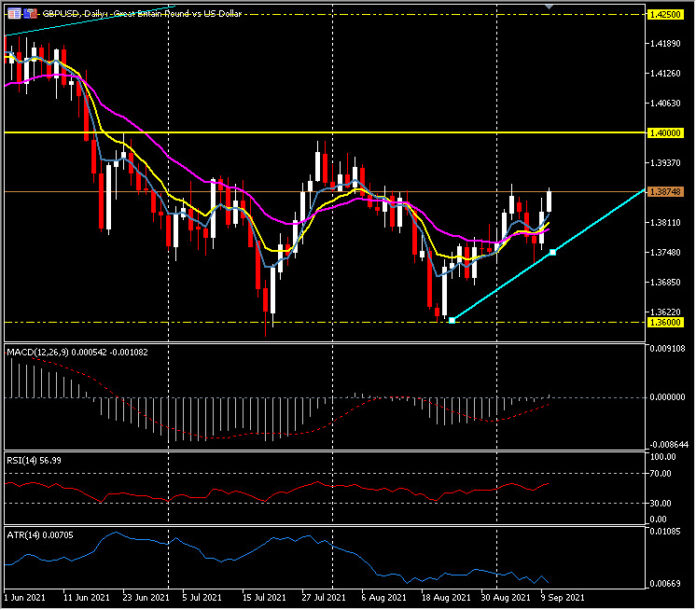

Cable, Daily

The pound has perked up over the last day, with Cable posting a one-week high at 1.3888, just shy of last Friday’s, post NFP pop to 1.3890. EURGBP turning lower, back towards the three-week low the cross saw yesterday and GBPJPY rallying to a 20-day high at 152.50.

A Reuters poll out today found a consensus expecting the BoE to hike the repo rate by 15 bp to 0.25% in Q4 2022. This is earlier than the same poll found from last month, when most economists favoured the first rate hike to be in 2023. The Reuters poll follows a REC survey, released yesterday, showing that the pace of hiring for permanent positions hit its highest in the survey’s near 24-year history. BoE MPC member Saunders (a key Hawk) also said earlier in the week that “we no longer need as much stimulus as previously.” Note that the BoE has stated that any unwinding of assets bought under QE will happen after the repo rate has been hiked. Note, too, that BoE policymakers will be closely watching the impact of the ending of the government furlough scheme, at the end of September, as it is still supporting 1.6 mln of the UK’s labour force. Finally, also note that the new BoE Chief Economist (Huw Pill) sits very much in the hawkish camp.

The bullish pound view, that prevailed at the start of the year, recouping most of its Brexit discount, has been partially accomplished. The UK currency presently the strongest performer out of the G10+ group of currencies on the year-to-date, marginally beating the Canadian Dollar into second place. Sterling is up by an average 4.6% versus the Dollar, Euro and Yen on the year so far. Markets are likely to remain broadly bullish on the Pound, though to a lesser degree than at the year’s beginning, as there is downside risk in the case against the Dollar given the prospect of Fed tapering and more expansionary fiscal policy in the US. The speed with which Sterling has shrugged off the announcement of a major tax hike for UK workers and business, scheduled for next April, suggests the Pound possibly has further to accrue.

Technically, Cable on the Daily time frame has resistance at 1.3900, the July high at 1.3980 and then the key psychological 1.4000. A break of 1.4000 could then test 1.4200 and the 2021 high at 1.4250. Support can be found at 1.3750, 1.3700 and the July and August lows at 1.3600. The 2021 low was posted in January at 1.3450.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.