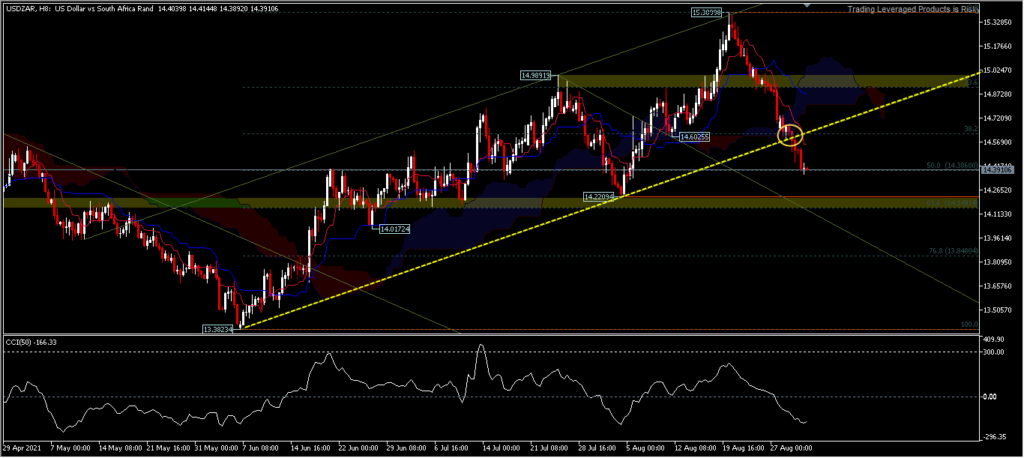

USDZAR, H8

South Africa’s economic growth in the decades following the end of apartheid has been at a pace consistent with other developing countries. However, since 2007, GDP growth has tended to be lower and never recovered above 5.0%, the Covid crisis has simply added more pressure to an already vulnerable situation. Gross Domestic Product (GDP) in Q1 2021 even contracted -3.20% compared to the same quarter the previous year.

Annabel Bishop, Chief Economist at Investec, said in a routine research note that “volatility in currencies could intensify unless governments promote significant private sector investment. The South African Rand is very sensitive to changes in commodity prices, as South Africa is a major exporter of commodities, particularly metals and minerals/food commodities, and higher prices benefited the trade balance, economic growth and income of the SARS. Due to near-term support in industrial metals, the Rand could see further strength, as the emerging market’s third strongest currency this year.

From the price records of the last 5 years, in September the USDZAR pair decreased 4 times and strengthened 1 time. How about this September? Will USDZAR weaken again like before? This year significantly, we have seen the commodity market strengthen broadly which has implications for the exchange of the Rand against the US Dollar. Apart from South African fundamentals, this September we saw some commodity assets bounce back from the point of rebound after the correction in the first weeks of August.

The Rand extended its recent gains against the US Dollar, breaking the ascending trendline adjacent to the 14.6025 support and posting a daily low of 14.3639 (50.0% FR) following USD weakness after the disappointing ADP report. Further moves would target the 14.2209 support which is slightly above the 61.8% FR (14.1491) level. Meanwhile on the upside, as long as the support for 14.1491 holds, there is a probability of the price going to 14.6025. However, the continuation of the price will be influenced to some extent by the NFP report on Friday.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.