The last week of July continues to be an exciting week for stock investors in the US, as the ‘Big Five’ technology giants Alphabet, Amazon, Apple, Facebook and Microsoft will publish their 2nd quarter financial reports. These 5 companies control a total of 1/5 of the market capitalization of the USA500 index, with a share of 22%, and account for nearly 10% of the USA500 companies’ total sales and nearly 18% of total profits. Facebook (FB) is expected to announce their financial report on July 28, 2021 after the market closes.

Although the Covid-19 pandemic affected millions of companies around the world, Facebook showed the opposite performance; it was seen to be completely unimpressed by this pandemic and continued to record the highest share prices and very surprising financial reports. Facebook became the company that benefited the most from the stay home orders which caused Internet usage to hit a record high. The use of Facebook products including the social sites Facebook, Facebook Messenger, WhatsApp and Instagram continues to be strong and is expected to be the largest contributor to Facebook’s revenue growth. Daily and monthly users of the company’s products reported an increase of 8% and 10% (y/y) in the first quarter of 2021.

Despite a situation where online advertising spending is increasing and usage transition to digital is faster, Facebook is facing considerable challenges after Apple and Google made changes in their operating systems and search platforms where it limited Facebook in tracking user activity trends. However, Wall Street analyst Brent Thill in a commentary on CNBC was quoted as saying that market analysts were somewhat conservative in their 2nd quarter projections. He said the iOS14 privacy issue was not expected to disrupt or weaken Facebook’s advertising revenue and increased advertising demand after most business activities resumed operating on a larger scale in the Americas and Europe.

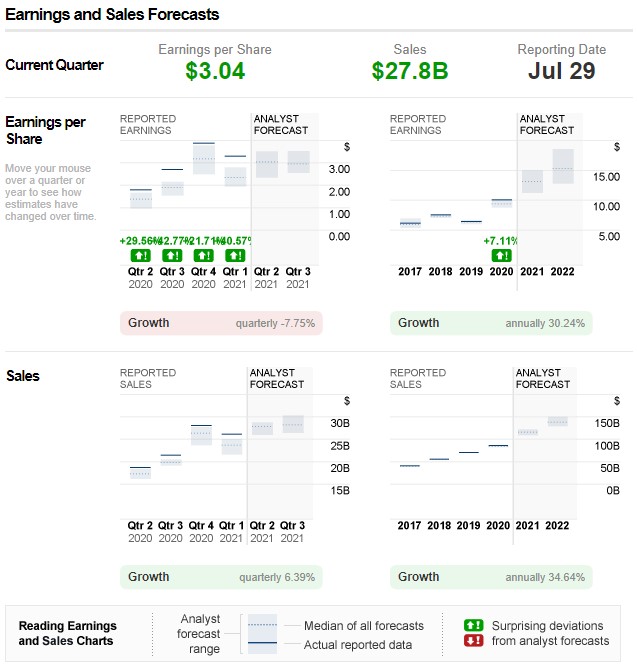

(Image source:CNN Money)

Facebook has consistently exceeded market expectations in its last 4 quarterly reports where revenue and earnings per share (EPS) were reported more than market projections. In the first quarter of 2021, Facebook recorded a revenue increase of over 48% (y/y) at $26.2 billion contributed by a 12% increase in the addition of advertising on their product platform. Meanwhile, EPS rose 93% to $3.30 in the same quarter.

In a press conference last April, Facebook expected their financial outlook for the 2nd quarter to remain stable or rise slightly compared to the first quarter. Market analysts project Facebook’s revenue for the 2nd quarter at $27.8 billion, reflecting a 49.3% increase from the same quarter last year, while the consensus for earnings per share (EPS) is expected to register a growth of 69% compared to last year at $3.04 per share which is projected to be 0.3% higher from the last 30 days.

The FB price (MT5: #Facebook) has consistently recorded the highest price in history every month since March 2021. It once again traded at a record high of $375.23 this week and is still in a strong bull movement. The 50-DMA at $339.00 and the July low at $334.44 are the closest support. For 2021 alone, Facebook shares have recorded a price increase of almost 38%. Market analysts now project the median price of FB at $395.00 with the lowest price at $275 and the highest price projection at $480 and all analysts put Facebook shares in the “buy” consensus.

It should be noted that Facebook shares experienced a fall after financial results were reported last April following profit-taking activity, though it is unlikely it will recur in the 2nd quarter report.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst – HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.