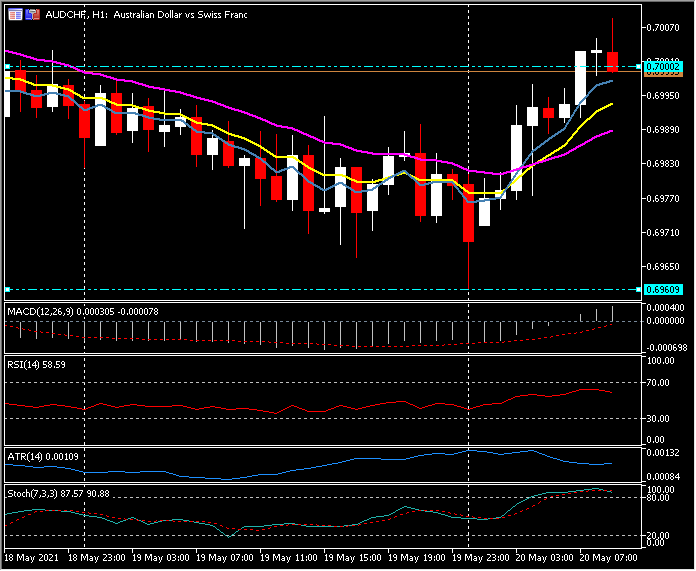

Biggest FX Mover @ (07:30 GMT) AUDCHF (+0.34%) rallied from under 0.6961, yesterday to over 0.7005 now. Faster MAs remain aligned higher, RSI 60 & moving higher, MACD histogram & signal line aligned higher having broke 0 line earlier. Stochs rising and in OB zone from earlier. H1 ATR 0.0011, Daily ATR 0.0051.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.