Market News Today

Treasuries extended gains overnight. The advent of month-end with a large duration extension, momentum from the break of 1.30% on the 10s, the lack of supply, and Covid worries have underpinned. Concurrently, stocks firmed led by a 0.9% jump in the USA100 and a 0.43% gain in the USA500, both at fresh record highs of 15,265 and 4,528, respectively. The USA30 lost altitude and closed with a -0.16% loss. Signs that China’s economy is struggling thanks to virus measures and the regulatory clampdown weighed on the market.

- China’s official PMI readings meanwhile showed the manufacturing number dipping to just 50.1, while the services reading fell back into contraction territory for the first time since early last year, at just 47.5.

- Japan’s jobless rate unexpectedly improved, but factory output declined, as did Australia building approvals.

- The Delta variant is also leaving its mark on economies across the region. Covid surges in US.

- EU to reimpose travel curbs to US.

- USD (USDIndex 92.45) weakened as there is no clear signal on the Fed’s tapering timeline.

- Equities are mixed as Topix and JPN225 managed to rise 0.7% and 1.2% respectively, also helped by stronger than expected retail sales numbers.

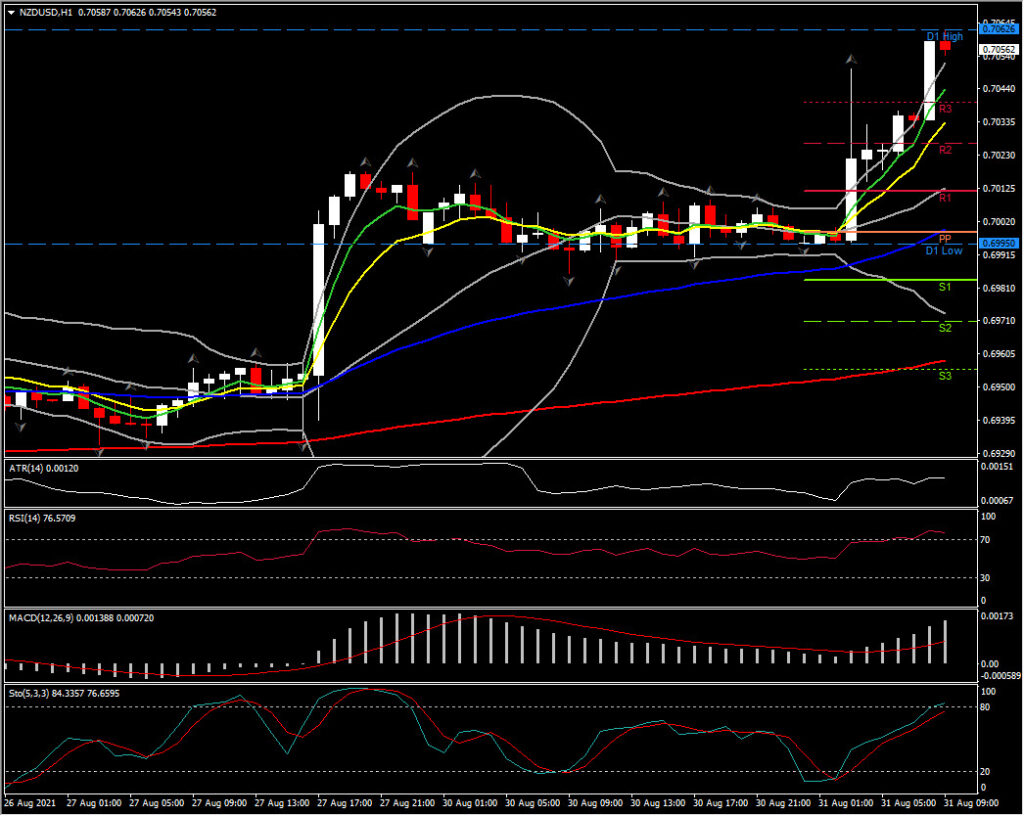

- Overnight – USDJPY fell back to 109.81. The Yen declined against most other currencies though. NZDUSD jumped to 0.7062. NZD and AUD strengthened as lockdowns in NZ were seen successfully lowering new COVID-19 infections, while the Aussie was stronger after building permits raised hopes its economy could avoid recession.

- USOil is trading at $69.14 as traders assess the prospect for an easing of output restrictions ahead of the OPEC+ meeting.

- Gold rose to 1,819, Platinum down over 4%, Silver down 5.4% for the month, Palladium heads for its worst monthly performance in seven months.

Today – Calendar includes Eurozone inflation, German unemployment, Canadian GDP for Q2 and US Consumer Confidence.

Biggest Mover @ (06:30 GMT) NZDUSD (+0.94%) Spikes to 0.7062 from 0.6995. It is retesting the 3-month Resistance area at 0.7000-0.7100. Faster MA’s aligned higher. The MACD signal line & histogram rising. RSI at 78 and rising. H1 ATR 0.0012, Daily ATR 0.0065.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.