GBPUSD, H1

UK GDP revised sharply higher in the final reading. The quarterly growth rate was boosted to 5.5% from 4.8% previously, which left the annual rate at 23.6% y/y. The annual comparison is of course distorted by virus developments, but nevertheless the numbers look positive, and while the breakdown showed that government consumption accounted for a part of the revision, the external balance also looked more healthy, with exports rising 6.2% q/q and imports a mere 2.4% q/q.

The picture will likely be different in the third quarter and in particular the fourth, as national delivery problems and the phasing out of the furlough scheme and temporary benefit payments today will weigh on consumption going forward. Against that background, the Q2 GDP reading looks pretty much outdated and won’t change the BoE outlook. Governor Bailey may have signalled that rate could rise even as asset purchases continue, he is likely to wait until next year before actually moving even if inflation looks high.

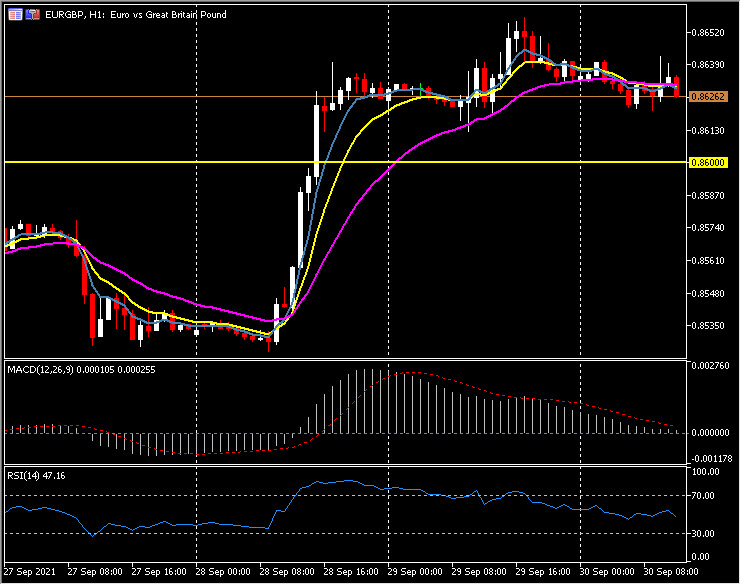

Cable, after two consecutive significant daily falls and with the pair printing new 2021 lows and testing 1.3400, the recovery continues to be capped by the 21-hour EMA, and trades at 1.3436. The MACD signal line is showing signs of life, but it did that yesterday too, RSI remains weak at 39.40. EURGBP holds for a third day over 0.8600 and trades at 0.8625, even GBPJPY, with a Yen under pressure – trades at 150.40, over 230 pips below Tuesday’s high.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.