The Reserve Bank of Australia announced in its latest interest rate resolution to maintain its interest rate unchanged at 0.1%, in line with market expectations (the RBA once again emphasized that given that inflation and employment are still some distance away from the target, it does not expect to raise interest rates before 2024). In terms of the bond purchase plan, the central bank also announced that it will buy 4 billion Australian dollars of bonds every week until mid-November, and continue to use the April 2024 bond as the target bond for the yield of the 3-year Treasury bond. After the interest rate decision, the Australian Dollar against the US Dollar fell to 0.7543, and then reversed the decline and continued to rise.

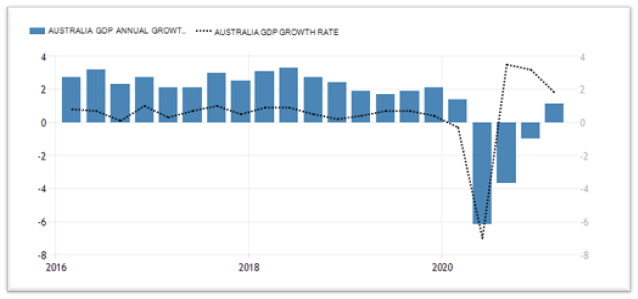

Figure 1: Australian GDP data. Source:Trading Economics

In any case, compared to the beginning of the pandemic last year, the Australian economy has improved significantly. From the economic data perspective, RBA and government stimulus boosted household consumption, private investment and investment in machinery and equipment and they have all recorded growth. Although exports grew slightly less than imports, the annual rate of the Australian economy rose to 1.1% in Q1 2021 in sharp contrast to the 6.2% decline in the second quarter of 2020. In addition, the country’s first quarter GDP quarterly rate announced last month was 1.8%, slightly less than the 3.3% and 3.1% recorded in the third and fourth quarters of last year. However, this level is still higher than the average level between 1959 and 2021, which is 0.84%.

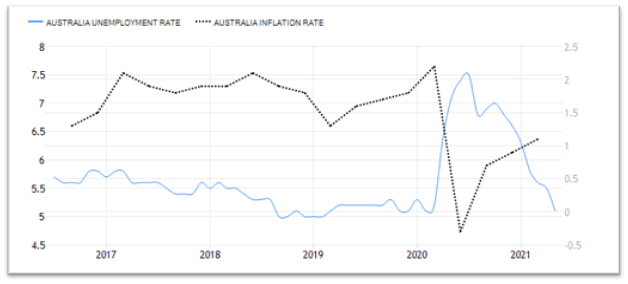

Figure 2: Australia’s unemployment rate and inflation rate. Source:Trading Economics

Since November last year, Australia’s adjusted unemployment rate has recorded a 7-month consecutive decline to 5.1%. This reading is also the lowest since February 2020. With the gradual lifting of restrictions, the number of workers in part-time and full-time employment has increased, and the overall employment participation rate has risen above the 6-month low (65.9%) at 66.2%.

On the other hand, Australia’s current annual inflation rate recorded the highest reading since the first quarter of 2020, at 1.1%, but overall it is still far below the 2% to 3% target range set by the Reserve Bank of Australia. It is worth noting that the slow national vaccination campaign and the rapid spread of the Delta virus strain are still hidden dangers for economic recovery. Although studies have shown that existing vaccines have the ability to resist the Delta variant, the reliability of the results still needs more time and data to prove.

Technical Analysis: AUDUSD & AUDJPY

AUDUSD

The 4-hour chart shows that the Australian Dollar against the US Dollar rebounded from the low of 0.74437 and formed an asymmetric double bottom pattern, followed by the positive divergence signal released by the MACD double MA and the RSI all the way up to the 0.75 level.

Currently, the currency pair is testing the key 100-SMA Resistance and 0.7570 (100% Fibonacci extension level) resistance area. If the bulls stay strong and the candle closes above the area, then the currency pair may continue its rally and further test the confluence area of 0.7605 (127.2% Fibonacci extension level) to 0.7620 (38.2% Fibonacci retracement level). A break in this area will also mean the end of the downtrend.

In addition, if 0.7570 fails to hold its line of defense, then this may also mean that the Australian Dollar against the US Dollar continues to fall. The support below includes 0.7520 (61.8% Fibonacci extension level), the 0.7500 psychological level (50.0% Fibonacci retracement level) and 0.74437 (July 2 low).

AUDJPY

In Japan meanwhile, in the Regional Economic Report, the BoJ increased the economic assessment of 2 regions, namely Hokuriku and Kinki, downgraded 2 regions, Chugoku and Shikoku, and kept 5 regions unchanged: Hokkaido, Tohoku, Kanto-Koshinetse, Tokaiand Kyshu-Okinawa. Economic conditions remain in a dire situation as the impact of the new coronavirus slows the pace of improvement.

Governor Haruhiko Kuroda said, “Japan’s economy remains in severe form but is improving as a trend… As the impact of the pandemic gradually subsides, the economy will recover thanks to increasing external demand, loose monetary policy and the effects of government stimulus measures.”

AUDJPY – The pair has been trading in the 81.97 – 85.79 price range for the 19th week. The Yen, which tends to weaken post RBA meetings, and the AUD, which is supported by commodity prices, are interesting to analyze.

In June, there was a correction of 1.6% even though the asset held in the range. The rally momentum is clearly reduced because the correction was validated by AO in the sell area and the price movement below the Kumo. However, the uptrend sustains despite the break of the 81.97 Support level, and the price is still above the 200-day MA. A break of the immediate Resistance at 84.25 will turn attention to the high of the 85.79 range. If the price moves above the latter, the rally could extend higher on the average yearly high around 90.00. On the flipside, if the price moves below the 81.97 Support, it could create a deeper retracement to the 79.19 or 50.0% FR level from the pullback running low of 73.12 to the interim top of 85.79. Overall the trend is still moving up.

Click here to access our Economic Calendar

Larince Zhang – Regional Market Analyst

Ady Phangestu – Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.