Revenue of American pharmaceutical company Pfizer Inc. in Q2 2021 jumped 92% on the year to $19 billion, exceeding analyst expectations. Earnings per share in the three-month period jumped 58% to $0.98 on a net profit of $5.6 billion. The drugmaker also raised its full-year guidance and now expects revenue generated by its coronavirus vaccine to increase to $33.5 billion in 2021 from $26 billion.

Pfizer said Wednesday it had sold $7.8 billion worth of Covid-19 vaccines in Q2. Income forecasts were raised as the delta variant spreads rapidly and scientists debate whether people will need a booster shot.

Other Pfizer business units also experienced strong sales growth. Revenue from its oncology unit rose 19% year-on-year to $3.1 billion. The company’s hospital unit generated $2.2 billion in revenue, up 21% from a year earlier. Internal medicine units grew 5% from last year to $2.4 billion.

Pfizer said earlier this month that it was seeing signs of reduced immunity in recipients of its Covid vaccine with German drugmaker BioNTech, and planned to ask the Food and Drug Administration to authorize a booster dose. It also said it was developing a booster shot to target the delta variant.

Pfizer said it could potentially file an emergency use authorization for booster doses with the FDA as early as August, and it expects to start clinical studies testing the delta variant vaccine in the same month. It expects full approval for its two-dose vaccine by January 2022.

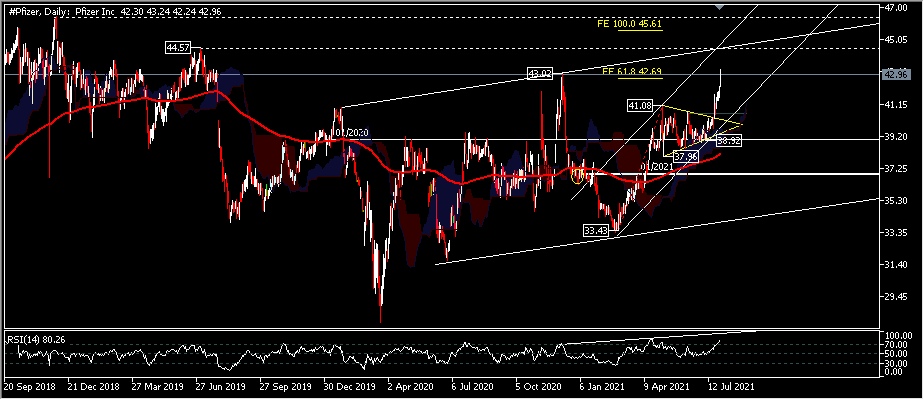

Pfizer was up 0.71% to $42.40 a share in premarket trading after the update. The company’s stock has gained more than 14% since its inception.

Technically, bulls dominance has been seen since the break of the symmetrical triangle to the current resistance level at 43.02. A further move will test the upper trendline of the ascending tunnel which coincides with the next resistance level 44.57. The continued movement due to strong investor interest in pharmaceuticals allowed the company’s share price to reach a peak price of 46.46 recorded in December 2018. On the downside, it places 41.08 resistance as support in case of profit taking.

Meanwhile, here is the outlook for other similar companies:

- Merck & Company, Inc. will also report earnings today, Wednesday 29 July, before the market opens. According to Zacks Investment Research, based on 3 analyst forecasts, the consensus EPS forecast for the quarter is $1.3. The reported EPS for the same quarter last year was $1.37.

- AbbVie Inc. is scheduled to report earnings on July 30 before the market open. According to Zacks Investment Research, based on 5 analyst forecasts, the consensus EPS forecast for the quarter is $3.12. The reported EPS for the same quarter last year was $2.34.

- Astrazeneca PLC will report earnings on July 29 before the market open. According to Zacks Investment Research, based on 4 analyst forecasts, the consensus EPS forecast for the quarter is $0.45. The reported EPS for the same quarter last year was $0.48.

- Gilead Sciences, Inc. will report earnings on July 29 after market close. According to Zacks Investment Research, based on 9 analyst forecasts, the consensus EPS forecast for the quarter is $1.76. The reported EPS for the same quarter last year was $1.11.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.