GBPAUD, H4

According to a BBC report citing sources within the UK government, British Prime Minister Boris Johnson and his Australian counterpart, Prime Minister Scott Morrison, have agreed to the broad terms of the UK-Australia free trade deal.

The deal aims to increase the volume of trade between the two countries, which currently stands at £20 billion ($28.2 billion). It is the UK’s first post-Brexit free trade agreement not to build on the trade foundations set by the European Union but will account for less than 0.02% towards UK GDP over 15 years, equivalent to £200m-£500m more than 2018 levels¹.

As part of the overall free trade deal, Australia wants access to the UK food market, with no taxes on imports or limits on tradable quantities. This will make it easier and cheaper for large Australian farms to export products such as sheep and cattle to the UK. In return, British farmers will enjoy equal access to the Australian market. Many UK farming groups remain sceptical and disappointed.

The agreement with Australia would also be an important stepping stone, the government said, towards joining a broader Asia Pacific free trade agreement – the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP) that could provide UK farmers with huge opportunities.

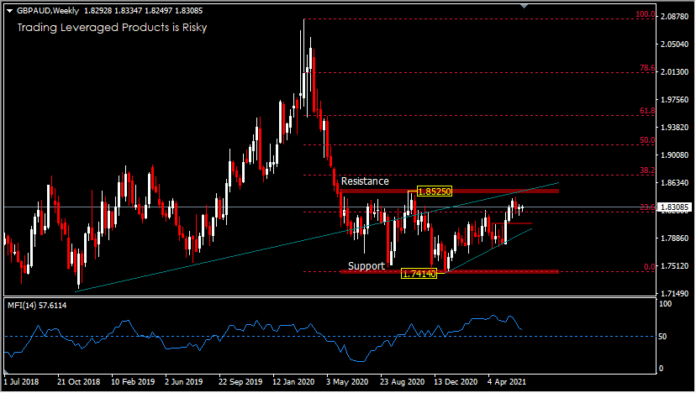

Meanwhile, the GBPAUD currency pair is still very solid, trading in a 13-month range between a low of 1.7414 and a high of 1.8525. On the upside, a break of the key 1.8525 resistance would project gains to the 38.2%FR retracement of 1.8739. As long as the resistance at 1.8525 holds, the consolidation will last longer.

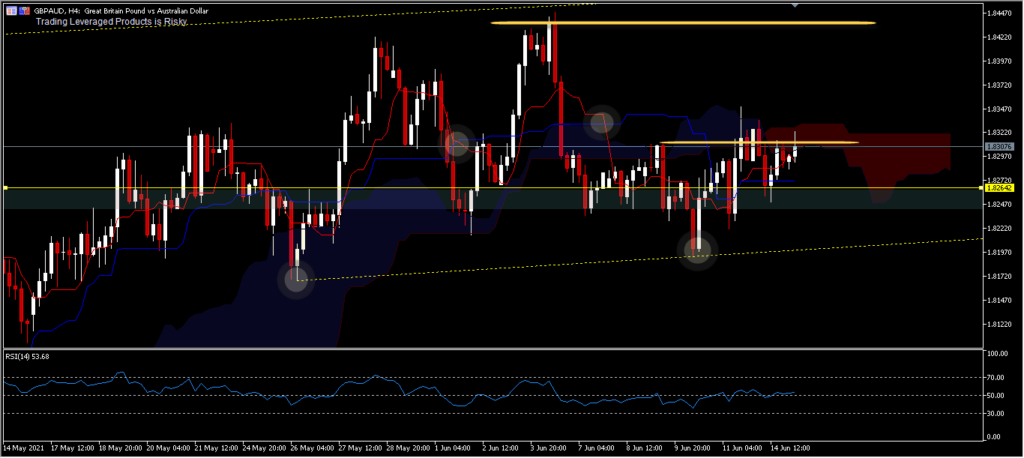

GBPAUD, H4

Intraday bias still shows a neutral bias, with a temporary peak of 1.8448. If there is a break of this level, the price will continue to retest the key resistance 1.8525. On the downside, a move below 1.8193 would target 1.8102. Momentum does seem to be disappearing with the average price movement in Kumo being thin and the RSI 14 moving horizontally above the 50 level.

¹https://www.ft.com/content/e74fd99a-aa89-4cd8-a759-9ccc25f8ca27

Click here to access our Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.