Duke Energy Corp. is a company engaged in energy supply through natural gas and related energy industries. The company was established more than 100 years ago in 1904 and is involved in the business of electric utilities and infrastructure, gas utilities and infrastructure and also in the renewable energy sector. To date, Duke Energy, which is traded on the New York Stock Exchange, has a market capitalization of $78.7 billion.

Duke Energy is expected to announce its 3rd quarter financial report on November 4 before the market opens.

Zacks market analysts now expect Duke Energy to announce revenue for the 3rd quarter of 2021 at $7.02 billion, a growth of 4.4% over the same quarter last year with a rate of return per share (EPS) of $1.81, a slight decrease over the same quarter last year at $1.87. Over the past 4 quarters, Duke Energy has consistently reported revenue lower than projections but at the same time reported EPS that exceeded market projections. But the market sees the possibility that Duke Energy will report better earnings and EPS if it takes into account the factors of the reopening of economic activity that is expected to help boost Duke Energy’s revenue. Weather factors are expected to pose little risk to the possibility of misplaced projections due to uncertain weather conditions over the summer in the Duke Energy operational area.

Duke Energy is one of the stocks in the utility sector that is valuable and attractive to investors; its main competitors are NextEra Energy, National Grid, Dominion Energy Inc, and Xcel Energy Inc. Although the US economy is about to recover and the Dow Jones and USA500 exchanges are recording rapid recovery and gains, shares in the Utilities category were seen failing to perform well with the rise in shares for the sector only around 10.6% compared to the Russell 1000 which increased around 42.6% over the past 12 months. If compared more closely between Duke Energy and S&P 500 stocks, Duke Energy only posted a gain of around 7.11% compared to a high gain of almost 37% for the S&P 500. Despite the low rise in shares, Duke Energy is seen among the most attractive stocks following the high dividend offer where on October 29, Duke Energy announced they will pay a dividend of $0.98 to shareholders this December.

Technical Analysis

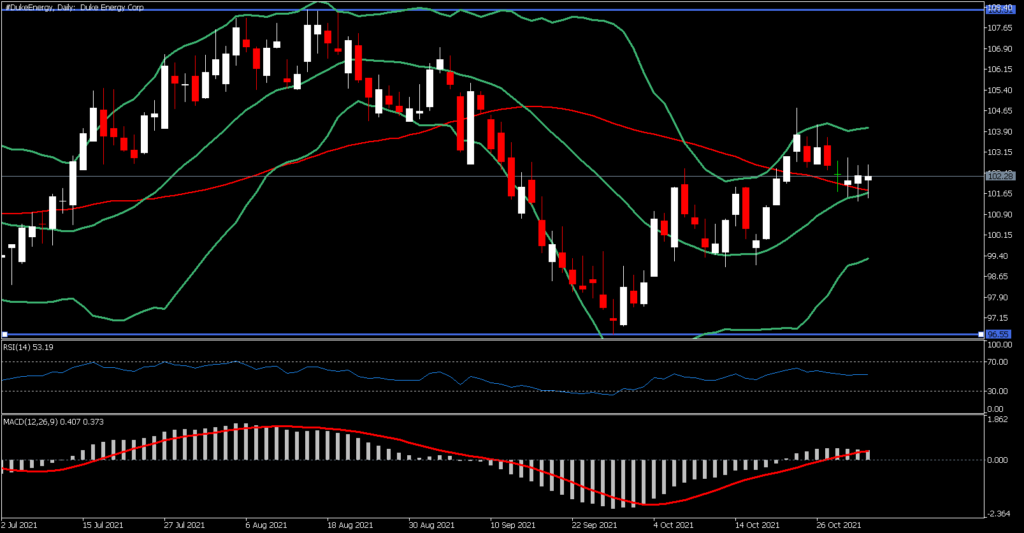

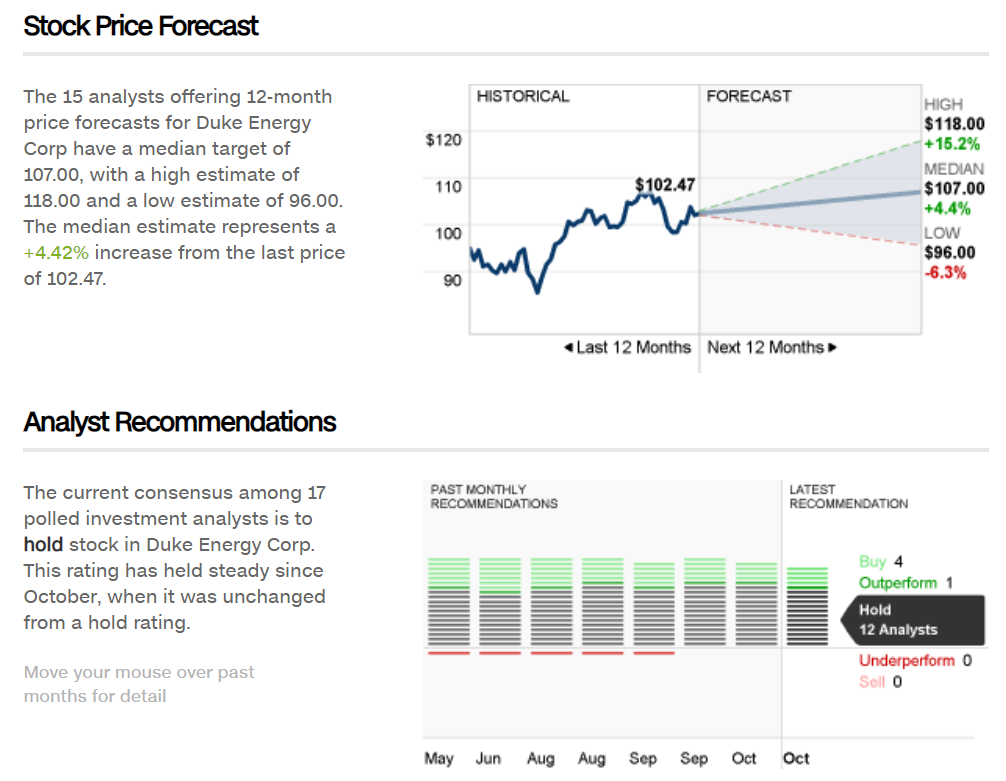

Shares of Duke Energy (MT5 #DukeEnergy) opened today lower at 101.68. The daily price movement is now right above the 20-day and 50-day SMA. The highest gain ever recorded in 2021 was at 108.31 last August before dropping to 96.55 and rising again. It has been trading flat since last April in this range. This is supported by the movement of the RSI which is neutral at 53 and the MACD signal line which is slightly above 0 while the MACD histogram is also above 0. In a CNN Business survey, analysts projected Duke Energy shares will remain in the 96-118 range for the next 12 months with a median at 107. Hence 12 out of the 17 analysts polled placed Duke Energy shares in the Hold category, 1 Outperform and 4 in the Buy category.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

CNN Business

CNN Business