Market News Today – USD reprieve peters out & Powell & US Treasury turn attention to Cryptos. USDIndex under 90.00 to test Tuesday low at 89.65. Equities closed higher +1.00% USA500 4159, Nasdaq outperformed up 1.77%. Asian markets follow higher (Nikkei + 1.00%). Overnight – AUD PMI’s inline, Retail Sales big beat, JPY CPI remains weak but beat. London session UK Retail Sales surge to 9.2%, EZ PMIs better than expected. (55.1 vs 52.5 Services & 62.8 vs 62.5 Manu.) UK PMIs mixed – a big beat for Manu. (66.7 vs 60.7) and a miss for Services. (61.8 vs 62.2)

This week – Economic data slim, FOMC Minutes, Earnings from Walmart (Beat), Vodafone (in-line), Home Depot (beat), Target (beat), Lowes (beat) Cisco (miss). Applied Materials ( beat – +4.42%) & Ralph Lauren also big beat but shares closed down 7.00%.

European Open – The June 10-year Bund future is down -15 ticks, underperforming versus U.S. futures, which have moved slightly higher, while in cash markets the 10-year Treasury rate is down -0.2 bp at 1.67%. The reading is up from overnight lows though, as stock market sentiment started to stabilise during the Asian part of the session and DAX and FTSE 100 futures are posting gains of 0.6% and 0.9% respectively. U.S. futures have moved sideways after a weaker close on Wall Street and against the background of the Fed minutes, which suggested that some policy markets have at least started to think about tapering “some point”. For now though the official line at central banks is that the uptick in inflation is transitory and ECB’s Schnabel, who predicted a German CPI rate of over 3% later in the year, said that inflation is likely to recede again in 2022.

Today – US PMIs, Canadian Retail Sales, EZ Consumer Confidence, Baker Hughes Rig Count, ECB’s Lagarde and de Guindos, Fed’s Kaplan, Bostic, Barking, and Daly. Earnings – Deere, Foot Locker & Booz Allen Hamilton.

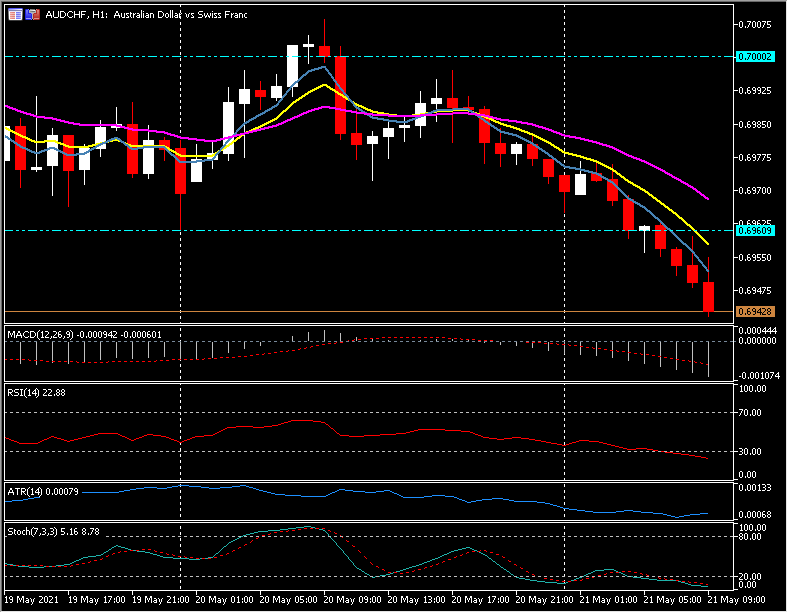

Biggest FX Mover @ (07:30 GMT) AUDCHF (-0.44%) declined from 0.7000 yesterday to move below Wednesday’s 0.6960 low and trade at 0.6945 now. Faster MAs remain aligned lower, RSI 22.7 OS and still moving lower, MACD histogram & signal line aligned lower having broke 0 line earlier. Stochs. falling and in OS zone from yesterday. H1 ATR 0.0011, Daily ATR 0.0051.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.