Central bankers continue to do their best to keep tapering concerns at bay, but while ECB’s de Cos added to the dovish voices out of the Eurozone this week, Bundesbank President Weidmann and centrist Executive Board member Schnabel are due to speak this afternoon and likely to present a more balanced view. A compromise for the June meeting could be a scaled back monthly purchase target within an unchanged PEPP framework and overall QE target, which would effectively mirror the BoE’s action. Against that background the air for Eurozone bonds as well as stocks may be getting thinner at these levels as markets look to US data releases. GER30 and UK100 are down -0.3% and -0.1% respectively.

EURUSD has drifted off highs as markets anticipate a batch of US economic data releases today and tomorrow, including key price data. The Euro has lately found an underpinning from the improving outlook in the Eurozone economy, with the recent wave of Covid infections having been quelled and the EU having finally got its act together with its vaccination program. As for the US inflation situation, the prevailing dominant view is that price pressures will abate in Q3, as year-on-year base effects narrow and supply bottlenecks are ironed out, which — for now at least — is keeping shorter-dated Treasury yields anchored at low levels, with the Fed expected to hold out on ZIRP and QE.

The CME’s Fedwatch Tool shows that market positioning is implying a probability for a 25 bp Fed hike by year-end of just 9%, having ebbed back from the 11% odds that were being implied last week.

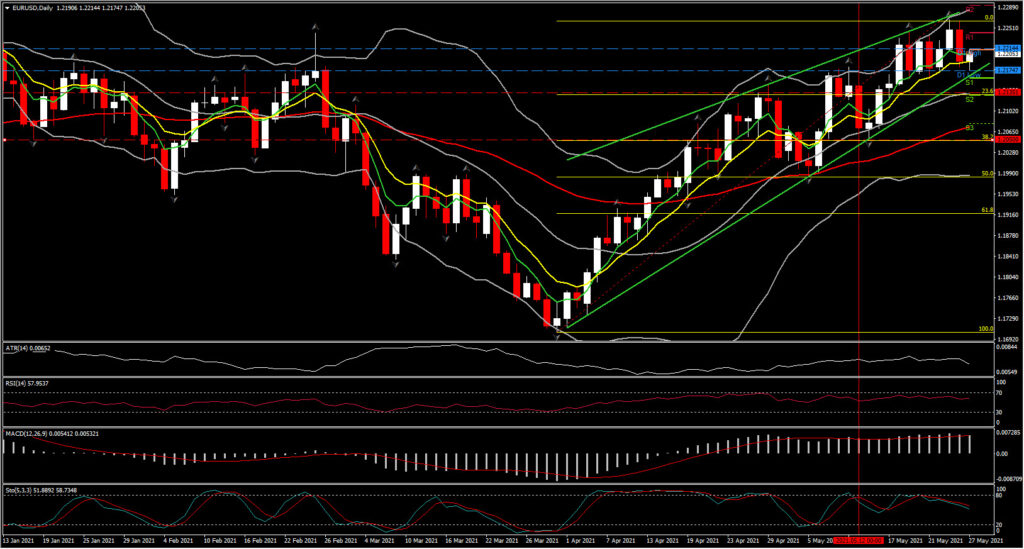

EURUSD futures are implying a first 25 bp hike in 2023, about a year ahead of what the Fed has been signalling. EURUSD is holding higher above the 20-day EMA. However, the market has been trading in a horizontal trajectory the past 8 days within the upper boundary of the 1.2165 Resistance and the lower immediate boundary of the 1.2157 Support. The RSI is sloping sideways above the 50 level, while the stochastic is heading downwards after the negative cross within the %K and %D lines. MACD lines held well above zero, presenting along with RSI an overall bullish outlook but a neutral outlook in the near-term.

However the key Support level for the asset is 1.2135, which is the confluence of the 20-Day SMA and 23.6% Fib. level. If the price breaks this bottom, it could meet the 50-day SMA and the 1.2000-1.2050 area. Bullish movements could open the way for the pair to test the year’s peak and even the multi-year highs at 1.2460-1.2500, if the bulls manage to successfully surpass 1.2250 (FE 61.8%).

In conclusion, EURUSD is neutral in the near term but is looking neutral to bearish in the short-term outlook.

Nevertheless, as stated in our latest post, EURUSD’s prevailing upside bias seems likely to sustain so long as markets continue to buy-in to the Fed’s narrative, but would see downside risk should Fed tapering start to look more inevitable. This would be when the US versus Eurozone growth differential is matched by a Fed versus ECB tightening expectations differential, which would be the circumstance for the directional bias of EURUSD to shift to the downside.

It is notable that the doves on the governing council have lately been quiet about the ascent of the Euro, despite the tightening effect via real interest rates. In fact ECB’s Panetta said just yesterday that the recent rise in the Euro could, if sustained, “weaken inflationary pressures.” Given the outsized fiscal stimulus and higher growth trajectory in the US, the bigger-picture risk for EURUSD is to the downside.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.