American pharmaceutical giant CVS Health Corporation (CVS) is scheduled to announce its earnings report on Wednesday, August 04, 2021 prior to the market opening. The report is for the fiscal quarter ending June 2021.

In 2021, CVS Health was ranked 4the on the Fortune 500, a list of companies that Fortune magazine makes each year based on gross income, with revenues of around $268,706 million, profits of $7,179 million and total assets of $230,715 million.

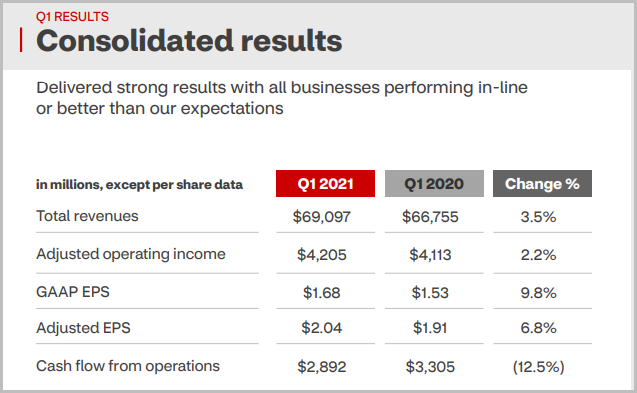

For the fiscal first quarter ended March 31, 2021, CVS reported a 3.5% increase in total revenue over the previous year driven by growth across all segments. Revenue rose to $69.1 billion from $66.8 billion a year earlier and adjusted earnings per share rose to $2.04. The health care and drugstore chain reported net income of $2.22 billion, or $1.68 per share, up from $2.01 billion, or $1.53 per share, over the previous year. The effective income tax rate was 25.1% for the three months ended March 31, 2021. For this second quarter earnings report estimate, the consensus EPS forecast from Zacks Investment Research, based on 9 analysts’ estimates, is $2.07. The reported EPS for the same quarter last year was $2.64.

The company has raised its guidance for the year, from expecting 2021 earnings to be between $6.24 and $6.36 per share to expecting between $7.56 and $7.68 per share. This reaffirms that the full-year cash flow from operations is projected to range from $12 billion to $12.5 billion. This is understandable given that COVID-19 vaccines and testing have helped increase revenues and offset a weak cold and flu season. Vaccines and testing, on the other hand, also attract foot traffic. About 9% of new customers who receive tests via CVS also fill out new prescriptions at pharmacies. But all of this also relies heavily on pharmaceutical sales to drive revenue growth, as the pandemic-related sales boost may not last forever.

The company has become a major provider of Covid-19 vaccines, tests and prescriptions, services that have helped many drugstore chains attract customers. CVS takes up a larger percentage of the prescription drug market and its healthcare benefits segment is now growing at a fairly strong pace. In fact, the company has turned some drugstores into HealthHubs, a store model that includes more services like sleep apnea testing and mental health appointments with clinical social workers.

In the first quarter of 2021, CVS became fully integrated with health insurance company Aetna after a massive $69 billion acquisition, generating more than $69 billion in revenue. In 2020, revenue grew by $12 billion over the previous year. This integration brings together various parts of the CVS business into the healthcare ecosystem. This will strengthen the company’s fundamentals going forward.

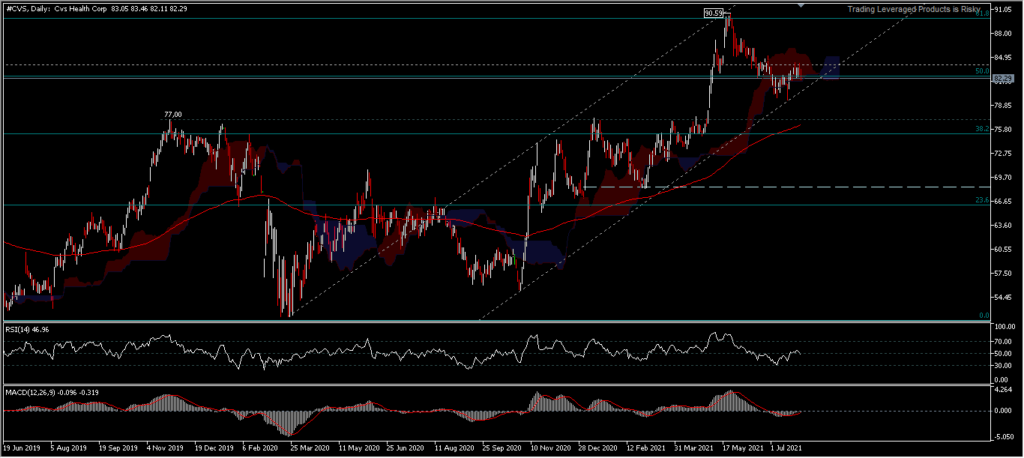

Technical Level

#CVS stock surpassed its 4-year average high of 84.00 in May 2021 by printing a fresh peak at 90.59 right around the 61.8% FR retracement level (pullback from the 113.65 peak to a 51.77 low). The total 2021 H1 equity price growth hit +21% more at the June close (83.45) around the 50.0% retracement, back below its yearly high average price. An ATH price was printed in July 2015 at 113.65. For July 2021, the price slightly corrected before closing at 82.29.

After scoring an annual high of 90.59 the value of this asset is overvalued and has since corrected by -9%. The long-term return on its shares is likely to be lower than its business growth, which has averaged 4.3% over the last three years and is forecast to grow 4.38% annually over the next three to five years. But overall these equity positions are still technically consolidating, in the area of the average yearly high within the Kumo. This is reinforced by the validation of the RSI which has been flat in the 50 area for some time (currently at 46.96); MACD histogram is thinning towards neutral levels, but equity prices are still above the 200-day moving average in an ascending channel. A price move above the resistance at 84.26 will target 87.27 and a top of 90.59. As long as the resistance holds, the price bias is likely to form a corrective wave around 79.

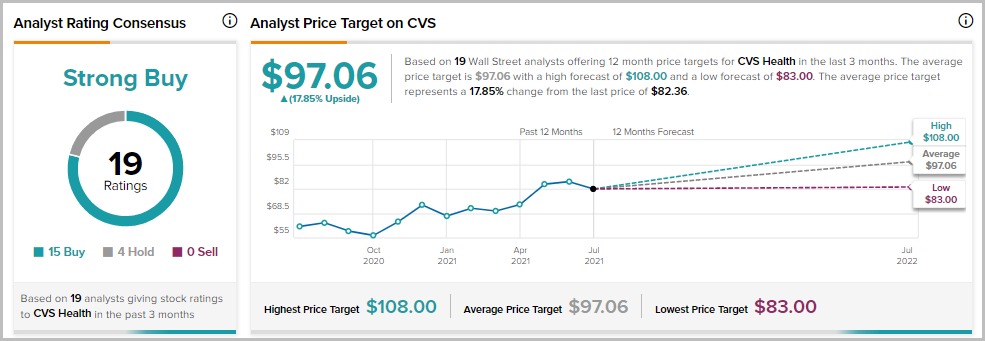

Tipsrank provides a Strong Buy rating based on 19 analysts who rated CVS Health’s shares in the last 3 months. The average price target is $97.06 with a forecast high of $108.00 and a forecast low of $83.00. The average price target represents a 17.85% change from the last price of $82.36. Meanwhile, Zacks Equity Research gave a rating of #3 (Hold) for CVS Health.

Click here to access our Economic Calendar

Ady Phangestu

Analyst – HF Educational offfice – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.