Allianz SE, a German multinational financial services company with core businesses of insurance and asset management, is scheduled to report Q2 2021 earnings on Friday, 06 August 2021 prior to market opening. Allianz’s core insurance business includes the protection of property as well as life and health. In addition, there are also business areas with global reach, such as global corporate customer insurance, credit insurance, assistance services and reinsurance. Meanwhile, their asset management includes Allianz Global Investors (AllianzGI) and PIMCO.

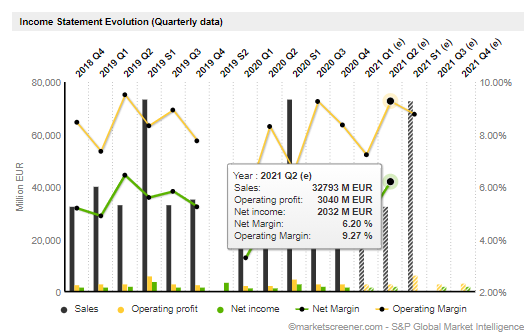

Although Q1 2021 revenue fell 2.6% to €41.4 billion and was flat compared to the previous year’s level, the company reported a 44.8% increase in operating profit to €3.3 billion with contributions across all segments. Net income attributable to shareholders increased 83.4% to €2.6 billion driven by growth in operating profit and better non-operating results after lower impairment losses and higher income taxes had a slightly offsetting effect. Basic Earnings per Share (EPS) increased 85.2 percent to 6.23 euros, from 3.36 euros). The company targets a confirmed 2021 operating profit of 12.0 billion euros, plus or minus 1 billion euros.

Higher investment income came from Allianz’s fixed index annuity business primarily in the United States, while in Europe there was a lower decline in value compared to the highest level recorded in the first quarter of 2020. A further contributing factor was unit-linked management costs which were higher in Italy.

Overall the company has been able to increase its revenue, in a very challenging market. As such, recent analyst forecasts suggest that the company will continue to see its earnings expand broadly for the industry or on company fundamentals. With its shares down 3.0% over the past three months, it’s easy to overlook Allianz. However, stock prices are usually driven by a company’s long-term financial performance, which in this case looks quite promising. Tipsrank rated it moderate buy with an average target price of €239.54; EPS consensus forecast of €4.8 versus €3.71 in the same period last year.

Recently, Allianz said that China’s local asset management unit has received regulatory approval and will become the country’s first foreign-owned insurance asset management company as Allianz takes advantage of regulations that relax ownership restrictions for foreign players in the asset management, insurance and securities brokerage sectors.

Technical Levels

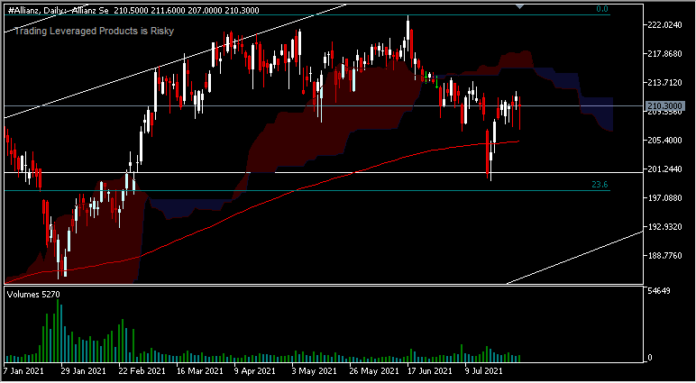

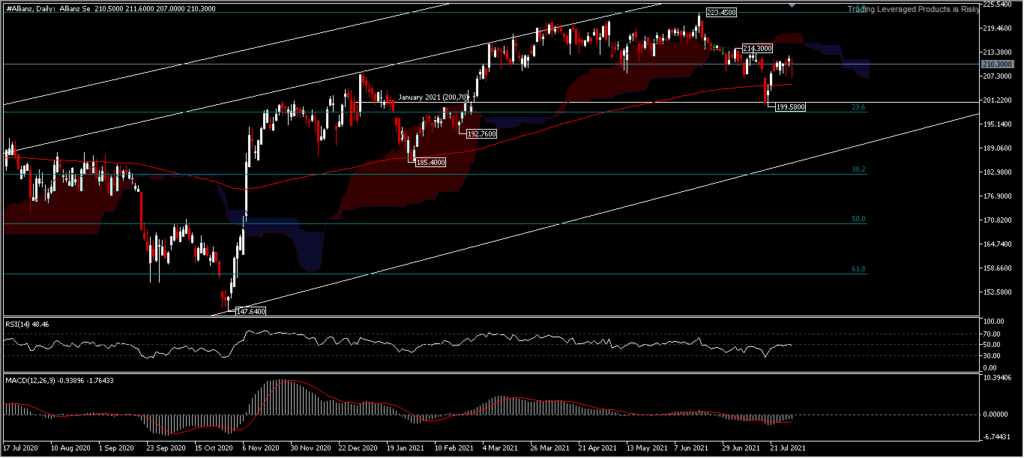

The #Allianz stock posted a historic peak of 353.55 in April 2000 and it took 20 years to return to the 61.8% retracement (232.55) in February 2020 before the global pandemic broke out. The economic recovery that has been going on since last year has not been able to bring #Allianz back to pre-pandemic levels, with the share price only strengthening to 223.45. The stock price on H1 rose +4.8% and closed at 210.35 in June, while in July there was no significant price movement; the asset tried to match the January 2021 open (200.70) with a low of 199.58 but closed at 210.30, just 0.20 euros lower of the opening price of 210.50 to form a monthly doji candle.

The outlook is tentatively neutral after July’s decline that failed to surpass the opening price and remains temporarily stuck above the 200-day moving average. Throughout the early years to date, stock prices seem to be consolidating more than trending. Technical tools provide information that consolidation is likely to continue until the earnings report. The stock price has broken through the thin Kumo which is formed from a thin trading range, the RSI is flat between the middle 50 level (at 48.46 as of the time of writing) and the MACD is still in the sell zone with the histogram thinning to the neutral side. A break of the support level of 199.58 would be very decisive for the direction of the weakness, but as long as this level holds, the price projection is likely to test 214.30 and 223.45.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.