USA500, H1

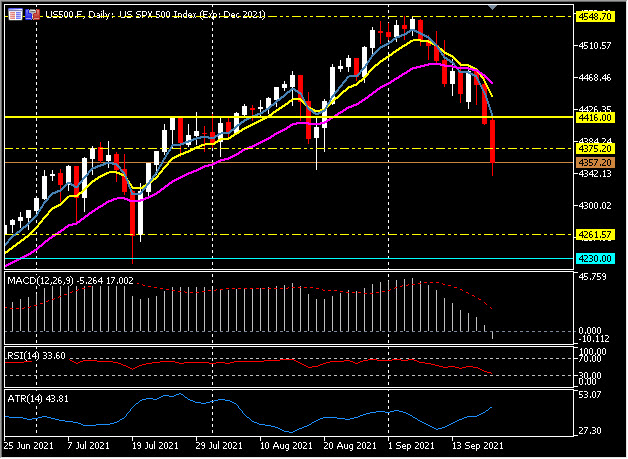

Wall Street opened the week sharply lower, with major indices opening with a 1% to 1.6% dive at the opening bell. The USA500 closed under its 50-day moving average on Friday for the first time since June, which has caused some handwringing, while fears of contagion from a potential China property market meltdown have weighed.

In addition, other factors causing heartburn include: uncertainty over the FOMC’s stance on QE tapering (news not due until 18:00 GMT Wednesday); the US debt ceiling (could run and run); the $3.5 billion infrastructure budget (still stuck in gridlock even after Democrats accepted the total bill will have to be lower); US tax rises and (as ever over the last 18 months) general concerns over the growth outlook due to the pandemic.

Earlier in the day the Asian market closed significantly lower, led by the Hang Seng (-3.3%). In Europe the GER30 was down close to 2.95% and the UK100 1.9%, at 15,017 and 6,824 respectively.

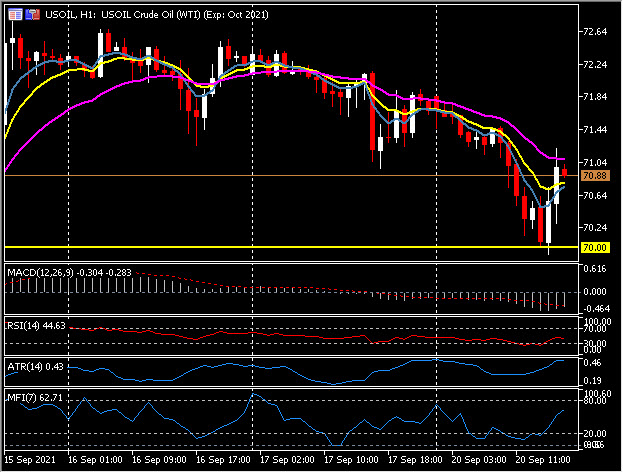

USOil is down over 2% too and has traded under $70.00 for the first time since last Tuesday amid broader market concerns over China, and the significantly lower stock markets. A stronger Dollar and signs that US production capacity is gradually recovering from the impact of Hurricane Ida has left lows today of $69.93, before a bounce back to $71.00.

Yields at the long end of the Treasury curve dropped over 5 bps to 1.304% on the 10-year. The curve has flattened back to 109.6 bps after last week’s late bear steepening trade to 113.6 bps.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.