Like the SNB and BoJ, the ECB generally sees the market as likely to be dovish. This dovish stance reflects that the Euro is unlikely to show significant strengthening this week and the ECB will show no signs of raising interest rates anytime soon, unless there’s a hawkish surprise at this week’s meeting.

ECB monetary policy meetings generally lead to limited market movements, but Thursday’s meeting may be different because it is expected that the ECB will implement significant policy changes. The ECB presented a strategy review earlier this week and ECB President Christine Lagarde said that there would be an alignment of the forward guidance review with the strategy review. Therefore, we may see some important changes to the forward guidance at the meeting.

The strategy review raised inflation to 2% (or at least close to 2%); this means the bank will have a transition period where inflation is well above target. These changes are likely to be incorporated into the bank’s forward guidelines.

Meanwhile, the BoJ has revised down its lower growth forecasts for the current fiscal year through March. The BoJ’s quarterly report stated that the economy would grow 3.8%, down from a previous forecast of 4.0%. The Bank attributed the rating downgrade to the “impact of Covid-19”. At the same time, the BoJ revised up its inflation forecast for the current fiscal year to March to 0.6%, up from 0.1%, due to rising energy prices.

The BoJ also announced details of its climate change fund (green fund), following the ECB and BoE, which have made climate change part of their monetary policy strategy.

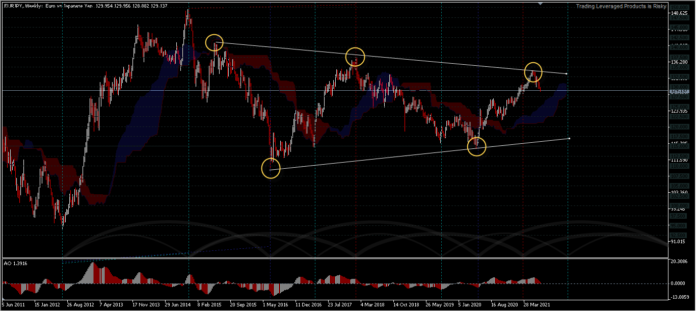

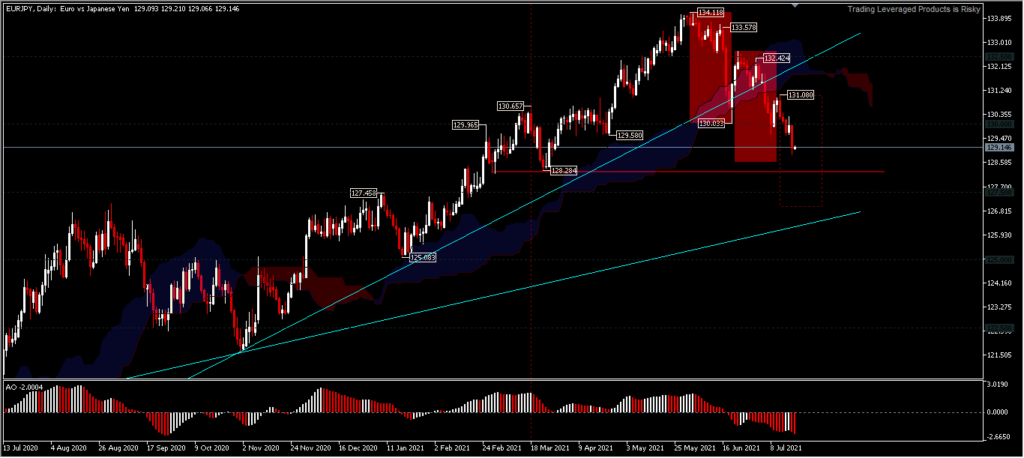

Technical Level

The massive worldwide spread of the Delta variant has prompted investors to shift assets to traditional safe havens such as the Yen. EURJPY was hit hard, leaving a peak of 134.11 towards the low of 128.58 after breaking away from the 130.03 support.

EURJPY, D1

Bias shows to the bottom after breaking through 2 low price levels of 129.50 and 130.03 with the target at the nearest support. On the upper side, a break in the resistance of 131.08 will indicate a short-term low point, and bring the stronger price back to 132.42 first. Overall, the decline is still a corrective wave of 114.42 increments, but a break of 128.28 would have deeper trend correction implications.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.