The Deutsche Post second-quarter earnings report is tomorrow. Considering the previous quarterly report, this guide will forecast the company’s second-quarter earnings report. On July 7, 2021, preliminary results for the second quarter of 2021 were announced. Revenue surged by 26% year on year to €22.7 billion in the first quarter, while free cash flow increased by one-third to €1.9 billion [1].

EBIT (earnings before interest, taxes) tripled to about €2.3 billion. In addition, the company’s net income increased to more than €1.4 billion. According to CEO Frank Appel, the profit figures were first-quarter records [1].

The business earned €1.13 in earnings per share on a diluted basis, more than quadrupling its first-quarter 2020 results. According to the organization, quarterly operating cash flow more than tripled to €3 billion, while free cash flow increased to more than €1.4 billion. Free cash flow is frequently negative in Deutsche Post DHL’s first quarter, which is typically its weakest of the year.

Its Global Forwarding, Freight division saw forwarding revenue increase 32.7% year on year to €4.8 billion. This business also comprises its European road transport activities, which increased by 43.6% to €3.59 billion[1]. This was due to an 18.2% increase in airfreight volumes to 494,000 tons, as well as an 8.8% increase in the Freight division – primarily due to demand from Asia to North America.

Meanwhile, its Supply Chain division, which was exposed to a large-scale overhaul following the disposal of its Chinese assets, saw revenue remain unchanged at €3.24 billion, while EBIT increased by 59% to €167 million. The relatively young e-commerce segment increased revenue by 46% to €1.8 billion, as strong demand in 2020 spilt over into 2021. The supply chain segment, which had lagged behind the other divisions due to the impact of the COVID-19 pandemic on customer activity, recorded 4.7% organic sales growth to €3.8 billion [1].

Given the current profits growth, the Group EBIT for 2021 is forecast to exceed €7.0 billion. This includes around €200 million in additional expenses for the one-time corona bonus.The Group now anticipates a free cash flow of more than €3.2 billion for the fiscal year 2021. In 2021, gross CAPEX is estimated to be around €3.9 billion.

Stock Analysis

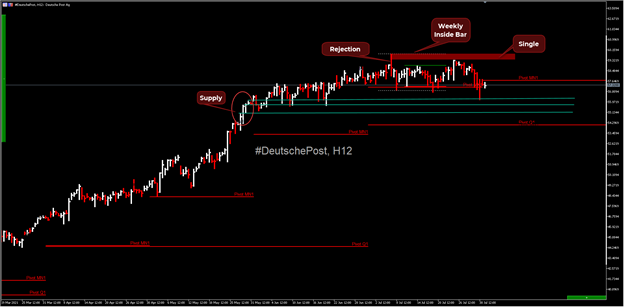

Deutsche Post has continued to move upwards for the past five months. The recent low came on March 5 with a low of $48.49. The company’s most recent high came on July 7, when it breached above the $70 mark, trading at 71.28. The 9-day moving average indicates the positive trend will continue for the German company.

Deutsche Post’s next resistance level, based on its upward trend, is $71, which was its latest high. If the price breaks through $71, it may see some demand on to the next resistance of $80. However, the price may see some downturns. Furthermore, the stock is trading well above its 48 support level [2]

- https://www.dpdhl.com/content/dam/dpdhl/en/media-center/investors/documents/presentations/2021/DPDHL-Preliminary-Results-Q2-2021-Presentation-2021-07-07.pdf

- https://finance.yahoo.com/quote/DPSGY/analysis?p=DPSGY

Click here to access our Economic Calendar

Adnan Abdul Rehman

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.