Big bank Earnings disappointed on Friday, the USD recovered from 8-week lows and Fedspeakers continued to worry about inflation as hawkish tones increased. Stocks recovered early losses, Yields moved up to close the week as Oil moved up and Gold moved down. China’s PBOC delivered the first rate cut in a while as signs of slow down persist and Covid cases once again spread.

- USD (USDIndex 95.20) holds on to gains from Friday. Bouncing from 8-week lows under 94.60.

- US Yields 10-yr moved higher again to close at 1.772%.

- Equities – USA500 +3.82 (+0.08%) at 4662 as Financials weighed following Earnings from JPM (-6.15%) Blackrock (-2.19%) and WFC (+3.68) Tech & Energies lead recovery into long weekend. USA500 FUTS lower at 4652.

- USOil – Spiked over $84.00 as markets look beyond Covid spikes with very tight supply.

- Gold – settled at $1816 from a test of 1830 again. Now at $1822.

- Bitcoin support once again at $42,000, Friday, back to 42,800 now.

- FX markets – EURUSD back to 1.1465, USDJPY now 114.40 at 115.85, Cable back to 1.33680.

Overnight – Chinese GDP and industrial production exceeded expectations, whilst retail sales disappointed. UK house price data from the Nationwide was strong. The Chairman of Credit Suisse has resigned due to Covid breaches.

Week Ahead A Bank of Japan meeting which concludes on Tuesday, UK inflation data on Wednesday and Australian jobs figures on Thursday. Earnings from GS, BAC, MS, P&G, Netflix

European Open – The March 10-year Bund future is down -36 ticks, alongside broad losses in US futures, which points to a further rise in yields across Europe. Stock market futures are trading mixed, with DAX and FTSE 100 futures posting gains of 0.4% and 0.2% respectively, while an 0.4% decline in the NASDAQ is leading US futures lower. Central bank outlooks and inflation expectations remain in focus, the Fed is gearing up for a round of central bank hikes this year that will also impact the outlook for BoE and ECB amid hopes that the pandemic phase of Covid-19 will start to fade.

Today – Little data from Europe & All US markets closed for MLK Day.

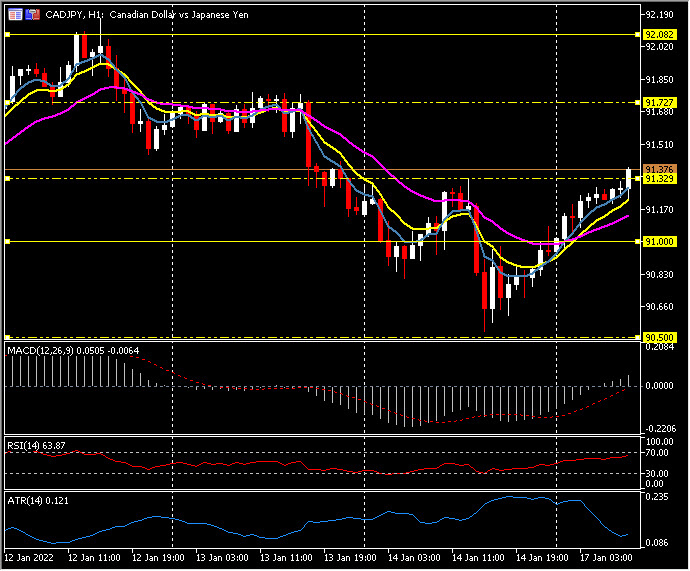

Biggest FX Mover @ (07:30 GMT) CADJPY (+0.34%) Rallied from 90.50 lows on Friday to 91.37 (Fridays high) now. MAs aligned higher, MACD signal line & histogram higher & above 0 line. RSI 64 & rising, H1 ATR 0.121 Daily ATR 0.794.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.