The RBA announced it would reduce purchases of government securities to AUD 7 billion a week, and it also extended the program, at least until mid-February 2022, from mid-November. At the same time, the cash target rate was maintained at 0.10%. The target for the April 2024 Australian government bond yield is also maintained at 0.10%.

The central bank said the economy had been disrupted by the Delta variant and related activity restrictions. GDP is expected to decline in Q3, with the unemployment rate moving higher over the coming months, but the slowdown in economic expansion is expected to be temporary as the Delta variant has only caused delays, not derailed the recovery.

The decision to extend asset purchases reflects the delay in the economic recovery and the growing uncertainty associated with the Delta outbreak. The RBA promised to continue to review the program and in addition, stated that the conditions for a rate hike would not be met before 2024. http://www.rba.gov.au/

What about the BoC?

The Central Bank of Canada is widely expected to keep monetary policy unchanged at the meeting today, which will not be followed by a press conference. The central bank will likely await new economic projections next month before making a decision, which means the weekly pace of asset purchases will be maintained at CAD 2 billion and interest rates will be maintained at 0.25%. The BoC is in “wait and see” mode due to the contradiction of disappointing economic activity and rising inflation, as well as higher vaccinations but Delta infections not declining. Plus, the political events of the federal election are less than two weeks away.

AUDCAD is another commodity related pair; the AUD has broadly strengthened in the previous 2 weeks, as has the CAD. The RBA’s decision put pressure on the Australian Dollar yesterday, and today it has broadly weakened against the US Dollar by 0.28%, while the CAD has also weakened by 0.31% against the US Dollar.

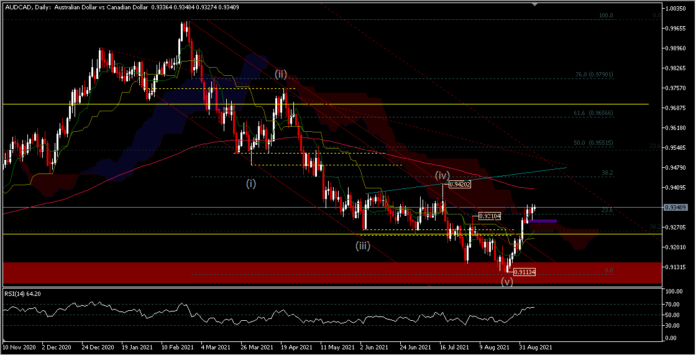

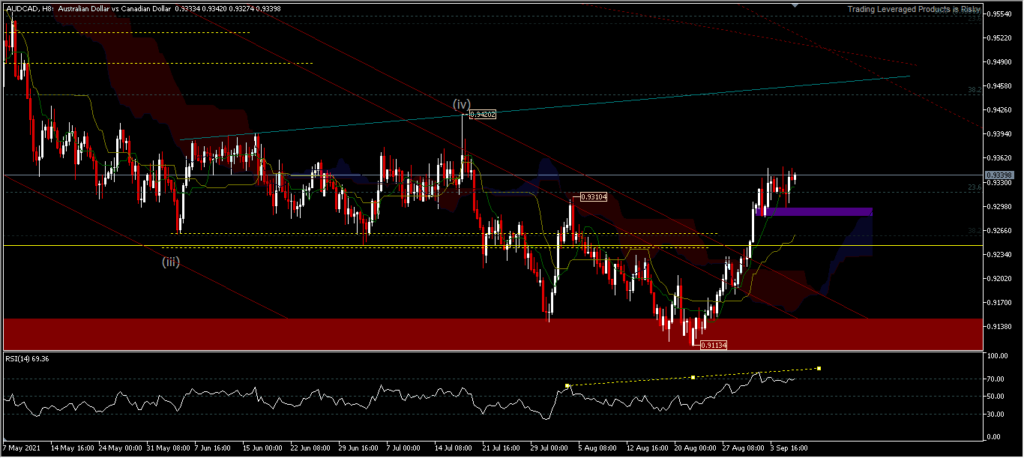

The AUDCAD cross extended its 0.9113 rebound after breaking the 0.9310 resistance. The bullish outlook is still visible with resistance level at 0.9420, the validation of the moving average above the Kumo, and as the pair has already exited the descending channel. However, a correction is possible considering the RSI is in the overbought area. A retest of the 0.9283 level is possible, or 0.9246 if there is an unexpected change in policy from the BoC. Overall, the outlook remains bullish for the short term, as part of a correction to the 0.9992 peak.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.