PayPal Holding, a leading company involved in technology platforms for digital transactions, was founded in 1998. It offers online payment technology that connects consumers to consumers and also sellers to buyers through websites as well as through mobile device applications.

PayPal is scheduled to announce its 3rd quarter financial report on Monday, Nov. 8 after the market closes.

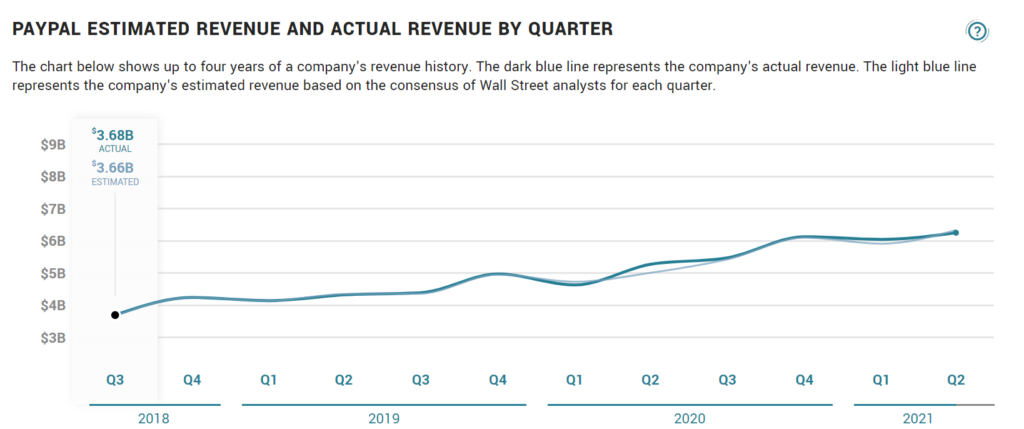

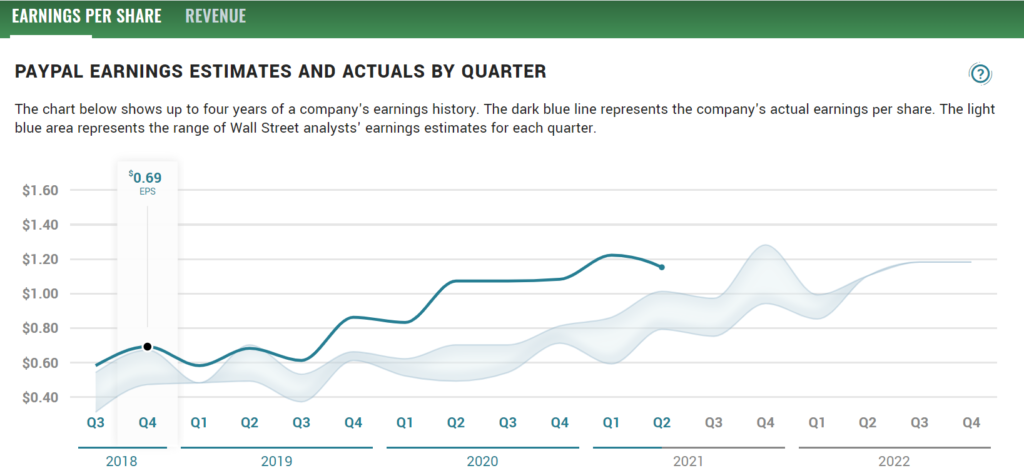

Statistically, PayPal has reported consistent financials since 2017, with annual earnings per share (EPS) showing a positive increase from as low as $1.90 in the 2017 quarter, up to $3.88 in the first quarter of 2020, while sales revenue also recorded a healthy annual increase of $13.1 billion in 2017 and jumped nearly 2-fold in 2020 at $21.5 billion. In its 2nd quarter 2021 report, PayPal reported positive EPS exceeding the market projection at $1.15 but sales revenue was slightly off at $6.2 billion compared to the projection.

In the 3rd quarter, analysts project a strong financial report from PayPal. PayPal’s flagship product, the Venmo app that offers cryptocurrency services, is expected to show an increase in revenue as well as an increase in users across all platforms in the US. In addition, the increase in consumer spending such as in the tourism sector is also expected to increase PayPal’s transaction volume. Analysts see PayPal’s aggressive investment in upgrading their consumer products especially in cryptocurrencies as well as mobile banking showing a positive improvement in this 3rd quarter. A Nasdaq article also reported an increase in traffic (676.8 million visitors) in visiting the PayPal website between July and September 2021, indicating more interest in the use of PayPal.

In the 3rd quarter report expected to be announced next Monday, Zacks market analysts project sales revenue of $6.20 billion, a 14% increase over the same quarter last year, while EPS (non-GAAP earnings) is projected at $1.08, up 0.9% from the same quarter last year. The annual sales forecast is placed at $25.7 billion with annual EPS at $4.71. PayPal is seen reporting EPS that exceed market projections over the past 4 quarters.

#PayPal Stock Analysis

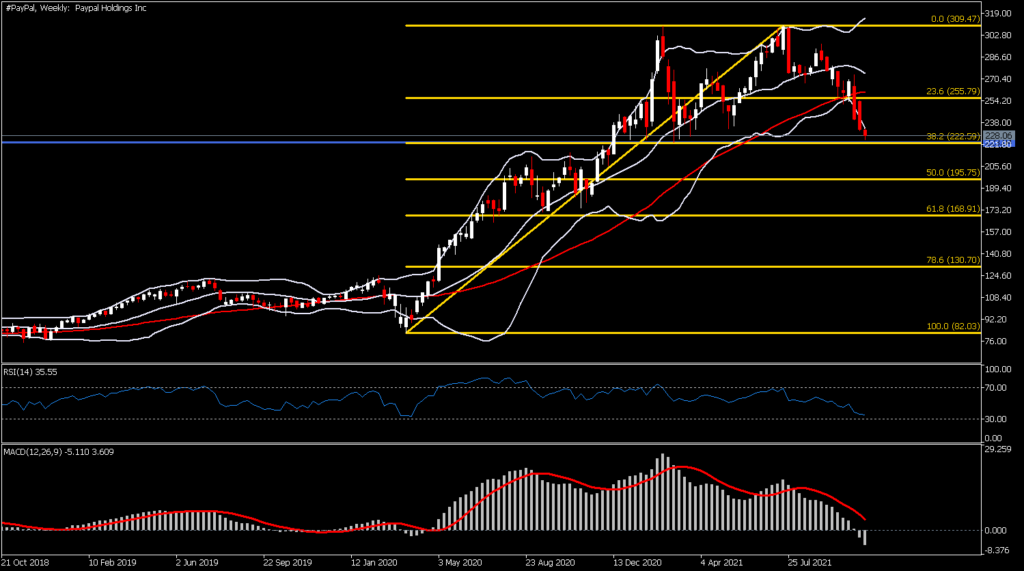

PayPal shares showed a volatile performance in 2021. After posting good gains in the first half of 2021 and hitting a high of $309.47, PayPal shares declined sharply from July and are now trading at $228.06, just slightly higher from the January 03, 2021 low of $225. From a technical point of view, it has now shrunk to the 38.2% fibo retracement level ($222.59) and will find further support at 50% fib ($195.75) should the bears continue to dominate the market.

The 50-week SMA and 23.6% fibo retracement ($255- $260) are the closest barriers to the $ 309.47 level, a psychological target for the bulls. The RSI-14 shows the weekly bearish momentum is still strong at 35 and the MACD is also projecting downwards, and the signal line is still above the 0 line, but 2 negative histograms have formed and are increasing. Even so, PayPal shares are still seen as attractive to investors with most analysts polled by CNN Business still placing it in the Buy category (33/36) with only 3/36 placing it in the sell category. The median projected price is projected at $325 for the next 12 months.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst – Eduxational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

Market Beat

Market Beat