Trading was lackluster on Wednesday and consolidative mid-week as the markets equilibrate to the new reality with the FOMC on the move to normalize. Sentiment has turned cautious again and Asian equity markets are narrowly mixed at the moment, with indices struggling to add to yesterday’s gain. Chinese tech stocks retreated after jumping yesterday and troubles at China’s property firms have come back in focus ahead of a wave of key payments.

- USD (USDIndex 94.80) – dips breaking the 2-month range – inflation (the biggest jump since June 1982) didn’t surprise and kept intact expectations for the Fed’s tapering and timeline for the first rate rise as early as March.

- US Yields 10-yr at 1.74%.

- Chinese property developer Sunac China Holdings Ltd plans to raise HK$4.52 billion ($580.09 million) from a share sale for repayment of loans and general corporate purposes.

- Chinese Real estate developers extend declines in afternoon trading amid a Bloomberg report that several of the nation’s biggest banks have become more selective about funding real estate projects by local government financing vehicles.

Equities -Topix and JPN225 meanwhile are down -0.7% and -1% respectively. The ASX managed to move up 0.5%, but Hang Seng and CSI 300 are down -0.07% and -1.4% respectively. - USOil – slips at 81.58 from 82.40 highs, after EIA inventory data showed fuel demand has taken a hit from Omicron.

- Gold -steady above $1820, as the US Dollar and Treasury yields retreated after inflation data reinforced the need for quicker interest rate hikes.

- Prime Minister Boris Johnson apologised for attending a party in the Downing Street garden during a coronavirus lockdown.

- FX markets – EURUSD at 1.1449, USDJPY steady at 115.30, Cable at 1.3711,the Pound generally supported amid signs that PM Johnson has managed to survive yet another scandal.

European Open: The March 10-year Bund future is down -8 ticks, US futures are also lower. In cash markets the 10-year Treasury has pared earlier gains and is unchanged on the day at 1.74% at the moment. Stocks mostly corrected in Asia, with the rally in tech stocks running out of steam after a cautious close higher on Wall Street yesterday. Central bank moves and virus developments remain in focus and while GER30 and UK100 futures are posting fractional gains, US futures are broadly lower.

Today – The data calendar today brings December PPI and weekly jobless claims. There are some ECB speakers scheduled.

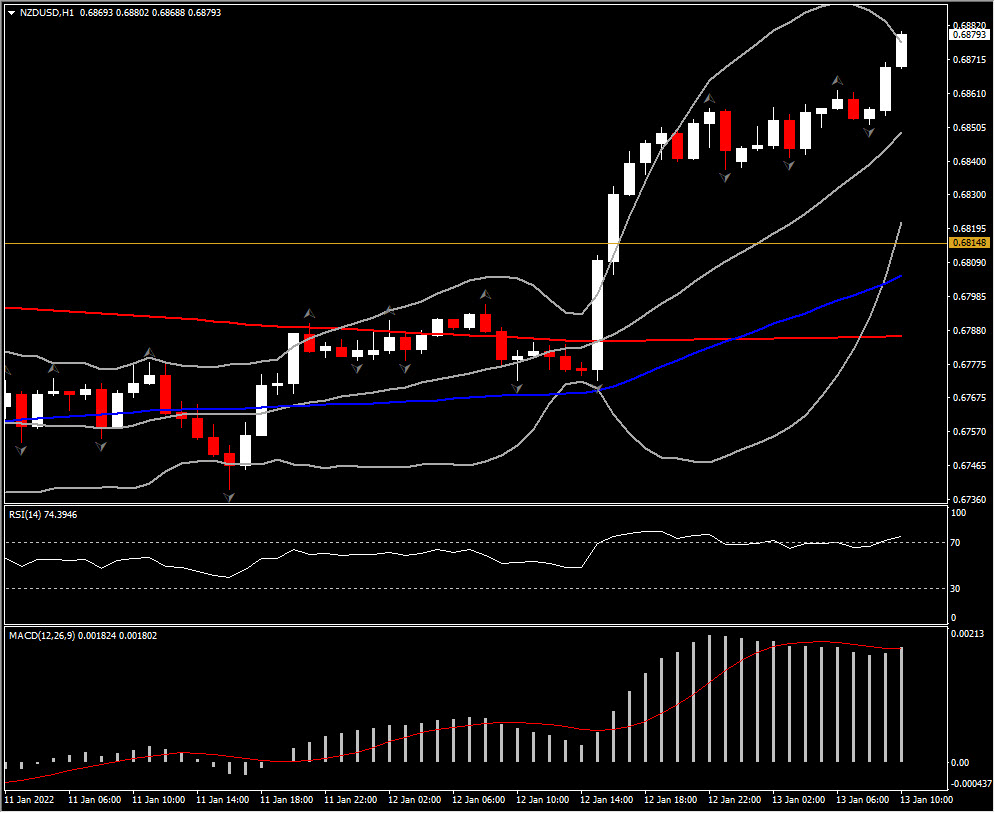

Biggest FX Mover @ (09:30 GMT) NZDUSD (+0.44%) extends above R1, to 0.6880 high. Fast MAs aligned higher, with MACD rising, RSI at 74 and stochastics sloping northwards.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.