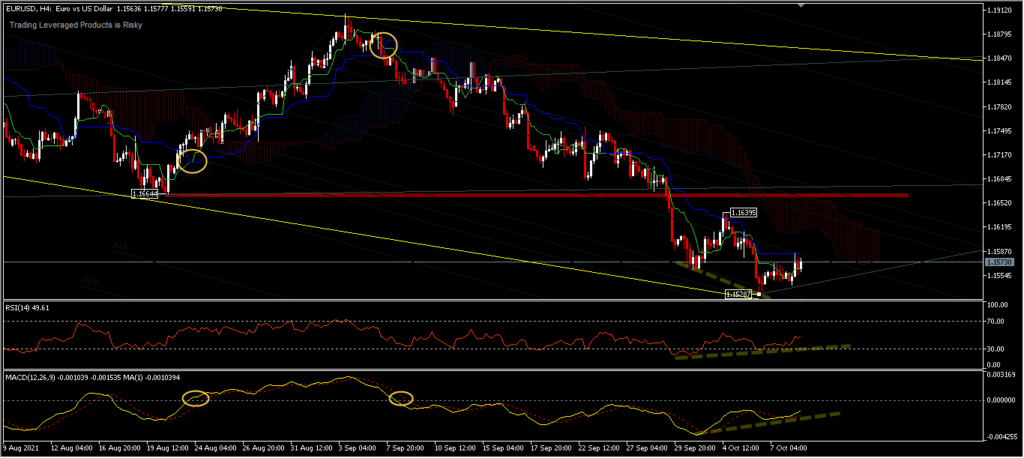

EURUSD, H4

The weakening of the US Dollar throughout 2020 was influenced by the intensive pumping of billions of dollars into the US economy as part of the monetary stimulus policy implemented by the US Federal Reserve. It benefited most of the major currencies, including the single currency. The easing part of the story will soon enter a new phase, probably by the end of this year; although we know it will happen sooner or later only the Fed knows for sure when and by what amount the tapering will be and for how long it will be done.

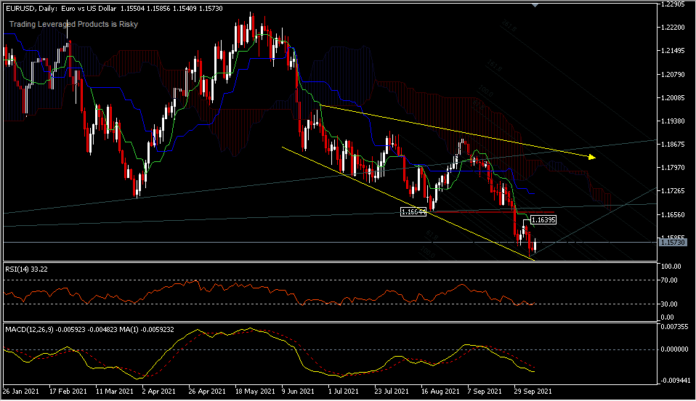

Although this has not actually been announced, it is expected that it will be at the November 3 FOMC meeting, and as far as we can see, the market has long anticipated this. One of the things that can be seen is the recent decline in equities, while currencies may be influenced more by a variety of more complicated factors, but still most of the corrections to 2020 performance have been carried out from the beginning of this year. Investors started to expect that the Fed will start lowering QE by the end of this year and will finish it by mid-2022, and to start raising interest rates by early 2023 and possibly late 2022. The Dollar has strengthened again, dropping the EURUSD pair to the 1.1528 zone.

EURUSD, H4

Bias divergence was seen in the intraday period, but has not confirmed that the asset will strengthen soon, as the bearish structure is very strong under the Kumo movement. A move to the upside is possible to target 1.1639/1.1664 as long as the 1.1528 minor support holds. The downside bias will likely strengthen further, if there is no catalyst that supports the pair to strengthen. A move below 1.1528 would target the 1.1500 psychological level before moving further to 1.1350 and 1.1250.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.