Market News Today – Bonds were in the spotlight on Tuesday, posting solid gains, while stocks were mixed in a more back-and-forth trade. Dovish comments from central bankers, and especially Fedspeak, which continue to play down inflation, provided support, as did a strong 2-year Treasury auction. Wall Street stumbled from its opening rally and shed its gains after data suggested rising price pressures knocked consumer confidence lower. But ongoing dovish Fedspeak helped offset the selling.

In Europe, GER30 and UK100 futures are currently up 0.4% and 0.04% respectively, with a 0.4% rise in the USA100 leading US futures higher. Strong survey data out of Germany confirmed a broadening and strengthening of the recovery, but in a way that backs the assertion that a temporary mismatch of supply and demand is the main reason for the rise in price pressures. ECB’s Stournaras said he doesn’t see the need for a change to the PEPP program.

The June 10-year Bund future is down -0.6 bp, which suggests bonds will get a bid in early trade, after Fed officials once again moved to calm taper concerns and inflation jitters by re-iterating that the rise in prices will prove temporary.

Any initial demand for bonds may quickly fizzle out, especially after the RBNZ projections reminded markets that the next move at central banks will almost certainly result in tighter policies. RBNZ left policy unchanged, as expected.

In FX markets, the Yen and US Dollar struggled, while the NZD rallied as yields jumped higher. USDJPY is currently little changed at 108.76. Both EUR and GBP moved higher against a largely weaker Dollar, with EURUSD at 1.2259 and Cable at 1.4161. USOIL is trading at USD 66.04 per barrel, as traders weigh expectations of improving demand in the US against the possibility of new supply from Iran. Bitcoin gained 2.39% to $39,314.81 despite China’s northern region of Inner Mongolia escalating a campaign against cryptocurrency mining on Tuesday, days after Beijing vowed to crack down on bitcoin mining and trading. Gold is at $1907.

Today – The calendar is pretty empty today, with only some national business confidence readings out of France, before the Eurozone ESI report tomorrow and FOMC Quarles speaking, and Crude Inventories.

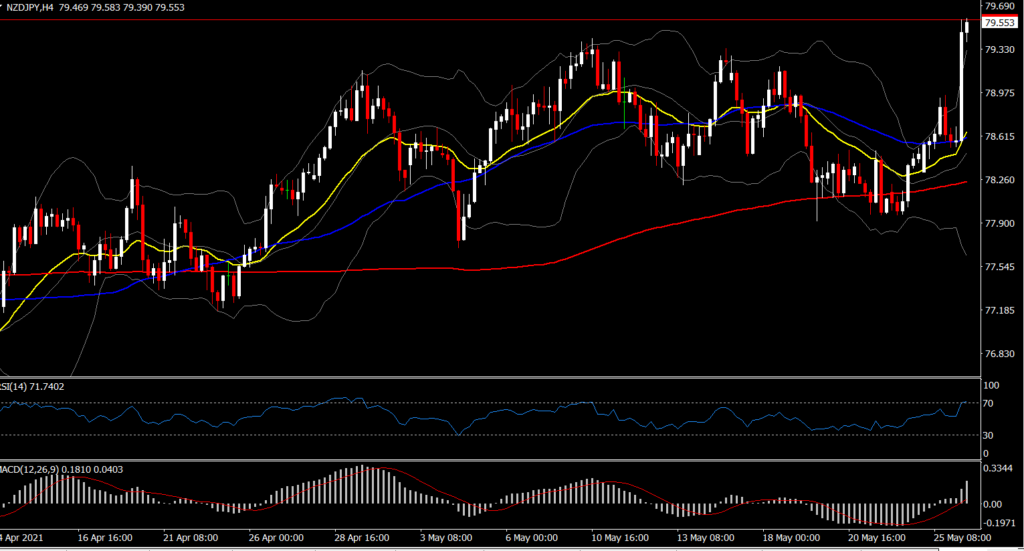

Biggest Mover @ (07:30 GMT) NZDJPY (+1.28%) rallied to 79.55 after RBNZ, breaking 79.41 which was the Resistance level maintained since March 2018. In the 1 hour chart, faster MAs remain aligned higher, RSI 82 but still pointing right, MACD histogram & signal line aligned higher while Stochs rising despite reaching OB at 93. The OB condition of both RSI and Stochs could alert the need of consolidation or pullback, but this is not the case so far. H1 ATR 0.1596, Daily ATR 0.6699.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.