Coffee prices are gaining support from the prospect of increasing demand as faster Covid vaccination speeds allow more restaurants and coffee shops to reopen around the world.

In early May, the International Coffee Organization (ICO) cut its forecast for global coffee production 2020/21 to 169,633 million bags from a previous estimate of 171,896 million bags, and cut its estimated global coffee surplus of 2020/21 to +3,286 million bags from the previous estimate of +5,258 million bags.

The bullish factor for coffee recently has been the stalled exports from the world’s second largest Arabica producer, Colombia. Colombia’s National Coffee Growers Federation said Wednesday that shipping companies had suspended orders for coffee cargoes, as protests and road blockades to ports disrupted coffee exports. The protests, which began more than three weeks ago, were initially in response to the Columbian government’s announcement last month of a new tax reform bill and proposed tax hike, and are now spreading and causing countrywide turbulence.

Additionally, concerns about Brazil’s coffee crop sparked purchases Wednesday, after Marex Solutions said on Tuesday that beans collected so far from Arabica coffee fields were showing far below normal yields. Marex also said the low soil moisture might also hinder the development of the Brazilian coffee plant.

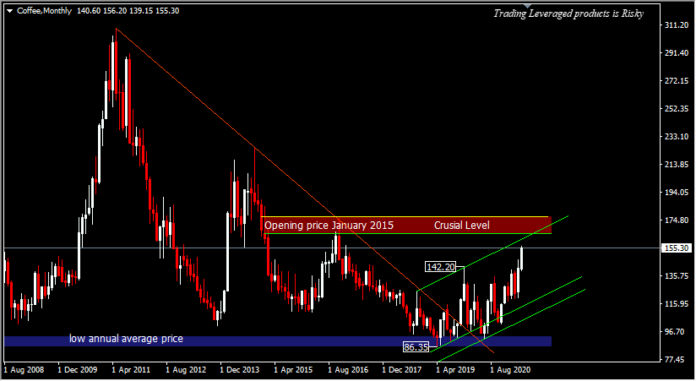

Coffee, W1.

Since the beginning of Q121, coffee price growth reached +21.5% with moderate growth, surpassing the peak prices of the past 3 years (2018, 2019 and 2020). Meanwhile, currently the price position is trying to match the 2017 peak (156.70); at the time of writing the price was at 155.30. Further rallies are expected to hit the 2015 opening price (165.30) and the 2016 peak (175.75). The technical benchmarks support the bullish move to date, where the price is moving in an upward tunnel with the dominant upward price structure. The average price is moving above Kumo and the histogram AO is still showing strong buying momentum. A correction in the price will put 140.00 as strong support. Broadly speaking, the outlook remains bullish.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.