Abbott Laboratories is an American multinational medical and healthcare equipment company with headquarters in Abbott Park, Illinois, United States. Abbott Lab’s strength in the field of coronavirus testing has made it a stock that investors should reckon with during the pandemic. Abbott shares rose 26% last year as Abbott sold billions of dollars’ worth of COVID-19 tests. At the same time, some of Abbott’s other businesses, particularly medical equipment, have seen a decline, as hospitals postpone non-essential operations and focus more on coronavirus patients.

Medical equipment generally makes up the bulk of Abbott’s annual revenue, with it accounting for 38% of overall revenue in 2019. So if the situation returns to normal and sales of medical devices improve, it will be good news. At certain times during the pandemic, some laboratories reduced operations and did not carry out non-essential tests, but this area has started to recover, especially with the emergence of new variants that are increasingly disturbing.

The company’s other segments include established nutrition, diagnostics and pharmaceuticals. The problem for Abbott investors right now is that demand for COVID tests has been on the decline for a while. As a result, its estimated earnings per share was lowered to a range of $4.30 to $4.50 from an earlier expectation of $5.

source:TIPRANKs

After Q121 revenue missed forecasts, but was still up more than 35% to $10.46 billion, investors may expect that Abbott’s coronavirus diagnostics along with the strength of its flagship product will offer a bigger revenue boost. Abbott’s coronavirus diagnostics revenue in Q1 was $2.2 billion and rapid tests accounted for 85% of COVID testing sales. The revised forecast still shows solid year-on-year growth. Adjusted diluted earnings per share from continuing operations in 2020 was $3.65. Abbott could post at least 18% revenue growth this year compared to 2020, if it meets the lower end of its forecast range.

Abbott hopes to maintain sales of Covid tests by releasing its BinaxNOW Self Test for over-the-counter and home use. But with the US vaccination rate moving faster, infections reduced and pandemic restrictions loosening, test usage has been on the decline, especially since April, when US health officials said that fully vaccinated individuals did not require testing, although they were advised to continue wearing masks under certain circumstances and to avoid crowds.

Abbott is set to deliver its Q2 2021 earnings report on July 22, 2021, with a consensus forecast of $1.02 EPS, up 80.7% from the previous year’s quarter. Meanwhile, the Zacks Consensus Estimate for revenue projects net sales of $9.72 billion, up 32.63% from the year-ago period. For the full year, Zacks Consensus projects earnings of $4.42 per share and earnings of $39.62 billion, which would represent changes of +21.1% and +14.47%, respectively, from the previous year.

Stock price

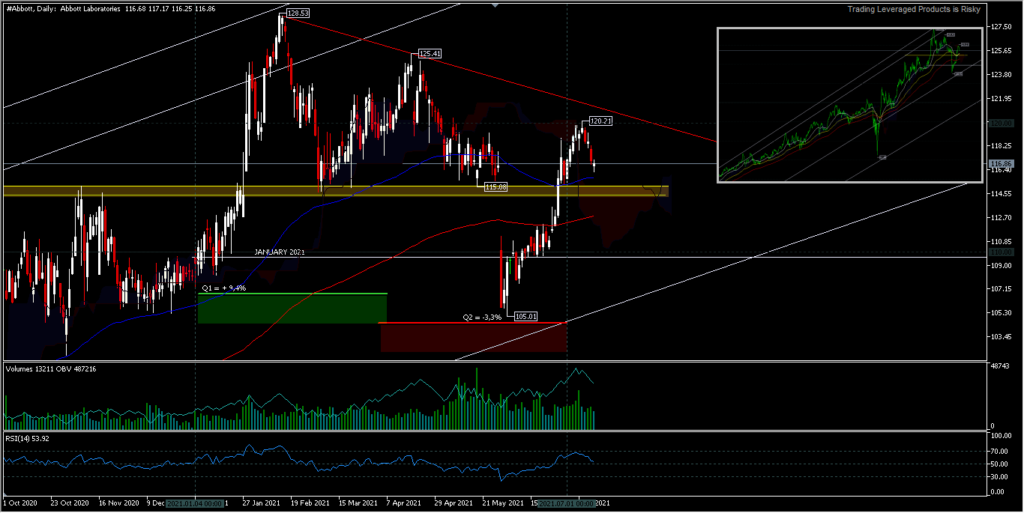

Abbot’s stock price movement during the first quarter (Jan-March) grew by +9.4%, while in the second quarter (Apr-Jun) it was relegated to -3.3%, especially after warnings delivered in early June that profits for the year will be lower than expected, as demand for Covid-19 tests eroded. This sent the share price down by a wide gap from May’s close at $116.69 to open in early June at $110.14 and managed to close the same day at $108.63, its biggest intraday loss since November 9. But since then, the price has gradually improved until the close of the second quarter at $116.00.

Abbot, Daily

At the beginning of July, asset prices were quite mixed, starting with an early first week gain of +4%, and entering the second week it corrected back -3% more, so it was almost balanced above the $115.00 support. Several survey agencies have forecasted a Strong Buy rating to this stock, considering its long-term medical need. In the latest trading session, Abbott traded slightly higher around $117.00 (+0.27%). This change surpassed today’s weaker S&P 500.

Technical indications suggest a slowdown in the rally momentum, with the RSI approaching its mid-level again and trading activity declining from tick volume and OBV readings. The decline in asset prices below $115 implies a correction towards the 200-day EMA support around $112.60, but as long as the support remains intact, a move north is still possible for a projection of $120.21 or $125.41.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.