Sentiment remains cautious and stocks under pressure, but Treasury yields tumbled lower on the day, recovering all of last week’s losses and then some. The 10- and 30-year yields fell over 5 bps to the 1.4698% and 2.0857% areas, respectively, on the day, with the break in key technical levels of 1.50% and 2.10% supporting the richening. Concern about the spread of the more infectious Delta variant of the virus is weighing on confidence as governments try to limit the impact.

Equities remain mixed, with the USA100 holding in record territory, and keeping the bulk of its gains. The USA500 continues to idle on either side of unchanged, while the USA30 underperforms, losing over 200 points early on, then recovering slightly in afternoon trade. The USA30 components Chevron off over -3% as oil prices faded, while Boeing shed -3% after being told certification of its new long range aircraft would not come until at least 2023. The energy and financial sectors were the biggest laggards, while utilities and tech paced winning sectors.

Valuations remain a question for further stock market gains, with the USA500 P/E ratio the highest in over 10-years.

The charts that matter

“Significant long-term charts with historical price data back to 1950 remain very powerful and important.

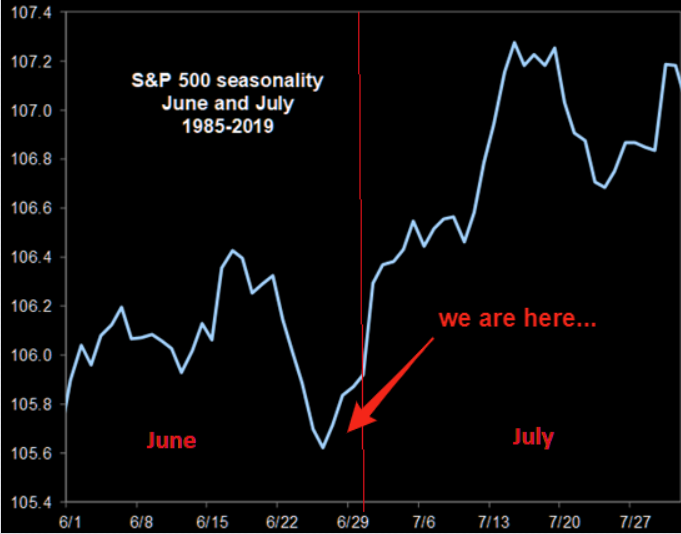

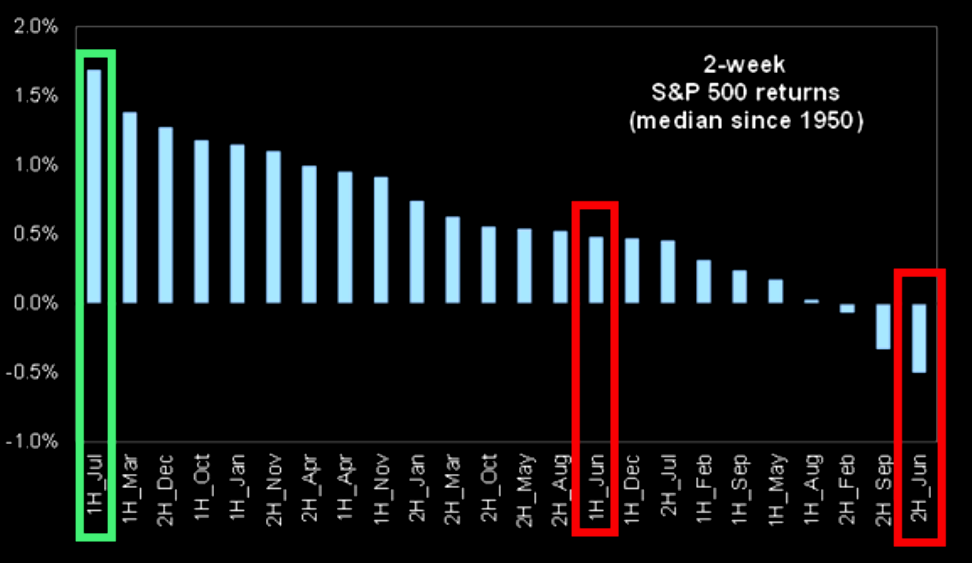

- The 2 first weeks of July are the best weeks of the year

- “we are here” – USA500 is just starting if you look at the seasonality pattern since 1985

- After the 2 first weeks of July, USA500 and Russell tend to “chill”, while NDX continues moving higher, but above all, note the USA100 pattern starting now

- Exposure in FAANMGs is close to record lows

- Tech’s range break out has been extremely powerful, and the candle today shows just how strong this momentum remains”

Forex Market: EURUSD is little changed at 1.1907. The Australian and NZ Dollars weaken for second day on low risk appetite, USDJPY steadied to 110.10-60 while the EUR steadied between 1.1920-1.1970 for a 5th day. The Pound declines further with Cable to 1.3857. Gold prices edged lower as USDIndex hovers below 2-month high.

USOIL slid to 3-session lows of $72.63 after printing new trend highs of $74.45 in Asia. The move lower was linked to concerns over rising Covid cases in many parts of Asia, including Thailand, Malaysia and Indonesia, which prompted some profit taking from 32-month highs. In addition, long positions may be cut ahead of the OPEC+ meeting on Thursday, where expectations are for an announced production increase, beginning in August.

Tuesday’s Calendar – Data releases today include Eurozone ESI economic confidence, German June HICP and UK lending data, while US Consumer confidence is also due, but virus headlines will likely dominate.

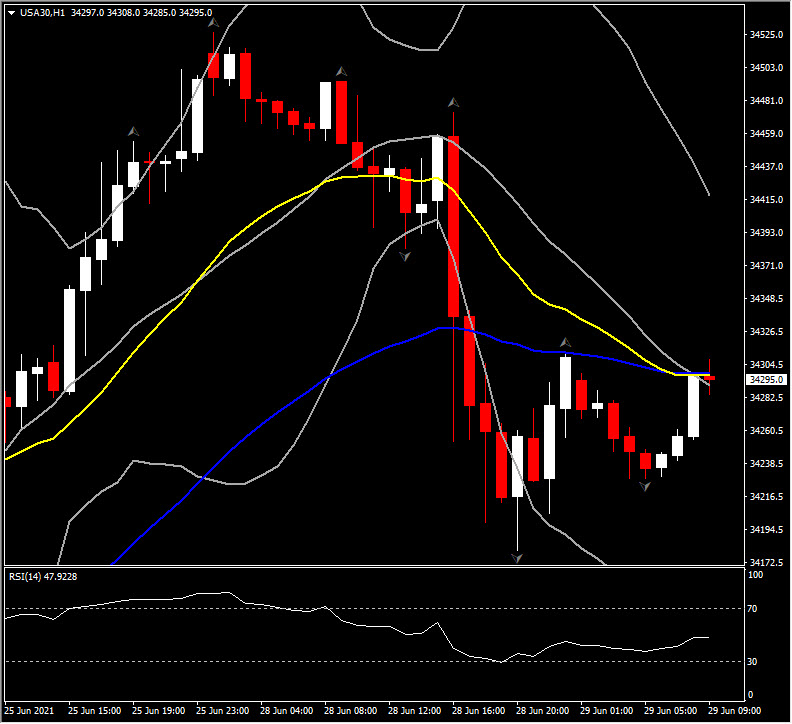

Significant FX Mover @ (06:30 GMT) USA30 (+0.34%) dipped by more than 0.44% from 34,525 to 34,172 low. Faster MAs and RSI are currently flattened,while MACD signal line and histogram are negatively configured, all suggesting that the short term decline run out of steam and the asset is consolidating for the time being.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.