Market News Today – Trading could be a little more cautious today ahead of data, with the second look at Q1 GDP, along with jobless claims and durable orders today, followed on Friday by income, consumption, and PCE prices. Inflation worries have faded for now as the Fed has continued to stress its transitory nature, but investors will be on the lookout in upcoming reports. Wall Street had been supported by improving expectations on the recovery and the slide in bond yields. There was some positive noise on US-China trade talks, and China signalled more support for micro and small enterprises.

Overnight, Asian bonds traded mixed, with New Zealand’s 10 year rate still rising after the RBNZ signalled yesterday that rates could rise from the second half of next year. Stocks are so far struggling to add to recent gains, however, and after a slightly higher close on Wall Street stocks traded mixed across the Asia-Pacific region and GER30 and UK100 futures are hardly changed this morning. US futures are fractionally lower.

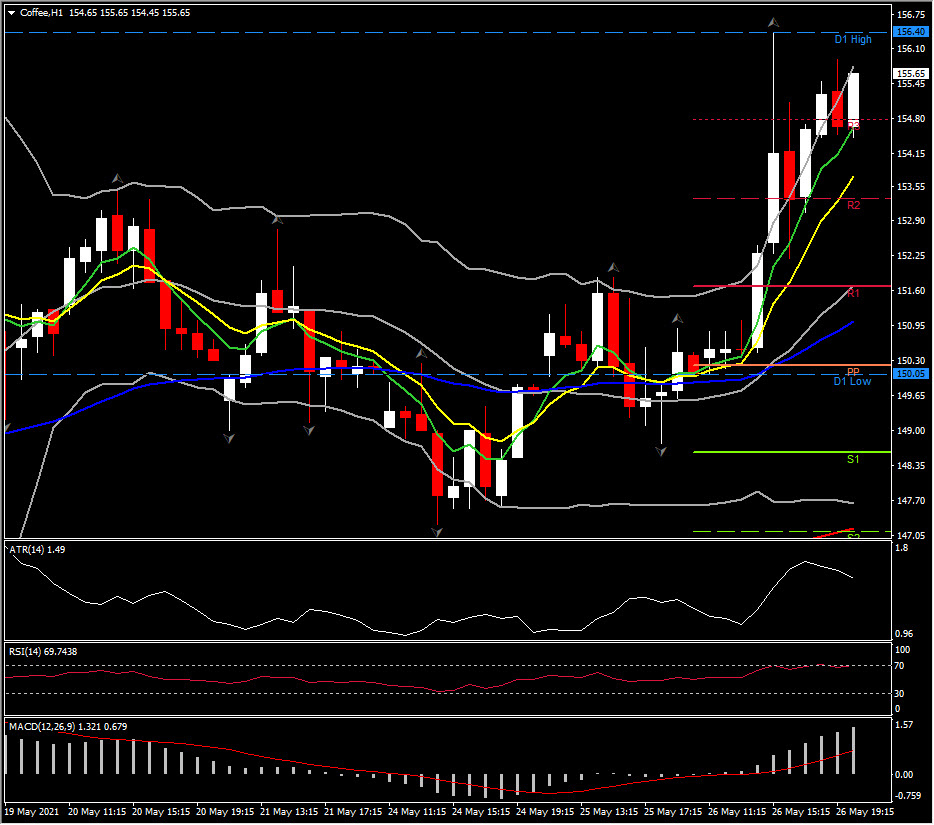

In FX markets, USDJPY dropped back to 109.09. NZD remained supported as traders price in rising rates. Both EUR and GBP moved lower against the Dollar, with EURUSD at 1.2175 and Cable at 1.4105. USOIL rallied to $65.95 from near $65.50 following the EIA inventory data which showed a 1.7 mln bbl fall in crude stocks. Bitcoin dropped 4% in Asia to about $37,600 and Ethereum was down 7.5% at $2,676. Gold is at $1903. Coffee futures up 3.62%, Vix 1.92%.

Today: Data releases remain thin on the ground, leaving the focus on US reports in the PM session ahead of Eurozone ESI economic sentiment tomorrow.

Biggest Mover @ (07:30 GMT) Coffee rallied to 156.40. In the 1 hour chart, faster MAs remain aligned higher, RSI 69.74 but currently sideways, MACD histogram & signal line aligned higher. H1 ATR 1.49, Daily ATR 4.19.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.