AT&T Inc. is the holding company of an American multinational conglomerate registered in Delaware but headquartered in Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, and the second largest mobile phone service provider. The company is scheduled to report its Q2 2021 earnings report on July 22, 2021, with a Consensus EPS forecast of $0.8 with a “hold” rating.

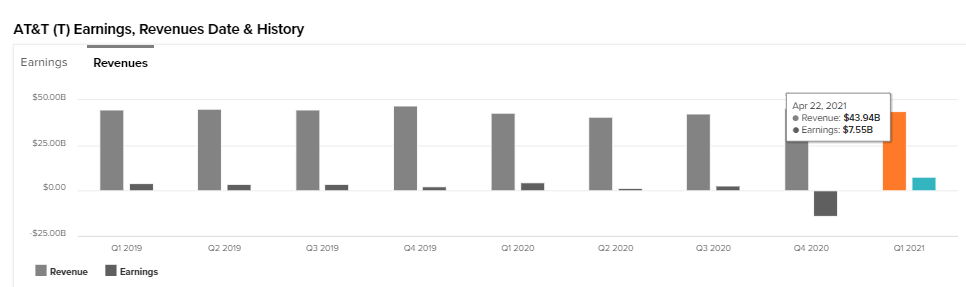

For the first quarter of the year ended March 31, AT&T reported total revenue of $43.94 billion, an increase of 2.6% compared with $42.78 billion in the same quarter a year earlier. Diluted earnings per share during the quarter was 86 cents, up from 84 cents a year ago. Net profit for the first quarter of 2021 was $7.94 billion, up significantly from $4.96 billion in the first quarter of 2020, driven primarily by higher subscription, advertising and content revenues, which partially reflected the recovery from the previous year’s COVID-19 impact and lower other revenue.

What investors need to consider now and in the future is AT&T’s business path, which sees mobility, fiber and 5G as the path to profitable growth in 2021, as the operator continues to refocus efforts on its core telecommunications business. AT&T hit several highs in its financials in the last quarter, with growth in postpaid phone network additions and an increase in HBO Max subscribers. Postpaid phone subscriptions continue to be a key area of growth for AT&T amid declines in several other legacy businesses.

Business wireline service revenues continued to decline, dropping 3.64% during the first quarter of 2021 to $6.05 billion compared to $6.27 billion last year, as businesses shifted to more advanced IP-based offerings. AT&T has seen increased interest around strategic and managed services—AT&T’s most advanced business offering, including VPN and security—over the past few quarters.

AT&T sees 5G as one of the main pathways to profitable growth this year, with its 5G network now covering 230 million Americans in 14,000 cities and towns and AT&T 5G+ now available in 38 US cities. In addition to 5G, fiber, another important pathway for growth for carriers, is getting stronger. AT&T says that more than 650,000 US business buildings are illuminated with fiber from AT&T.

The COVID-19 pandemic weighed heavily on AT&T’s finances last year, but they are now currently on the rise as the company begins to see a recovery from the pandemic. The increase in revenue for smartphones is also higher at relatively high prices this quarter compared to the same quarter last year, when retail stores temporarily closed due to the pandemic.

Stock Price

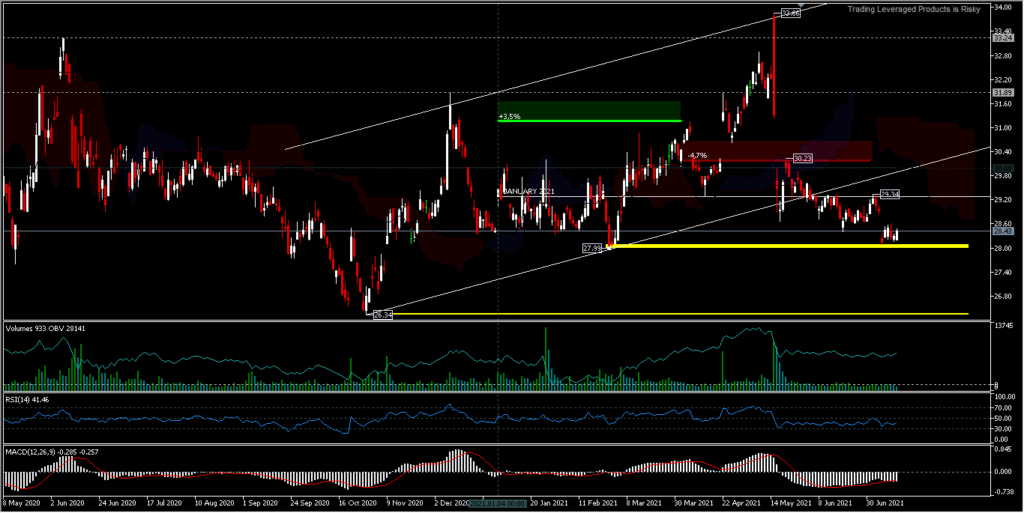

Shares of AT&T Inc. rose 0.85% to $28.45 on Thursday, above support at $27.99, the low seen last February. Yesterday’s trading was a positive trading session for the stock market, with broad weakness in the USA500, USA100 and USA30. The stock performed mixed when compared to some of its competitors on Thursday, such as Verizon Communications Inc. (+0.37% to $56.52), while Walt Disney Co. barely moved for 3 days (+0.13% to $183.20).

The daily bias is still showing on the downside, but has been stuck at the $27.99 support level for the last 6 trading days. Further gains will target $29.34 which was the opening price in January 2021. However a move below the $27.99 support will create selling pressure to the strong $26.34 support. In a relatively quiet trading session, which is read from tick volume, OBV is flat and the RSI and MACD are in the sell zone that has lasted for a long time, and it will take a strong catalyst to end the ongoing consolidation. If there is a strong rebound from this fairly low stock price, it could be a bright start for AT&T, but it all also depends on the upcoming earnings report. If the results are good, it will of course boost the value of the equity going forward.

Note: Analysts on Wall Street suggest a consensus price target of $31.24, implying a 9.09% increase against the share’s recent value, with extreme values ranging from a low price of $23.00 and high price of $37.00.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.