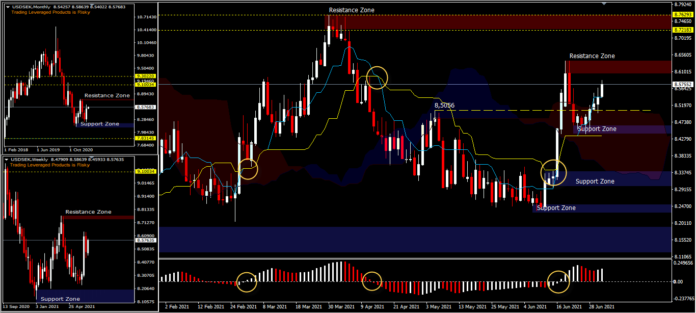

USDSEK, Daily

The Swedish krona weakened against the Greenback after Sweden’s central bank said it would leave interest rates unchanged until the third quarter of 2024. Interest rates are currently at 0.00%. The Riksbank also pledged to cut its repo rate, if related data show a weakening outlook for inflation.

This dovish scenario leaves USDSEK with room to the upside, especially if the NFP jobs report produces a strong figure. A better-than-expected Non-Farm Payrolls report would bring the possibility of the Fed’s rate-cut schedule closer. The Fed already has a dot plot-based forecast for a rate hike in 2023.

Technical Levels

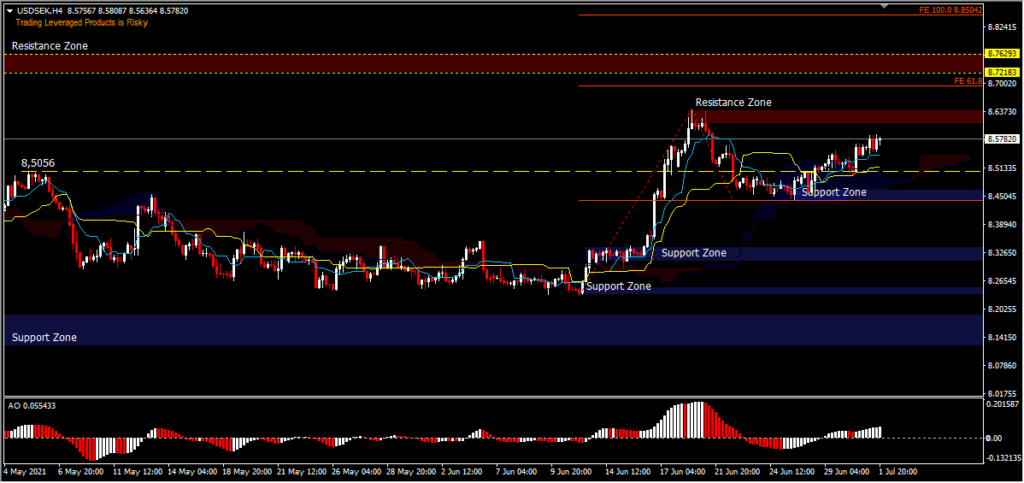

USDSEK has scored 5 consecutive days of gains after Riksbank maintained its dovish stance yesterday. This was reinforced by the break of the 8.5056 technical level in the previous 2 weeks.

Further strengthening should be able to break the 8.6395 minor resistance to target FE61.8 (+/-8.7000) or 8.7636 peak. A break of the 8.7636 peak would have implications for the 38.2% retracement around 9.0000 from the draw of the March 2020 peak and January 2021 low. This scenario would likely fail if the 8.7636 resistance holds, and if this is the case then the consolidation will return to the downside and the decline from the March 2020 peak will resume its course. The closest support seen today is at 8.4425. A price move below this level will target another level of support.

Technically, the temporary bullish support is validated, with the moving average above Kumo and AO, which are in the buy zone.

Click here to access our Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.