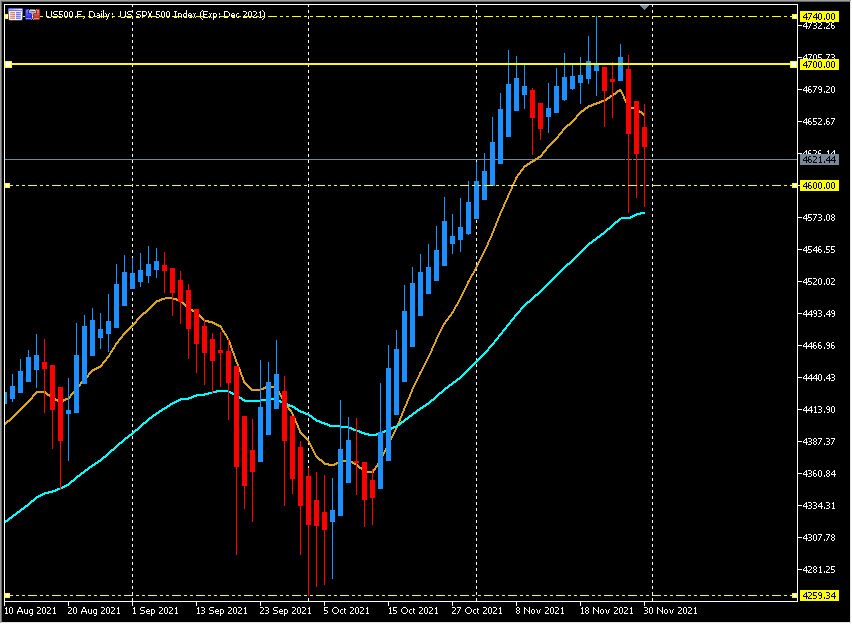

USA500, Daily

December is traditionally a strong month for global equity markets, especially in BULL years. During November all three of the major US equity markets posted new all-time highs, before being shaken by the arrival of the latest COVID-19 variant – Omicron. Initial reaction, as normal in markets, is to overreact to anything it is not expecting; the ONE thing above all else that markets hate is a surprise. Although a new, more transmittable variant was somewhat inevitable as the virus persisted and low-income countries continue to struggle to reach even 20-30% vaccination levels, the key metric continues to be hospitalizations and death rates and on these we will have to wait another few weeks. News this week has whipsawed from countries closing borders, President Biden warning against Omicron panic and pledging no new lockdowns, the WHO warning that the omicron variant poses ‘very high’ global risk and is likely to spread and Fed Chair Powell telling the Senate that the variant poses downside risk to economy and complicates the inflation picture.

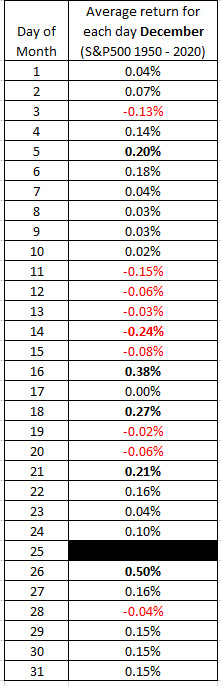

So, the traditional December equity rally has some significant headwinds this year, however the fundamentals remain robust and history is on the side of a positive month. Since 1970, the key equity markets (UK100 & USA500) have risen almost every December – 43 years out of 50, or 86% of the time1. 2021 is the 12th year of the equity market bull run. During November the USA500 rallied and tested 4,700 very quickly and then consolidated. However, it has only managed to close north of this key level on two days, (November 18 and the Futures closed higher on Thanksgiving (25th) on a low volume day). The market tanked -2.27% on Friday, losing over 106 points, and struggles to hold 4600.

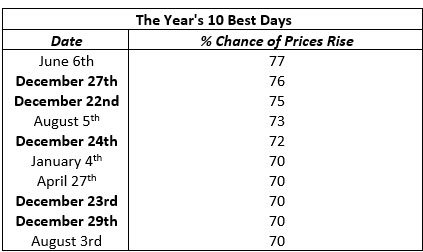

Since 1987, the USA500 has logged gains in 26 of 34 years from the close on Friday after Thanksgiving to year end.3 Five of the best (positive) trading days for stock markets (UK100 & USA500) for the entire year occur in December – all of them after December 21.2

December 2018 was a recent notable exception for the final month of the year. The S&P500 shed close to 300 points and over 10.5% that month as the stock market had its worst December since the Great Depression. President Donald Trump’s trade war with China, the slowdown in global economic growth and concern that the Federal Reserve was raising interest rates too quickly all contributed to the pessimistic reaction. In 2019 and 2020 it returned to trend, rising 2.29% and 2.45%, respectively. A close over 4602 today will see a positive November, however the next few weeks are likely be particularly volatile as Omicron headlines and economic data releases weigh on risk sentiment and investor outlook.

1 The Stock Market Handbook – David Schwartz

2 The Stock Market Handbook – David Schwartz

3 The Stock Trader’s Almanac – https://jeffhirsch.tumblr.com/

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.