Selling on the New York Stock Exchange (NYSE) appears to be nearing panic levels, with activity on the Nasdaq suggesting investors may be more interested in buying in times of decline. NYSE Arms Index, which is a broad, volume-weighted measure that tends to rise above 1,000 when the market declines, surged up to 1,812 in Tuesday afternoon trade. Meanwhile, the Nasdaq Arms fell to 0.464. Many Wall Street technicians say an Arms reading above 2,000 implies panic-like selling, while a reading below 0.500 implies panic-like buying. Source : Marketwatch

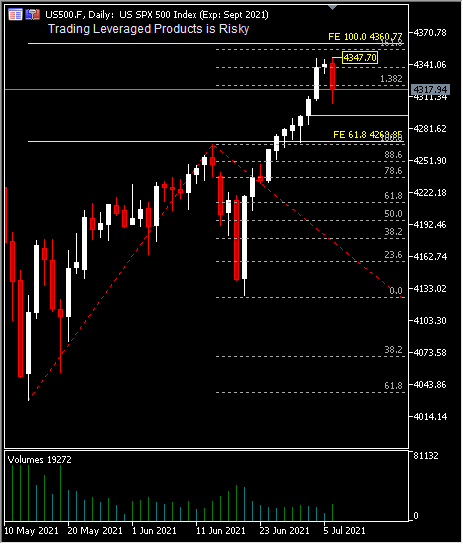

The USA500F briefly dropped to -0.85% in the North American opening session and the USA100F also fell -0.87% before rising again, while the USA30F fell a quite sharp -1.23% but recovered to close down -0.6% at 34,577. The CBOE Volatility Index, a popular gauge of stock market volatility expectations based on the S&P 500 index options, is seen rising to near 17. Meanwhile, the USDIndex is up 0.37%, trading around 92.50, below last week’s peak of 92.74.

The USA500F briefly dropped to -0.85% in the North American opening session and the USA100F also fell -0.87% before rising again, while the USA30F fell a quite sharp -1.23% but recovered to close down -0.6% at 34,577. The CBOE Volatility Index, a popular gauge of stock market volatility expectations based on the S&P 500 index options, is seen rising to near 17. Meanwhile, the USDIndex is up 0.37%, trading around 92.50, below last week’s peak of 92.74.

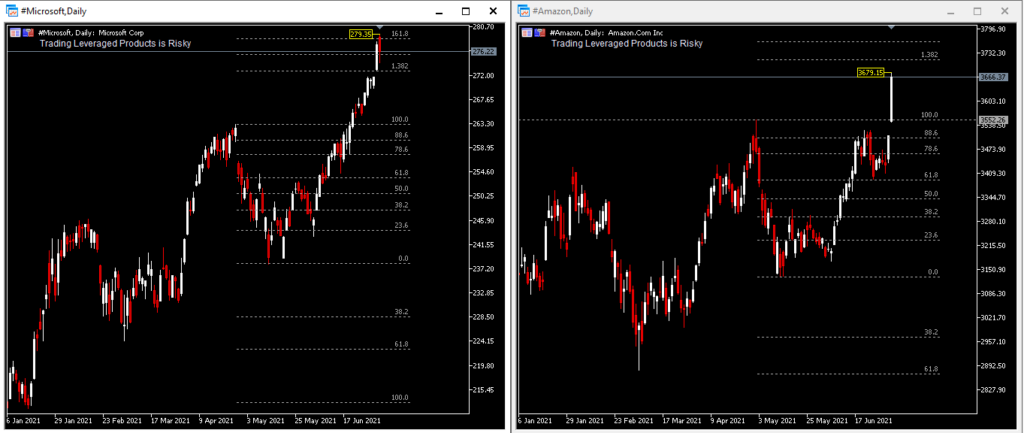

Another headline was news from the United States Department of Defense announcing on Tuesday that it had canceled its $10 billion JEDI cloud contract with Microsoft Corp. following a lawsuit filed by Amazon Inc., and they wanted to get the two tech giants to work together on the job. A Pentagon spokesman said, “Due to evolving requirements, increased cloud conversations, and industry advances, the JEDI Cloud contract no longer meets its needs. A report from May initially introduced that possibility, with government contracting experts saying the deal with Microsoft was “inappropriate and out of date” because of the “single-vendor approach. “Source : baha

#Microsoft corrected in a Dark Cloud Cover pattern and weakened by -0.94%, while #Amazon posted a new record peak of 3679.15, gaining +4.69% to close at 3675.64, breaking away from the key resistance at 3552.26 with a wide jump gap.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.