Stock markets were hit by growth concerns. Asian markets sold off against the background of virus developments, while the prospect of scaled back central bank support weighed on European markets ahead of the ECB.

The ECB is to scale back bond purchases “moderately”, but stressed that it will use the PEPP program flexibly according to market conditions, meaning it will stick with a more hawkish guidance. Interest rates were left unchanged and the PEPP program is still expected to run until March next year at the very least, with the decision on the future of the program postponed – as expected. A decision that was pretty much as expected, and as suspected, Eurozone bonds and peripherals in particular actually found buyers after the confirmation that the slight reduction in monthly purchase volumes isn’t the start of monetary tightening.

Indeed, the ECB’s balance sheet will continue to expand, but it is time to take the foot off the accelerator and reduce the speed of monetary expansion slightly.

Eurozone bond spreads narrow and stocks pare losses after the ECB announcement. The markets have taken the ECB announcement of a “moderate” taper in monthly asset purchase volumes in their stride and mainly seem relieved that PEPP is here to stay for now and that the ECB made clear that this isn’t the start of rapid tightening. The Italian 10-year bond in particular has rallied in the wake of the announcement, leaving the rate down -4.2 bp at 0.71%. The 10-year Bund yield meanwhile is down -0.9 bp at -0.33% and curves are flattening as the long end outperforms. The GER30 pared earlier losses and is up 0.02%, CAC 40 has lifted 0.15% while the UK100 still struggles as UK yields jumped sharply higher following a report showing a very tight labour market and rising wage pressures but also on BoE worries.

ECB lifts growth and inflation projections, with GDP growth now seen at 5% this year (up from 4.6% expected previously) and the economy expected to reach pre-crisis levels by the end of this year. The outlook for next year was left largely unchanged. The inflation projection for this year has been lifted to 2.2% from 1.9%. The ECB expects inflation to fall back to 1.7% (1.5%) next year and 1.5% (1.4%) in 2023. That means there would be no need for the central bank to lift interest rates over the current forecast horizon, especially as core inflation is expected to be lower, at least this year and next, with the ECB looking at underlying inflation of 1.3% (0.9) this year, rising to 1.4% in 2022 and 1.5% in 2023. So, as vice president Guindos already flagged ahead of today’s meeting, growth as well as inflation forecasts were once again revised higher. The central bank now judges risks to the outlook to be broadly balanced, but the forecasts justify a slight reduction in the amount of stimulus the ECB still continues to provide on a monthly basis.

In the currency market

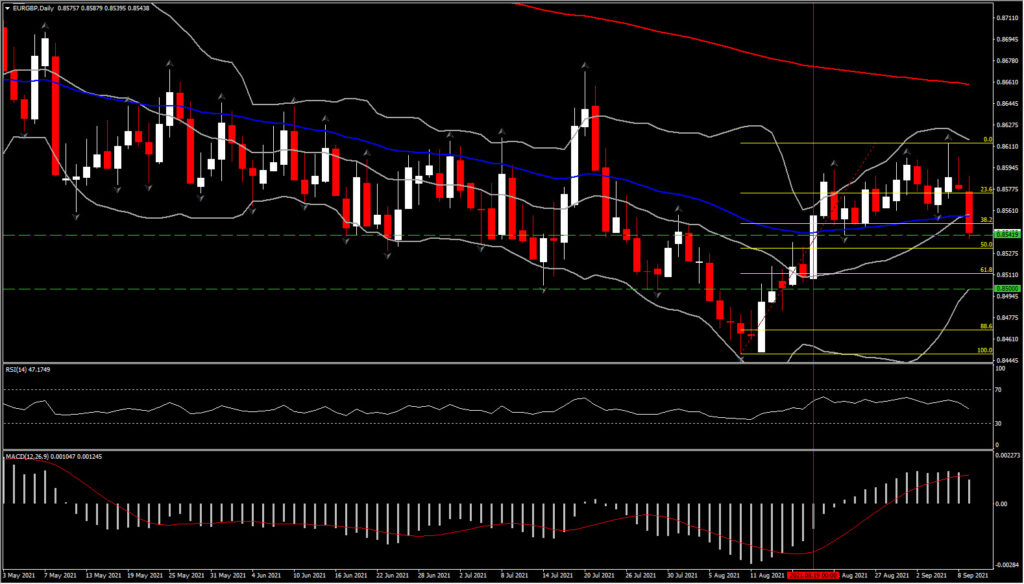

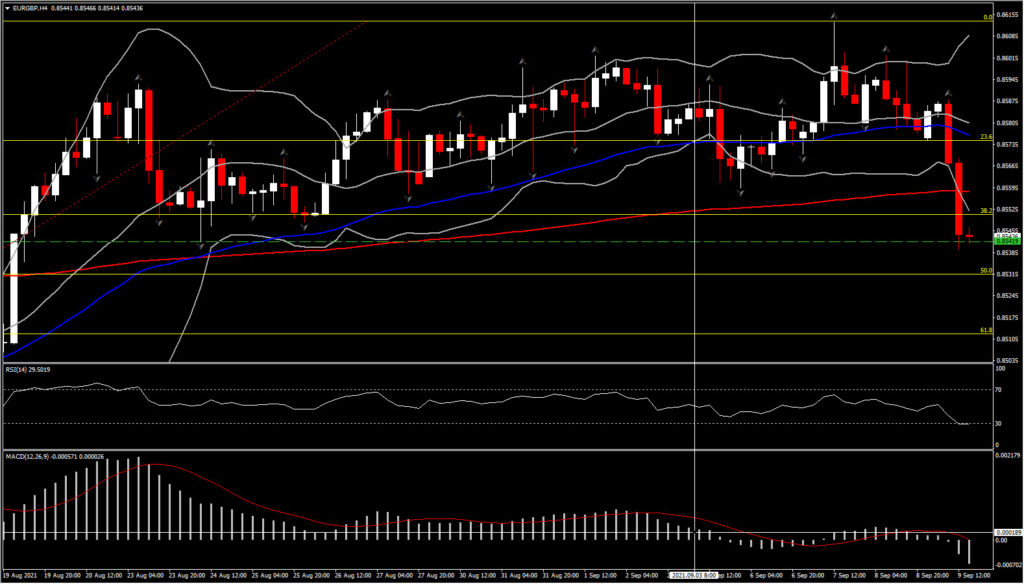

EURGBP has tipped to a 20-day low at 0.8539, partly on the back of a broadly softer Euro today and mostly due to a broad firming in the Pound, which has seen GBPUSD ebb in to 3-day high terrain and GBPCAD post a 3-week high. The Euro treaded water during the ECB announcement and President Lagarde’s press conference, as she characterized the taper as a ‘recalibration’. In the meantime, the survey from the UK’s Recruitment and Employment Confederation (REC) showing that the pace of hiring for permanent positions hit its highest in the survey’s near 24-year history has returned support to the Pound. REC said the post-lockdown surge in the economy, alongside the clearing of Brexit uncertainty, has led to staff shortages and a skill deficit in the labour market. The tightening labour market will be catching the attention of BoE policymakers. BoE MPC member Saunders said earlier in the week that “we no longer need as much stimulus as previously.”

EURGBP remains amid a multi-month orbit of the 0.8600level, hence this weeks performance could be crucial for the asset as a confirmed continuation southward could shift the outlook from neutral to negative in the medium-term view. The move below 20- and 50-day EMA and the bearish cross of these two, along with the negatively configured momentum indicators in the weekly chart could turn the attention to 2021 lows.

Click here to access our Economic Calendar

Andria Pichidi

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.