Telecommunications technology giant Verizon Communications Inc. (MT5: #Verizon), which was established in 2000 and is traded on the NASDAQ, is primarily a provider of technology, communications, information, entertainment products and services. Following strong first quarter results last April, when it reported revenue of $128.3 billion for the fiscal year 2020, it will be the main focus of investors when it reports its 2021 second quarter earnings on Wednesday, July 21 at 8:30am Eastern Time.

Although the American stock exchange posted strong gains in 2021, where the S&P 500 hit a record historical high, Verizon’s stock price remained traded flat in a small range between $53.83-$59.84. Nevertheless, Verizon remains the focus of investors ’attention due to its attractive and consistent dividend rate returns. Market analyst Simon Flannery (1) of Morgan Stanley reported that they expect a strong second-quarter report from Verizon, where positive returns from postpaid earnings and M&A accounting of the Verizon Media unit merger will boost earnings per share, and a 5.1% increase in revenue for wireless services. Investors will also pay close attention to financial reports related to Verizon’s 5G communications business where the rate of competition for this branch of business is expected to increase following aggressive efforts by Verizon’s rivals T-Mobile US and AT&T.

Zacks Equity Research (2) expects a revenue rate of $32.62 billion, growth of over +7.1% y/y, while earnings per share (EPS) is expected at $1.29, an increase of +9.32% y/y. Following that, Zacks also projected annual earnings per share at $ 5.11 (EPS) and earnings of $134.1 billion. Zacks maintains Verizon’s ranking as #3 (hold).

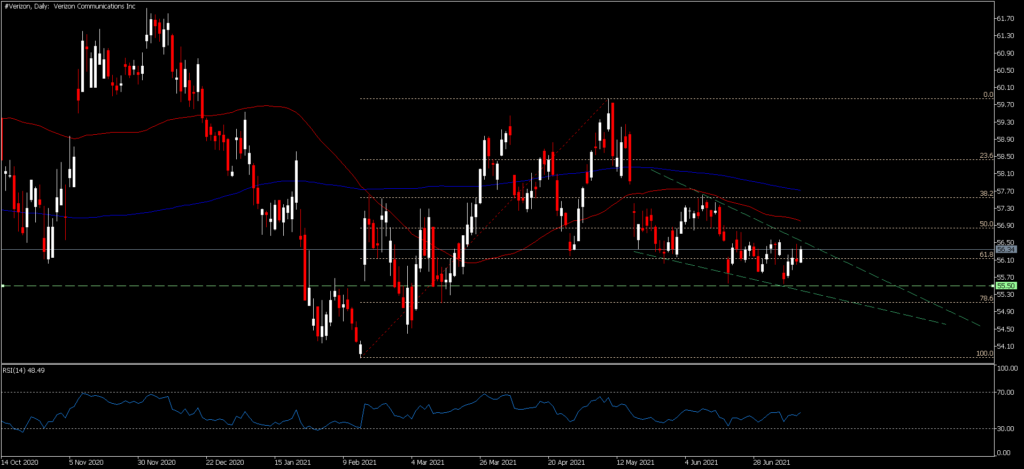

#Verizon shares have been trading in a small range since early 2021 between $53.83-$59.84. It traded lower compared to the rise of the key S&P 500 index which posted a gain of more than 20% in 2021. Verizon shares will typically strengthen ahead of and after the release of its quarterly financial report following increased investor interest. $55.50 is the nearest support area while MA50 and MA200 at $57.00 and $57.70 respectively are the nearest resistance. The RSI14 is seen to remain neutral, and Verizon shares have yet to cross overbought or oversold levels since last February.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst – HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

(1) https://www.investors.com/news/technology/verizon-stock-buy-now/

(2) https://finance.yahoo.com/news/verizon-communications-vz-reports-next-190007774.html