XAUUSD, H4

This week is a very important week, as several Central Banks (RBA, BOC & ECB) will provide clues on the direction of the global economy amid the development of the virus and the impact of lockdowns in several countries. Gold prices jumped 1% higher to close last week. XAUUSD’s rise to test the August high on Friday over $1832.00 was also following Fed Chair Jerome Powell giving the green light to start easing its QE program in late 2021. Two weeks ago in remarks given at the Jackson Hole symposium, Powell also said that the inflation spike would fade over time, dimming expectations. previous increase from the cycle of rising interest rates.

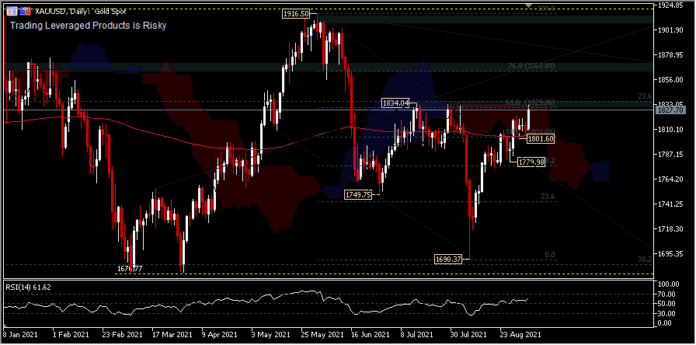

Markets were expecting an early start. The Greenback lost ground soon after the speech, and last week again the not-so-good US jobs data put the USD under further pressure and the higher Eurozone inflation data allowed XAUUSD to equalize on the 8 week high price average in the range of $1834.00.

The intraday bias remains on the north side, although it was blocked by the resistance at the 61.8% retracement level. A break of this level would target the 76.8% retracement level in the price range of 1863. The price remains on the upward path, supported by the 200 exponential moving average, but overbought is seen from the overbought level on the RSI which could send gold into a price correction. Attempts to develop the price decline and test the support level near the 1801 area are possible as long as the average resistance holds in the near term. However, further movement below 1801 will imply a correction towards 1776 and 1749.

Click here to access the Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for informational purposes only and not as independent investment research. This communication does not contain investment advice or recommendations or requests with a view to the purchase or sale of any financial instrument. All information presented comes from trusted, reputable sources. Any information containing indications of past performance is not a guarantee or reliable indicator of future performance. Users should be aware that any investment in Leverage Products carries a certain degree of uncertainty and that any such investment involves a high level of risk for which the user’s liability and responsibility is solely borne. We are not responsible for any losses arising from any investment made based on the information provided in this communication. Reproduction or further distribution of this communication is prohibited without our prior written permission.